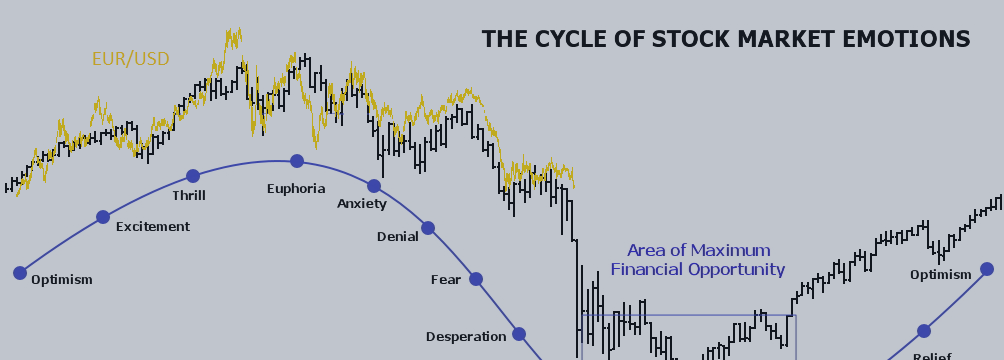

One month ago I wrote a blog called EURUSD - ready for panic selling?, which showed how the EUR/USD followed the emotional market cycle and is ready for a panic leg down. Since then, the EUR has depreciated by 0.025 dollars and is now just 0.025 dollars away from being cheaper than it was back in 2003.

The US presidential election provided a brief moment for a low risk short entry, since then the EUR has gone trough a sustained and orderly depreciation. Having been range-bound since the start of 2015, the EUR is now dangerously close to a downside break of this range, in which case it would mark the start of the panic stage.

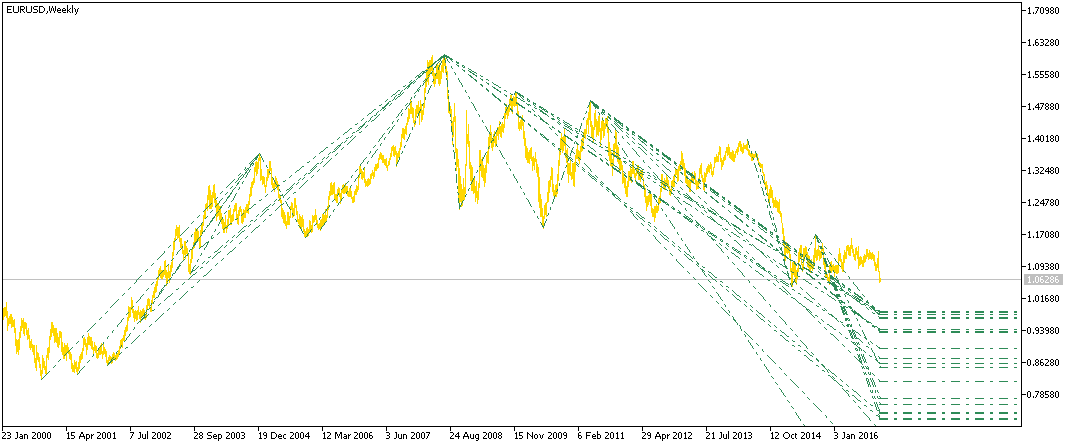

Panic is more severe than fear, and would be observed by a down-movement with larger than usual volatility in a short amount of time. As per the illustration, a month or two adjusting the EUR by 0.3 to 0.5 dollars would be needed for a convincing panic stage. This would put the EUR at a lower rate than it has ever been before in history since its introduction in 1999. Some interesting harmonic support levels over its entire history are shown below:

In the image above I have ran the Harmonic Pattern Finder V2 indicator and found that there are some clusters of harmonic patterns at the following prices:

- 0.983 - 0.970

- 0.935

- 0.740

- 0.725

So for now its just wait and see for the EURUSD to succeed to its next market state.