First, a few words about the forecast for the previous week:

■ if we talk about the forecast for EUR/USD, those 35% of analysts and graphical analysis on H1 and H4, who predicted the pair fall in the last five days, turned out to be right. As expected, at first the pair reached the first support zone of 1.1150, and then tried to reach the second support of 1.1030, but after going only half the way, it turned and finished the week at 1.1131;

■ following EUR/USD, GBP/USD also went south, but it did so more strongly than expected. Having broken through support at 1.4365, the pair fell to the 1.4245 level and then moved in a sideways trend channel of 1.4245 ÷ 1.4395, with Pivot Point 1.4310;

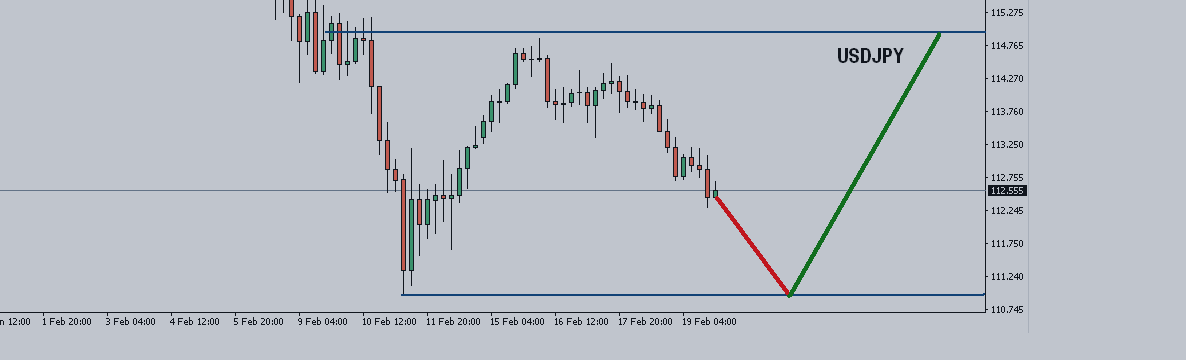

■ after the collapse started on February 1, the experts expected that the pair USD/JPY would rebound at least to the level of 115.60, but it could not even reach 115.00. Having frozen for half an hour at around 114.87, the pair rushed down again, finishing the week even lower than the level of the beginning of the week - in the zone of 112.55;

■ As for USD/CHF, the prediction given by graphical analysis, supported by 40% of analysts, turned out to be completely correct. The pair continued upward movement to the level of 0.9967, and then took a break and went down to the 0.9890 support.

***

Forecast for the coming week:

Summarizing the views of several dozen analysts from leading banks and brokerage firms, as well as the forecasts made basing on different methods of technical and graphical analysis, we can say the following:

■ if we talk about the prospects for EUR/USD, in the next 2-3 days, the pair can grow a bit, reaching the 1.2222 resistance zone, both graphical analysis on H4, and indicators on H1 and H4 talk about this. As for a longer-term forecast, the number of supporters of the downtrend grows in proportion to the time interval. Thus, on the weekly time frame 55% of the experts voted for the pair falling, on the monthly - they are already 65%, and on the quarterly - 78%. As for the graphical analysis, it draws a literally apocalyptic picture on the D1 - in the next two or three weeks, the pair may literally collapse, reaching the bottom at around 1.0500;

■ with regard to the future of GBP/USD, some 40% of the experts, as well as graphical analysis on H4 and D1 believe that the pair is now at the upper border of the corridor 1.4200 ÷ 1.4400, along which it will move all week. 33% indicators on the H4 and 75% on D1 also support this version. At the same time graphical analysis does not rule out that at the end of the current week or early next week, the pair will break through the upper boundary of the channel and, turning the resistance into support, it will continue sideways trend in the range of 1.4400 ÷ 1.4620 with Pivot Point 1.4500;

■ 60% of the experts, 100% of indicators, in full compliance with the graphical analysis, believe that the pair USD/JPY will continue to fall at least to the level of 110.70 (the next support is at 110.00), and then it will whack up first to the current level of 112.55 and then higher, aiming to the height of 115.00;

■ but as for the future of USD/CHF, about 70% of the experts tend to talk about the growth of the pair to the first key level of 1.0000, and then further - to the level of 1.0200. Graphical analysis on H4 and indicators on H4 and D1 believe that before continuing to grow, the pair can spend some time in the sideways trend in the area of 0.9830 ÷ 0.9930, with a predominance of "bearish" sentiment.

Roman Butko, NordFX & Sergey Ershov