USD/CHF Back Into the July Open- Bulls Look to U.S. CPI for Fuel

Talking Points

- USDCHF pullback looks to US data for support

- Updated targets & invalidation levels

USDCHF 60min

Technical Outlook: USDCHF failed to hold above a key r Fibonacci resistance confluence earlier this week with a break below the weekly open shifting the immediate focus lower. A proposed pitchfork off the 6/28 & 7/13 highs further highlights key resistance & bearish invalidation at 9863/80 where the upper parallel converges on the 61.8% extension of the advance off the June low.

Interim resistance stands at the confluence of the 50-line & the 6/28 close at 9820 with support eyed at the monthly open at 9760. Note that this level converges on the median-line extending off the highs & a longer-term parallel of the broader ascending formation off the lows. A break below would be needed to keep the short-bias in play targeting a more significant support targets at 9708 & 9664 – both areas of interest for possible short-side exhaustion / long-entries.

Bottom line: heading into tomorrow’s U.S. data stream, the risk is for a move lower before resumption of the broader advance off the June low with a breach / close above 9880 needed to validate a breakout targeting subsequent topside objectives at the May high-day close at 9921, the 61.8% retracement at 9946 & parity.Continue tracking this setup and more throughout the week- Subscribe to SB Trade Deskand take advantage of the DailyFX New Subscriber Discount.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

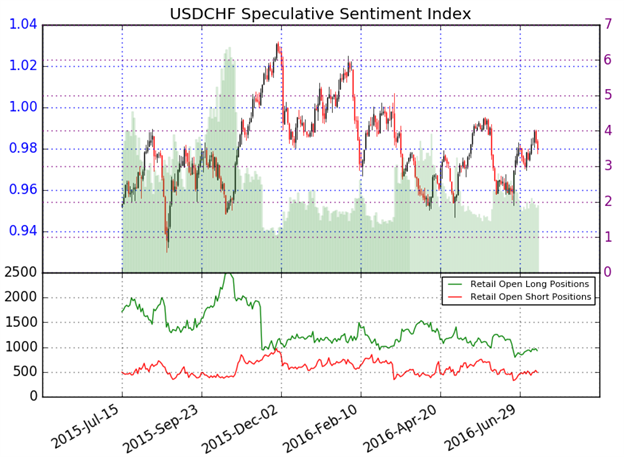

- A summary of the DailyFX Speculative Sentiment Index (SSI)shows traders are net long USDCHF- the ratio stands at +1.89(65% of traders are long)-bearishreading

- Yesterday the ratio was +1.94. Long positions are 5.8% lower than yesterday and 3.5% below levels seen last week.

- Open interest is 5.0% lower than yesterday and 3.5% below its monthly average.

- The recent pullback from extremes in sentiment highlights the risk for a larger rebound over the near-term, while the broader outlook remains tilted to the downside as trader remain net long.