Intra-Day Fundamentals - Non-Farm Payrolls: scenarios and trading ideas

As we are going to have USD - Non-Farm Employment Change news event today so The Royal Bank of Scotland made fundamental forecast related to this news event with the connection with the most attractive pairs to trade in any situation concerning the actual data for NFP for example. And just to remind: if actual data for NFP > forecast (200K for now) so it will be good for currency (US dollar will become more stronger).

The are 3 main scenarios for NFP:

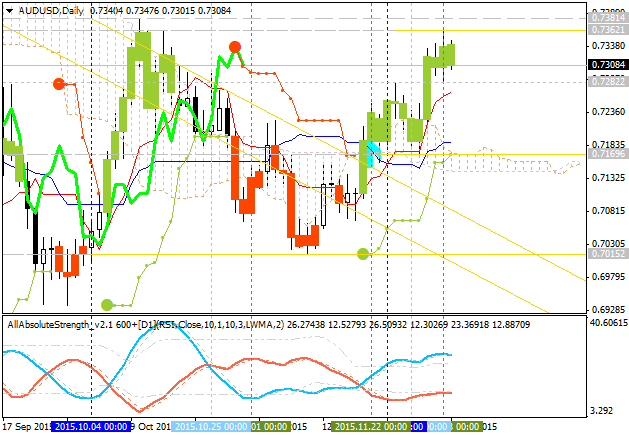

1. Actual

data is 225k and above (with 200K forecasting ones): The most

attractive pair to trade in this case is AUD/USD: the strong case with

Australian dollar will be finsihed and we can consider for this pair to

be in more bearish market condition.

Sell AUD/USD.

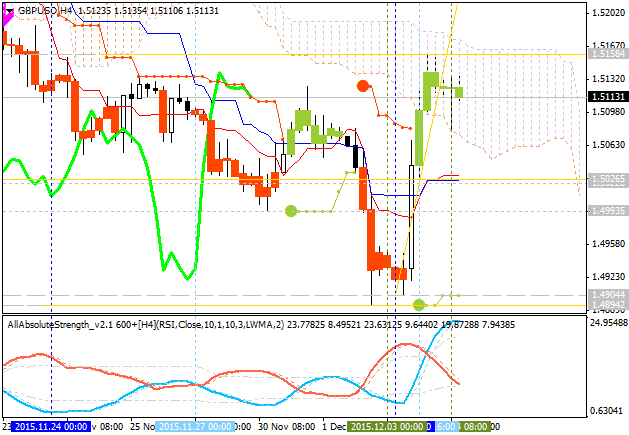

2. Actual data is 150-225k. This data is something to be around 200K

forecasting so we should consider the ranging market condition for most

of the pairs. The only pair may be attractive to trade is GBP/USD which

will be stapped with secondary ranging in intra-day for good breakdown

possibilities.

Sell GBP/USD.

Short-term: Buy EUR/USD.

Long-term: Sell EUR/USD.