Fredrik Nerbrand, global head of asset allocation for HSBC, has trimmed his weight in the S&P 500 index to 0% from 5%.

In a note to clients, dated October 12, he notes:

“Financial markets face a tricky trinity of slower growth and limited ability for central banks to moderate cyclical downturns at a time when risk premia is relatively limited in key markets. Hence, our asset allocation is highly conservative going forward.”

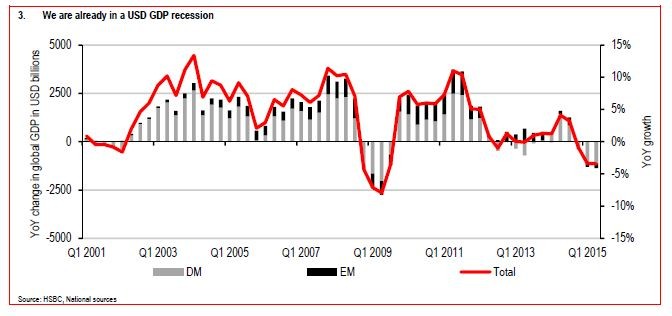

For one, he says, we are already in a global U.S. dollar recession, worse than the recesion of 2001.

The portfolio breakdown is 38% safety — a 12% cash allocation and increased holdings of 10-year Treasury bonds — plus 42% in “carry”.

“Carry” refers to borrowing and paying interest, so that to purchase something else that offers higher interest. Nerbrand thinks that demand for "carry" will rise, since yield becomes an even greater scarce resource in a world with ever-shrinking yields. He finds emerging-market debt and high yield appealing.

In the growth category, he’s got just 20%, and here’s a trap for U.S. stocks.

“In the long growth asset universe we find more value in copper and zinc than the S&P 500,” Nerbrand says. However, HSBC finds European stocks attractive, he notes.

“Going into year-end and looking at the financial landscape for 2016, we cannot help but remain highly risk averse,” says Nerbrand.