Position Trading with CFDs

“Don’t look for the needle in the haystack. Just buy the haystack!”

―John C. Bogle

Everything Should Be Made as Simple as Possible, But Not Simpler

―Albert Einstein

When Trading CFDs, Trends Develop For Multiple Reasons and depending on their reason, they can last for many years which lead to Position Trading.

CFDs allow traders to place trades or investments in large markets that are often covered on the Financial News or leading market commentary websites. Whether the market is stocks, energy or metals, CFDs allow you to decide if the trend is favourable for you to enter and if so to hold on until the trend ends.

What is Position Trading?

Position trading is the approach to the markets in which you’re looking to hold a long-term position in a specific market. That market could be Forex, Stock Indices or Commodities like Gold, Silver or Oil. However, a position trader may be someone who has the preference to join the market long-term without much interest in timing the market. Here’s a breakdown of characteristics common of Position Trading:

-Common with trend followers

Buy (or Sell)-and-Hold Investor:

*Objective: Long term capital appreciation while potentially earning interest off the rollover, also known as the carry trade

*Analysis Preference: Long term charts (weekly) and fundamental analysis of economies

*Trade holding time: Multiple months to multiple years

*Trade Frequency: 1 – 10 trades per year on average

*Targeted Return: Above or in line with common equity indices, 7-15% annual return target on average

Is Market Timing Wrong?

Market timing is really at the core of two sides of the investment services industry. On one side, you have fund managers who are effectively telling you they can time the market and they deserve a handsome fee for such a coveted skill set. On the other side, you have the index fund industry which tells you that timing the market is a fool’s game and that you simply must be ‘in it, to win it’.

Of course, this kind of black and white thinking is dangerous. An all or nothing approach doesn’t benefit someone as much as the espouser of such statements would like you to believe. Instead, a mixture of the two may be in your best interest if you’d like to put your beliefs about tomorrow and how the price of today is mis-pricing future outcomes then you may be a proponent of timing the market.

The person who shouldn’t time the market is likely the person who doesn’t have time. This isn’t meant to be a quip but rather an argument that risk management time requirements rise dramatically from position traders. One of the most famous investors of the 21st century, Bernard Baruch, once famously said, “don’t speculate unless you can make it a full-time job,” making the argument that to time the market is nothing less than a full time requirement.

Can You Know Ahead of Time When the Market Will Turn?

Past performance is no indication of future results.

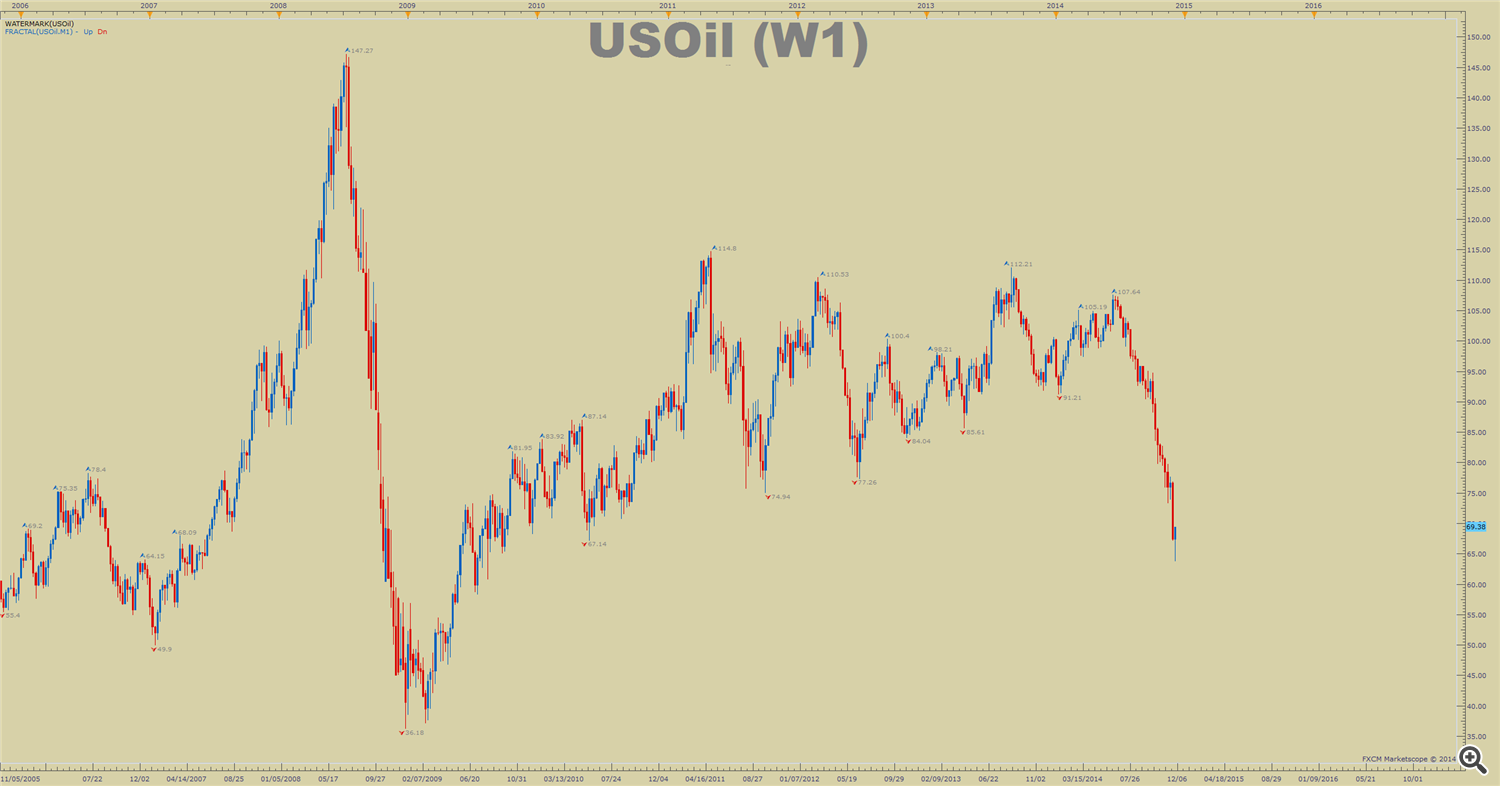

Commodity CFDs can be an odd bunch. They’re erratic but then again, most markets are. Unfortunately, most traders look to the left side of the chart and try to think they could have ‘easily’ predicted when the market would turn but then fail to do so in real-time. This difficulty is because there will be unforeseen fundamental factors, news prints, market participants, that may determine whether price is high, low or in equilibrium.

While it’s unlikely that a trader would have sold and held a short position in US or UK Oil you can see position trading, where you’re holding a long-term position, can sometimes go nowhere or make rather little progress. Stops should always be in place to prevent a long-term position going against you in a strong trend.

Past performance is no indication of future results.

The other side of position trading is some of the global indices that have had printed multi-year highs or all-time highs that benefits position traders the most. Chart’s like the JPN225 is often a bastion for the position traders because those who try to time the market are often the same traders who feel that the price is so high that it, ‘must drop soon’.

If one spends enough time in the markets, they’ll soon learn the market doesn’t ‘have to do anything’ except what the popular opinion wants from it. Therefore, position trading could be termed, the anti-timing trading strategy.

One more Bernard Baruch quote that can help you see whether Position trading is for you, Mr. Baruch said, “Don’t try to buy at the bottom and sell at the top. This can’t be done – except by liars.” If you disagree with this, Position Trading probably isn’t for you because you believe bottoms and tops can be timed. If you completely agree with this, then position trading may be best because, why would bother to beat or time the market, when you can simply, join the market.

One of the more popular CFD vehicles is stock indices. While position trading stock indices and single-share CFDs are not mutually exclusive, trading an index long-term is more common to position traders. As the opening quote from John Bogle says, “Don’t look for the needle in the haystack. Just buy the haystack!”

Case Study: The Warren Buffett 2008 bet – index funds (spx500) will beat the hedge fund index

Few people in the investment industry are as interested in timing the market as Hedge Funds. On the other end of the spectrum, few people are as critical about the timing phenomenon as a fallacy to the investing public as Warren Buffet, one of the world’s wealthiest investors.

In the crux of the 2008 credit crisis, Warren Buffet put his money, which isn’t hard for him to do, where his mouth is. He made a bet against hedge fund Protégé Partners. The bet was fairly simple. Protégé Partners could pick a group of hedge funds to perform against a simple S&P 500 index fund over the course of 10 years. Buffett bet $1 million that they couldn’t outperform the simple index. To this day, Protégé Partners is likely wishing they could take back the bet and in fact, Hedge Funds as a whole are shutting at a rate not seen since the financial crisis, as many managers continue to under perform the stellar SPX500 and only the best of the best seem to attracts the capital necessary to stay afloat.

As an example, this year alone, Hedge funds have returned just 2 percent as a whole in 2014 marking their worst performance since 2011 according to Bloomberg. This is shameful because the management fees are sky high relative to other investment method fees and at the same time, the SPX500 is up over 11% year to date.

Notes:

Position trading is about taking the long-view without worrying about timing the market other than long-term entry within an overall trend and exiting at a time that’s right for you.