Introduction

Trading in financial markets is mainly a mental activity that requires many qualities like independence of mind, patience, perseverance, absence of ego…

Every newcomer should make a diagnosis to define his personal qualities and identify the areas that need improvement in order to excel in this field.

However, a lot of novice traders accuse the market for being responsible of their losses and bad performance, and they ignore that the market is a neutral place for meeting between supply and demand, or in a more accurate term, between “speculators”, so trader must assume full responsibility for its decision, and must believe that all his actions will impact his results soon or later.

So, in this article I will talk firstly about the negative attitude of individuals toward risk of losing, and then i will show you how to overcome this obstacle using a very strong technique which is visualization

II. Individuals don’t accept losing by nature

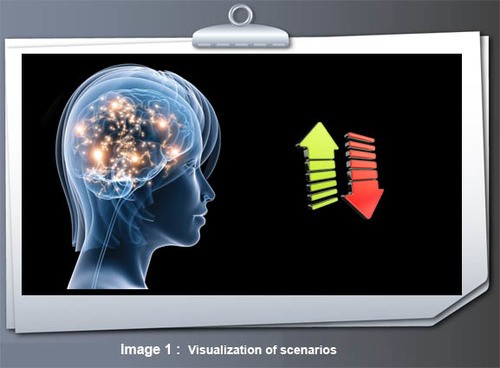

A very important study conducted by Kahneman and Tversky, shows that people’s attitudes toward risks concerning gains may be quite different from their attitudes toward risks concerning losses.

For example, when given a choice between getting 500$ with certainty or having a 50% chance of getting 1000$, 84% of people have opted for the certain gain of 500$.

In the other hand, Kahneman and Tversky found that the same people when confronted with a certain loss of 500$ versus a 50% of losing 1000$ loss, 70% have chosen to loss 1000$.

The result shows that the human choices are asymmetric, because

individuals take more risks when it comes to losing, and try to secure

their gain even if they are smaller, this phenomenon is called risk-seeking behavior.

.

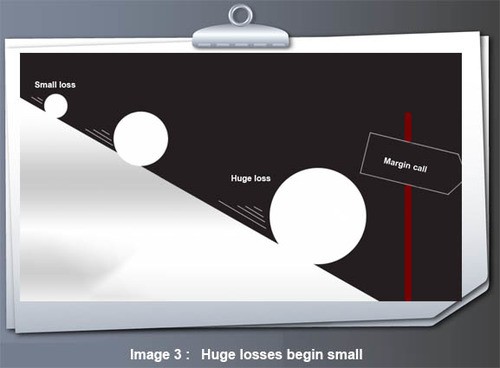

III. Visualization: a magic technique to overcome psychological obstacles in trading

A. What is visualisation in trading ?

Visualization is a method by which we consider mentally how to operate in the market when opportunities arise.

The trader must repeat mentally the steps of a position: the entry point, take profit and stop loss. He must imagine himself positioning in a market, and even cutting his loss when the trade didn’t move as expected.

The visualization of the different situations allows the trader to effectively be prepared to face real situations. The trader takes into account the possible scenarios and considers how he will respond.

By visualizing the worst possible scenarios and acting in a serene state of mind, the trader is preparing himself to deal less impulsively to these particular situations when they appear in reality.

B. Developing a repertory of responses

The trader must develop a repertory of responses that will enable him to

respond almost automatically to various situations. It must also have a

daily routine that includes visualization of possible scenarios of the

day, so the trader must ask several questions:

• What are the possible evolutions of the market?

• How will he react in such particular case?

C. A strong technique to accept losses

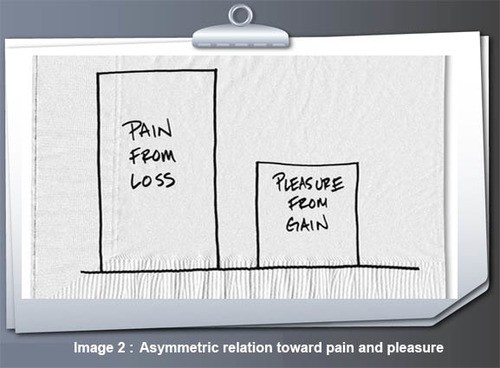

Visualization is a very effective technique to learn how to respect stop loss. Loss management is often problematic in trading, because the majority of traders lose control of their emotions when they make losses. Ignoring stop loss is a clear sign of how traders distorts painful information and tries to avoid it.

The majority of big losses begin small, then they are amplified to become huge, which is considered as a failure by the trader which provokes an emotional shock to him.

Traders digest hardly the loss and focus mainly on how they will recover their money. They forget their trading plan and set new priorities. The trader must be convinced that the respect of stop loss is critical to his survival. For this he must be familiar with situations where the market turns against him and don’t follow their expectations.

IV. Conclusion

To conclude, studies have shown that we don’t accept naturally to make losses, and we avoid the pain that can be caused by it, however, having an open mind to cut losses is a skill that can be learned through some techniques especially visualization, by the repetition of the steps of opening a position and imagining all the available scenarios, even the worst one, in order to be familiar with the eventual pain, so that we could make a long term gain.