Trading recommendations

Sell Stop 0.7620. Stop-Loss 0.7670. Take-Profit 0.7570, 0.7530, 0.7475, 0.7445, 0.7325, 0.7290, 0.7200

Buy in the market. Stop-Loss 0.7620. Take-Profit 0.7685, 0.7720, 0.7750, 0.7800, 0.7820, 0.7900

Technical analysis

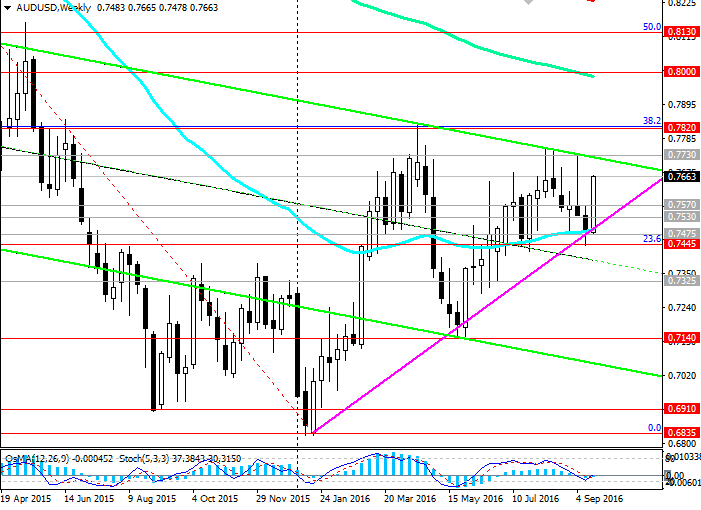

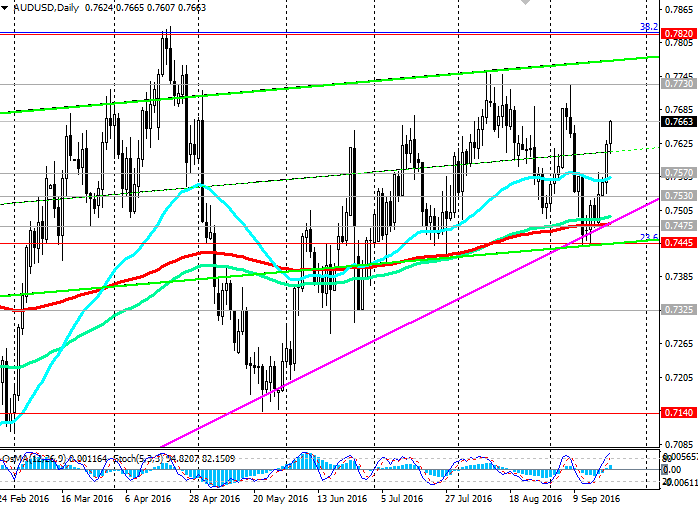

Earlier this week, the AUD / USD rebounded from important support level 0.7475 (EMA200 on the daily chart and the lower line of the rising tapered triangle). The upper boundary of the triangle passes through the level of 0.7730 (highs in August, September, and the upper line of the descending channel on the weekly chart). The AUD / USD gaining upward momentum yesterday after the Fed's decision not to change interest rates in the US and rising towards the next resistance level of 0.7730. Indicators OsMA and Stochastic on the 4-hour and daily charts went over to the buyers on the weekly chart - also deployed on long positions.

The upward tapering triangle is a continuation of the trend. Break its upper boundary at 0.7730 level could create conditions for the further growth of the pair AUD / USD. In case of breaking the resistance level 0.7820 (38.2% Fibonacci level of the correction to the wave of decrease in pair with July 2014, the April highs), the pair AUD / USD is heading to 0.8000 levels (EMA144 on the weekly chart), 0.8130 (50.0% Fibonacci level ), 0.8200 (EMA200 on the weekly chart).

Reverse the scenario associated with the breakdown of the support level 0.7445 (23.6% Fibonacci level). In this case, a negative trend can prevail, and the goals of further reducing the pair AUD / USD may be levels 0.7325, 0.7140 (May lows).

Support levels: 0.7570, 0.7530, 0.7475, 0.7445, 0.7325, 0.7290, 0.7200, 0.7140

Resistance levels: 0.7730, 0.7820, 0.7900, 0.8000

Overview and Dynamics

Yesterday's decision by the Fed did not change interest rates in the United States caused a widespread weakening of the US dollar, despite the fact that such a decision was expected.

While the Fed has signaled that there is now a strong case for a rate hike before the end of the year, some of its representatives have weakened the investors' expectations about the scope of a possible rise in interest rates over the next year because of a fundamental change in the global economy. The slowdown of the Chinese economy, Brexit, as well as mixed US macroeconomic indicators themselves back down the timeline of another increase in US interest rates.

The Fed lowered its forecast for US GDP growth in 2016 to 1.8% from 2.0%. Long-term prognosis of GDP growth was also reduced - from 2% to 1.8%.

According to CME Group futures market, the likelihood of higher interest rates at the December meeting is 60%. However, many investors continue to believe that the Fed will raise US interest rates until mid-2017. And instead of three previously planned increases in 2017 will be no more than two is possible.

In response to the Fed's decision to sharply risen in price in the price of gold and the US stock indexes rose, with the Nasdaq Composite rose 1% to 6295.00, this was a record closing level. At the end of trading on Wednesday, the index Dow Jones Industrial Average rose by 0,9%, S&P500 – on 1.1%.

The Australian dollar on Thursday at the start of the European session was trading near 2-week high near 0.7650 mark. New Managing RBA Philip Lowe said today that the bank will not be too aggressive in its decisions in order to achieve the inflation target range of 2% -3%. Too rapid inflation, according to Lowe, may adversely affect the financial stability in Australia.

Thus, AUD / USD pair had a double support, and, most likely, it will continue to grow in the short term.

The next RBA meeting on monetary policy in the country will take place on October 4th. Previously the RBA to cut rates twice this year. The current rate stands at 1.5%.

Author signals - https://www.mql5.com/en/signals/author/edayprofit