Talking Points

- USDCAD immediate short-bias at risk into BoC

- Updated targets & invalidation levels

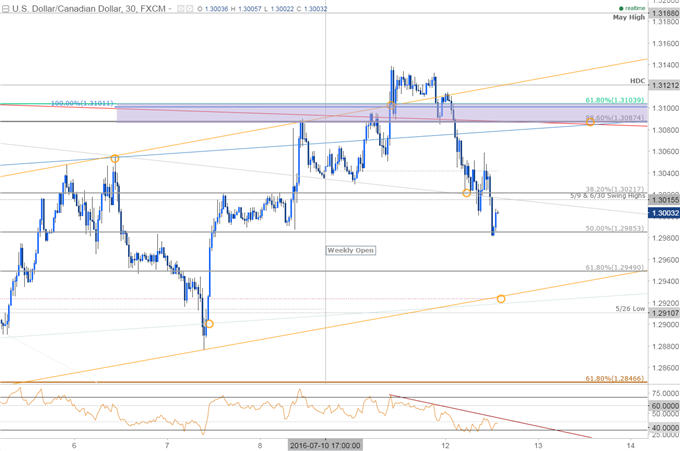

USDCAD 30min

Technical Outlook: USDCAD failed to close above key resistance noted last week at the May high-day close at 1.3121 with the pullback breaking back below the weekly open, keeping the near-term focus lower in the pair heading into tomorrow’s Bank of Canada interest rate decision. Interim support rests at 1.2985 backed by 1.2949 & the monthly open at 1.2924 – both areas of interest for possible exhaustion / long-entries.

Resistance stands at 1.3015/22 backed by the weekly open at 1.3041- A breach above key resistance shifting the focus back towards key resistance at 1.3087-1.3104. Note that a close above 1.3121 is still needed to validate a breakout of the broader triangle consolidation pattern we’ve been tracking since the yearly low.

\

\

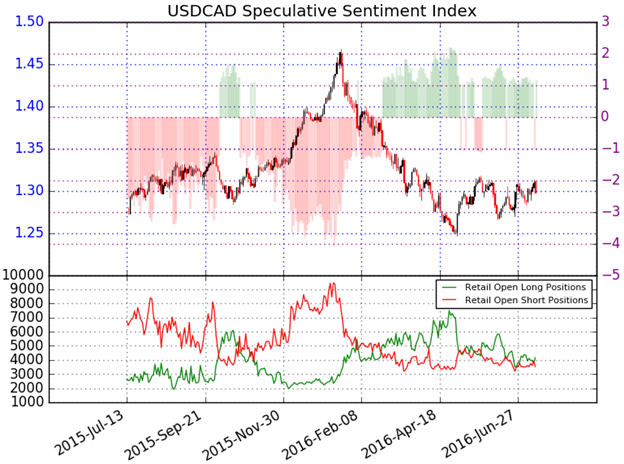

- A summary of the DailyFX Speculative Sentiment Index (SSI)shows traders are net long USDCAD- the ratio stands at +1.21(55% of traders are long)-weakbearishreading

- Yesterday the ratio was -1.09. Long positions are 15.3% higher than yesterday and 3.4% above levels seen last week.

- Open interest is 0.9% higher than yesterday and 3.1% below its monthly average.

- The recent flip from net-short suggests that the long-bias remains vulnerable- Immediate risk is for further declines near-term towards structural support

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

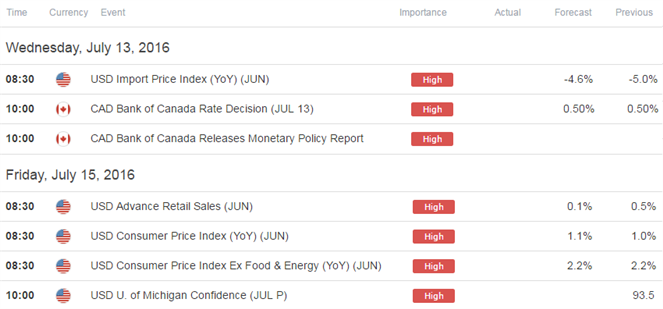

Relevant Data Releases This Week