From Volkswagen to China - what is weighing on Germany's growth

At the moment, Europe's largest economy is taking a test of fortitude.

Germany’s trademark industrial mastery has been called into doubt

by Volkswagen AG’s emission scandal. Economic downturn in China and other

emerging markets is threatening its exports, while the flow of migrants is

set to dampen the nation’s finances.

With the euro area’s revival depending largely on Germany’s economic health, European Central Bank President

Mario Draghi is watching closely for challenges ahead.

A fresh slide in energy prices has faded the effects of his quantitative-easing program, pressing the inflation rate back below zero and driving a debate about the need for more stimulus that is likely to intensify if Germany’s economic expansion shrinks.

A first signal came on Monday, when London-based Markit Economics said its index of manufacturing and services activity dropped more than initially reported. The Purchasing Managers’ Index dipped to 54.1 in September from 55 the previous month. A Sept. 23 preliminary reading was for 54.3.

"Made in Germany" image

... may be damaged.

Trade data on Thursday will provide insights into the impact on exports from the slowdown in China and elsewhere, while import statistics may give clues on the strength of domestic demand, which has underpinned growth in recent quarters.

Holger Sandte, chief European analyst at Nordea Markets

in Copenhagen, forecasts that a production drop at Volkswagen of

less than 10 percent could already undermine gross domestic product by a

quarter of a percentage point. “The worst case would be if the ‘Made in Germany’ quality seal takes a

hit and demand for cars from other manufacturers or machinery

declines,” he says.

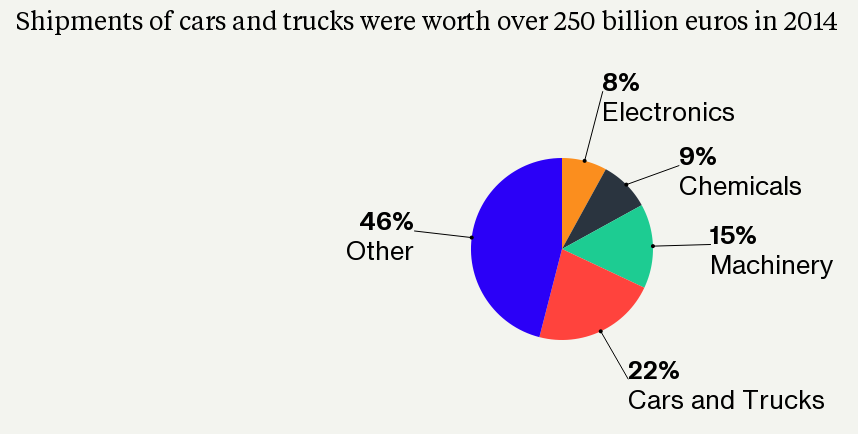

The automotive industry is an extremely important pillar for Germany's export-oriented economy. UniCredit Spa economist Andreas Rees accounts it for about 10 percent of Germany's GDP. In 2014, about 22 percent of shipments abroad were cars and trucks.

Exports

Economic indicators

Falling energy prices and a healthier labor market has supported German consumption. The labor market has added 150,000 jobs since the beginning of 2015 and brought unemployment to the lowest level since reunification. Wages have begun to advance, rising at about 3 percent while inflation has ground to a halt.

A short-term rise in spending may also come from the arrival of an estimated 800,000 refugees this year alone, an influx that puts at risk Finance Minister Wolfgang Schaeuble’s goal to keep Germany’s budget balanced in 2016. The government has assigned at least 6.7 billion euros to house, feed and assimilate the asylum seekers.

Germany's GDP rose 0.4 percent in the three months through June. The European Commission predicted in May that GDP would accelerate to 2 percent next year from 1.9 percent in 2015.

So far, at least, domestic growth drivers remain strong and should keep the recovery on track, says Maxime Sbaihi from Bloomberg Intelligence. He adds, however, that the three most painful challenges Germany is facing are the Volkswagen scandal, turbulence in emerging-market economies and the refugee crisis. Data due to be released in the coming days will show their initial impact on the economy.