BNPP: EUR/USD Into FOMC - back to 1.10 on dovish Fed result

16 September 2015, 10:11

0

1 277

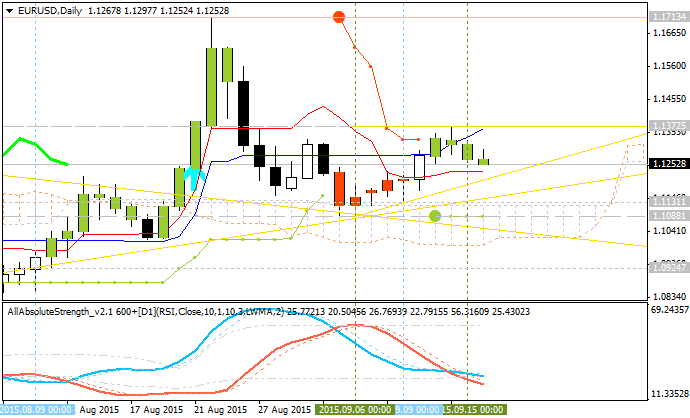

BNPP is expecting for Thursday’s FOMC statement to be in dovish way and as a result - the EUR/USD should come to 1.10 to be near 1.1088 reversal support level located inside Ichimoku cloud and below 200 day SMA in the ranging bearish area of the chart.

- "The pattern, if extended through Thursday’s Fed result, would bode well for EURUSD to trade back towards 1.10 and USDJPY to extend its recovery towards 123."

- "Still, we think risk-reward remains attractive for maintaining USD long exposure given our medium-term constructive view and light positioning."