Breaking Down BREXIT Scenarios Webinar Series

Well, that escalated quickly! When FXCM began the Brexit Webinar Series A few weeks ago, the Remain camp was in a commanding position a handful of weeks ahead of the June 23 EU Referendum. A few days ahead of the vote, the Remain vote is still favored, but much less so. Also, the options market is speaking so loud, that our attention is deserved.

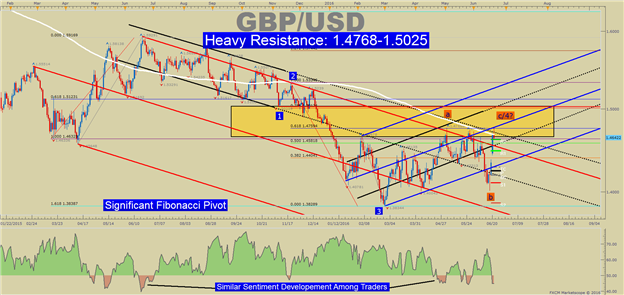

As a reminder of what we’ve looked at over the last three sessions, a few themes stand out. The polls were expected to give us a hazy picture at best, but the momentum of the previously stated ‘Undecided’ group to ‘Vote Leave’ could accelerate on building a more solid case for an EU without the UK. For now, it seems like the polls going into the final 72 hours will dictate trading opportunities. However, the options market is no longer a cost-effective way to trade, and many have turned to spot-FX, which has pushed the price below 1.4000 as of the week ahead of the vote.

Implied Volatilities in options are favoring a ~6% move lower and 4.5% higher in Sterling depending on the outcome. But, as we move down into the vote, we may see a bit more of a symmetric outcome given a pushing lower of GBP ahead of June 23 for new spot activity. However, what’s priced in the market is a potential move down into a key zone of January 20, 2009, low to be explained in detail below.

The votes are currently set to be counted to provide us a final answer in the morning of Friday, June 24, but it’s important to be aware of the different scenarios that could play out and to be well-capitalized.

Market Developments To Watch On A Risk-Off Trade:

First, GBP/JPY appears to be the clear preference for a short trade on a ‘Vote Leave’. GBP/JPY has already fallen ~1,450 pips (163-149) in June, but we could see more downside. You should note that the JPY has been in an uptrend for over a year that could strengthen aggressively on a ‘Vote Leave’ outcome pushing GBP/JPY lower still.

A ‘Remain’ outcome are presumed to favor Cable higher as well as EUR/GBP lower. The implications are that the Bank of England would need to prep the market for potential rate hikes over the coming year.

Even if we get a close remain, there will be fear about upcoming elections such as the Scandinavian

Elections followed by Italian, Germany, & Spanish elections that could also rock the boat of EUR confidence. Depending on a continuation of separatists movement, the fear will likely spread toward EUR weakness.

Cable Chart I’m Watching Into the Vote: