Interest rates are one or even more important that tracks price changes in financial market indicators. Interest paid or accrued to be the basis of decision-making in the financial markets approach.

Interest is the cost of the opportunity and the catalyst and the mechanism of support at the same time.

Central bank governors rule the economy in order to ensure financial stability. Following the Great Depression, which began Black Butlathae (October 29, 1929), it became clear that the politicians did not want to leave the economic boom, however, luck and chance. They wanted control of the economy in order to avoid the occurrence of a new Great Depression.

It accelerated the pace of recovery thanks to the new Roosevelt agreement, which cemented the idea of the possibility of more government intervention contribution in pushing the economy forward towards common goals.

It was created within the Federal Reserve Federal Reserve following the Great Depression, according to the law of public banks 1933. The Federal Reserve recognizes the function determining interest rates of the US economy. It does so by adjusting the federal funds rate (the rate at which banks pay each other on overnight loans).

If you want to buy a house, Stqsd likely the bank in order to get a loan. Will the bank borrows money to give him to you in return by loan. Will pay the bank lending interest rate based on the federal funds rate, which has to transfer 2% of the time, and makes you pay a higher rate of interest, to consider that up to 7%.

After two years, the lowest become more! Declining federal funds rate to 0.5% whereupon the accounts and find that you can refinance the loan in accordance with the interest rate of 6% less and save a little money on the interest each month. It's the house itself, and you are just by saving money through this new funding in accordance with the minimum rate.

But you are not the only one that this idea came to his mind. Your friends who have purchased a home in about the same time they realized this idea and sought to refinance their home and also not to waste the opportunity.

Not only that; Valosedka who rented homes did so as well. They find that they can get a greater distance at a lower price through this new low interest rates. Note after their ability to buy a home at a lower cost of the rental price, they could not waste the opportunity. They've told their friends about it, and before you realize it has become noticeable in the real estate market boom.

Investors from outside the United States began noticing this rapid rise in house prices and they are now willing to intervene. Investment groups took in the world are investing in buy American real estate with the goal of reselling them at a higher price in the future.

Japanese investors are in the process of selling the yen in order to buy dollars in order to invest in the US real estate market. They baptized understanding to buy the dollar / yen pair.

French investors are also aware of this opportunity, by deciding if the euro / dollar swaps in order to sell the euro to the dollar, they can, on the lines of Japanese investors, buying into the US real estate market.

We know where to turn this story, right?

This is similar to what happened with the financial crisis in 2008. The historically low interest rates have led to a prolonged period of time to overeating real estate market speculators to the extent that everyone wants to get home got one. Some got two or three. Most likely, not leaving any homes for sale and thus prices collapsed.

Japanese and French want to get out of this mess investment groups now because it has become in danger of capital loss if it does not come out of there fast enough. So, should the sale of real estate that was bought and put their money in a better place.

Rates are still low in the United States, and in the real estate market deteriorated, do not look for investment opportunity there.

After reading the global economic landscape carefully, investors noted that the percentage of revenues the highest in the world come from the Australian continent. The large gold deposits and strong export relationship with China allowed the continent to continue their growth.

If investors decide to invest in Australia, Fmdoa to buy AUD / USD, and sell the dollar during this process. This time, investors from Turkey, Hungary and Russia emerged with the desire to invest in Australia in search of higher yields. It affects more on the currency swaps, so these investors can get Australian dollars in order to do their investments.

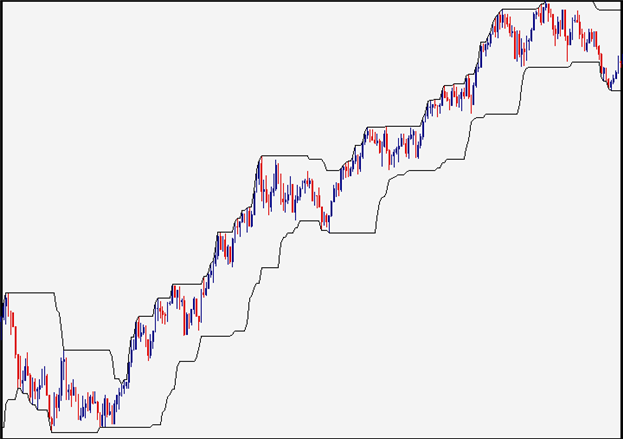

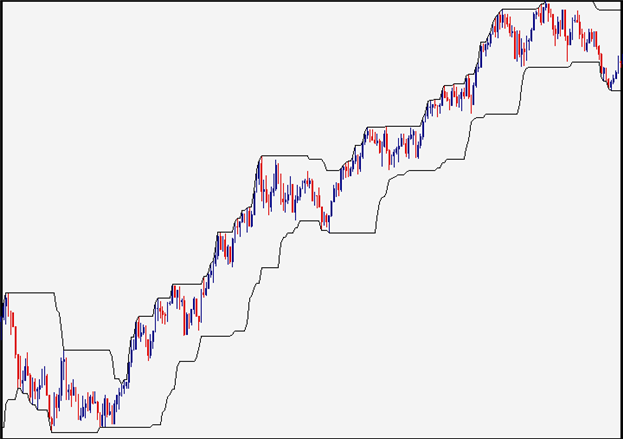

The table below shows the extent of the power that interest rates may enjoy in relation to the currency. The chart below is due for a couple of Australian / US $ 2009 where Australia was with the highest interest rates in modern economies. As prices continue to rise, we get additional evidence that the foreign investment drive prices to the progress in order to obtain a higher interest rate.

Investments tracks potential returns. In case the rates are expected to rise, we can often see the accumulation of such currency in order to obtain the expected higher revenue and may lead to higher prices more.