Trading recommendations and Technical Analysis – HERE!

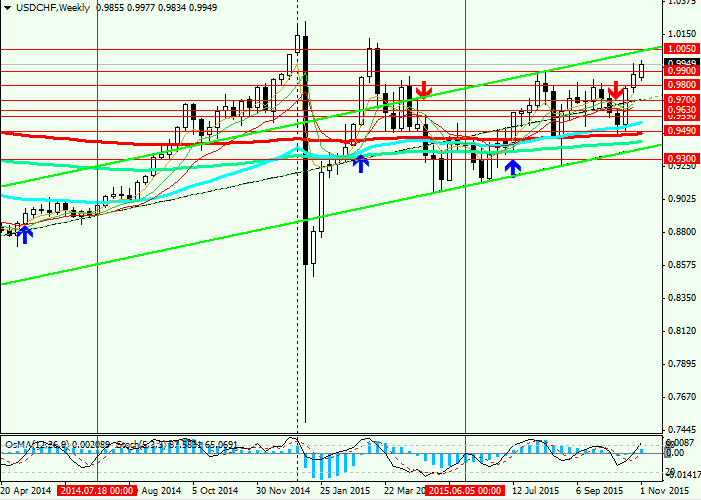

Growing market the US dollar is almost no chances to other safe-haven assets - precious metals, yen, US Treasuries. This fully applies to the other safe-haven currency - Swiss franc, which fell in the USD / CHF pair for the last 3 weeks more than 400 points.

The most important indicator of inflation - the consumer confidence index in Switzerland SECO - in Q4 came out significantly worse prognosis (-18 vs. -14 and -19 in the previous period).

Although that was released earlier in the week, the index of business activity in October SVME in Switzerland was higher than 50 and better than expected (50.7 vs. 50.2 forecast and 49.5 in September), real retail sales in September showed an increase for the year by only 0.2%.

Exports from the country in October fell by 2.9% to 16.95 billion francs, imports decreased by 1.5% compared with the same period last year, amounting to 13.903 billion francs. Reducing export component and the total turnover of the country as a whole can not but worry the government and the monetary authorities in Switzerland.

High franc put pressure on the demand from the euro zone and China, where the main flow is directed Swiss exports.

Nearly zero inflation rate and the level of retail sales by a decline in trade surplus in Switzerland on an annualized basis, the Swiss National Bank may push for further easing of monetary policy in the country and conduct interventions with sales of the franc, particularly against the euro to weaken the Swiss franc.

This, in turn, could trigger further strengthening and the pair USD / CHF.

The next meeting of the Swiss National Bank on monetary policy in the country is scheduled for December 10. According to the SNB franc is still significantly overvalued. The limiting factor of further easing of monetary policy in Switzerland is the current natural strengthening of the US dollar in the USD / CHF pair on a background of the Fed's commitment to tighten monetary policy and the beginning phase of rising interest rates in the United States.

Inaction is the Fed in this matter may disappoint market participants. Then, the pair USD / CHF can change to reverse decline and this may in turn push the SNB to act.

Today, in anticipation of important economic data on the state of the labor market in the US (Non-Farm PayRolls), which can determine the movement of the US dollar until the end of the month, investors and market participants are inactive, and the pair USD / CHF is near the level of opening of the trading day 0.9950.

See also review and trading recommendations for the pair EUR/USD!