Analytical Review of the Stocks of Merck&Co. Inc.

Merck&Co. Inc., #MRK [NYSE]

Health care, drug production, USA

Financial performance of the company:

Index – DJIA, S&P 500;

Beta – 0.69;

Capitalization – 145.01 В;

Return on asset – 4.30%;

Income - 4.44 B;

Average volume – 11.42 М;

P/E - 33.28;

ATR – 0.86.

Analytical review:

- The company ranks the fourth on capitalization in the sector of “health care” among the issuers traded in the American stock market.

- At the beginning of February the company reported for Q4 of the fiscal year 2015. According to the company’s press-release, in the reporting period net profit of the company fell by 46.6% (from 1.83 billion USD to 977 million USD).

- At the press-conference Management of the company said that company’s revenue fell by 2.5% to 10.22 billion USD, due to decline of sales of drugs for arthritis and diabetes and also because of pressure from strong USD.

- On 10 March the company has announced that it is planning to close joint venture with Sanofi SA because of the reduction of sales (over 18%).

- In the middle of February FDA commission did not approve new developments of ZETIA and VYTORIN within Merck&Co.

- Strong pressure on the “health care” sector was caused by the released negative report of the company Valeant released on 15 March, as the result shares of the company fell in price by 50%, which had strong impact on the pharmaceutical industry.

Summary:

- Negative report for Q4 of the fiscal year of 2015 will contribute to the decrease of investors’ confidence. Closure of the company’s enterprises in Europe, poor financial performance in the sector of “health care”, refusal to approve new medicine by FDA are the reasons, which cause the decline in the price Merck&Co.

- It is likely that in the near future company’s quotes will go down.

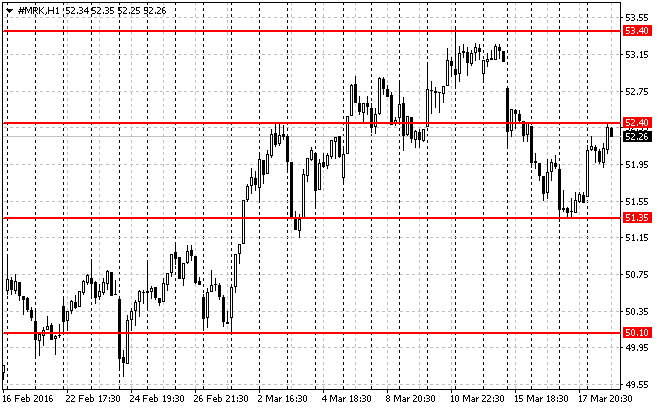

Trading tips for CFD of Merck&Co. Inc.

Medium-term trading: the moment the issuer has broken resistance level and consolidated below the local support level of 52.40 USD. If the price maintains at the gap of 52.75-52.40 USD and in case of the respective confirmation (such as pattern Price Action), we recommend to open short positions. Risk per trade is not more than 2% of the capital. Stop order can be placed slightly above the signal line. Take profit can be placed in parts at the levels of 51.40 USD, 50.50 USD and 49.25 USD with the use of trailing stop.

The material has been provided by LiteForex - Finance Services Company - www.liteforex.com