From Credit Suisse:

We are lowering our 3m EURUSD forecast to 1.05 from 1.17 previously, reflecting the likely growth spillover into the wider European region from the UK's woes.

Our former forecast had anticipated a general jump in European currencies which were all pricing in some degree of Brexit contagion risk premium. Now the bad outcome is realised, we suspect the market will be consistently looking to sell EURUSD rallies.

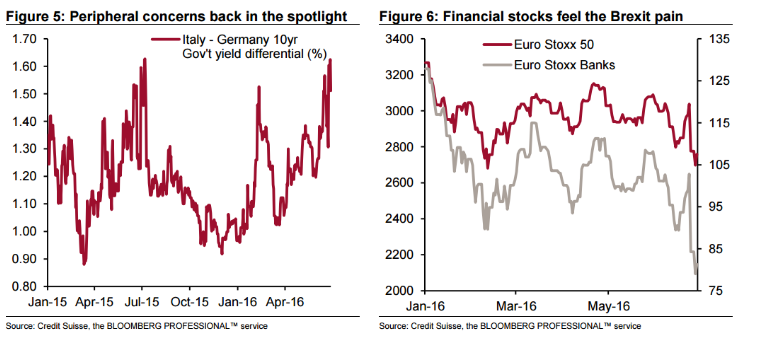

Issues such as the Italian constitutional referendum in October also present risk events that need to be priced. Slowing the EUR descent however is the currency's role as a funding currency, the euro area's massive current account surplus and the ECB's pro-active policies to prevent funding difficulties for the banking system as well as to mitigate sovereign credit risk. This is quite a different environment to 2012 and leaves the EUR less vulnerable as long as political shocks can be avoided.