Trading recommendations

Buy in the market. Stop-Loss 17900. Take-Profit 18040, 18280, 18375, 18435, 18450, 18500, 18620

Sell Stop 17900. Stop-Loss 18000. Take-Profit 17850, 17700, 17490, 17380, 17150

Technical analysis

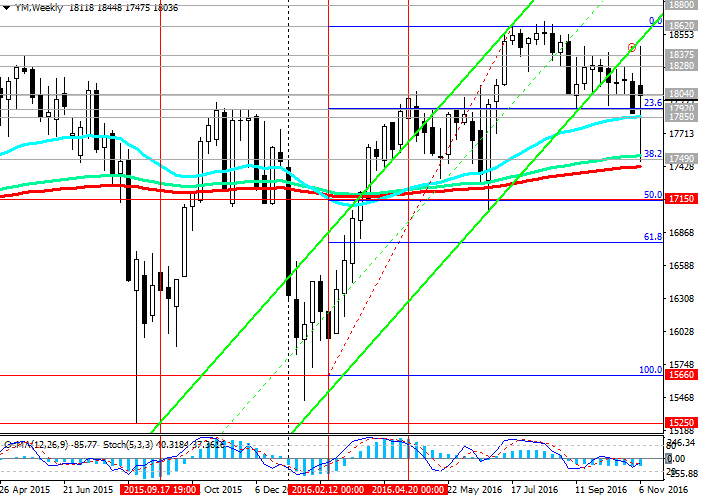

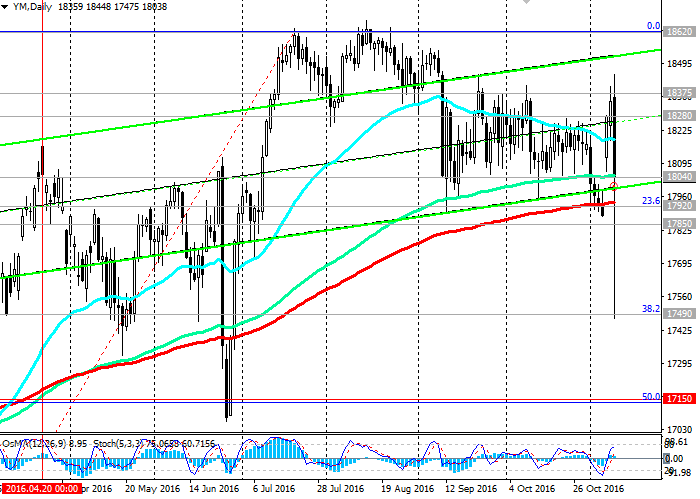

After a strong volatility during the Asian session, the global financial markets gradually calm down, and US stock indices have regained half the losses incurred today. DJIA index reached in the summer after new record highs near the mark of 18620 today declined to the level of 17490 (38.2% Fibonacci level of the correction to an increase in the wave with a level of 15660 after the recovery in February this year to the slump in the markets since the beginning of the year). The current volatility of the DJIA was more than 970 points, or 5.5%, breaking the record of the past few months. However, the DJIA index is corrected at the beginning of the European session and is trading near the key support levels 17920 (Fibonacci level of 23.6% and EMA200 on the daily chart) and 18040 (EMA144 on the daily chart).

Despite the strong decline in the current index, indicators OsMA and Stochastic on the daily chart are still in positive territory on the 1-hour and 4-hour chart indicators are also deployed on long positions.

It is likely that in the course of the day, and finally to the end of the week the financial markets stabilize. In the dynamics of indexes of great importance is the fundamental factor. The focus of the Fed's monetary policy on its gradual tightening - a strong reduction factor for the US stock market, but not the only one. The US economy is currently strong, as evidenced by the very positive macro data from the US recently. And this is - a bullish factor for the stock market.

In the case of a confirmed break and consolidation below 17290 risks of further decline of the index increased. Securing the below 17490 (Fibonacci level of 38.2%, EMA200 on the weekly chart) may finally deploy in the DJIA downtrend.

The reverse scenario is associated with fixing the index above the level of 18040 and the resumption of growth in the levels of resistance 18280, 18375. A break of these levels will increase the risk of further gains towards the annual absolute maximum near 18620 level.

While the DJIA is above the key support level of 17920, its positive momentum is maintained. Relevant again become long positions above the level of 18040.

Support levels: 17920, 17850, 17700, 17490, 17380, 17150

Resistance levels: 18280, 18375, 18435, 18450, 18500, 18620

Overview and Dynamics

Trump wins the US presidential election and becomes the 45th US president.

Clinton congratulated him on his victory in the presidential election. Equity assets have suffered the most severe losses in a few months immediately after the announcement of the election results, but then at the beginning of the trading session in Europe rebounded half.

Many economists believe that economic policy Trump could lead to slower growth and weakening the foundations of the US economy, which may also cause a drop in the stock of assets. Trump calls for a reduction in taxes, restrict immigration and intends to pursue protectionist policies in trade.

After the sharp fluctuations against the background of the first publications on the outcome of the election financial markets gradually stabilized, and the dollar regains some lost ground against the safe-haven assets. US stock indexes also regained in the early European session, half of today's losses.

However, the Fed is likely to raise interest rates in December. And this is another negative factor for the US stock market. Economists expect the Fed to raise rates twice in the next year. The US economy is steadily showing signs of recovery. One of rising interest rates is not sufficient for breaking the bullish trend of the US market. The markets are likely to stabilize in the run-up to the December meeting of the Fed.

Earlier, at the end of last month, the Commerce Department reported that in the 3 rd quarter, adjusted for inflation and seasonal factors of the US GDP grew by 2.9% year on year (forecast was + 2.5%), and this is the strongest evidence over the past 2 years.

Last Friday, the US Labor Department released data showing that in October, the number of jobs has increased by 161 000 (at the forecast 173 000 and 191 000 in September), and the unemployment rate, as expected, declined to 4.9% from 5 0% in September.

Despite the fact that NFPR data were lower than expected, still, it is quite strong performance, along with data on US gross domestic product, and to the Fed could raise rates in December.

After the elections carried out when the markets finally calm down, to the fore once again perform US macroeconomic indicators. And they show a very positive trend. And it will be a strong supporting factor for the dollar and for the American stock market.

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.