China Stocks Sink Again as Growth Concerns Spur Investor Exodus.

15 September 2015, 16:42

0

134

- Value trust qualities tumbled in August in the midst of recoveries.

- Information this month show state boost yet to restore economy.

China's stocks drooped for a brief moment day in slim turnover in the midst of concern government measures to bolster the world's second-biggest value business and economy are fizzling.

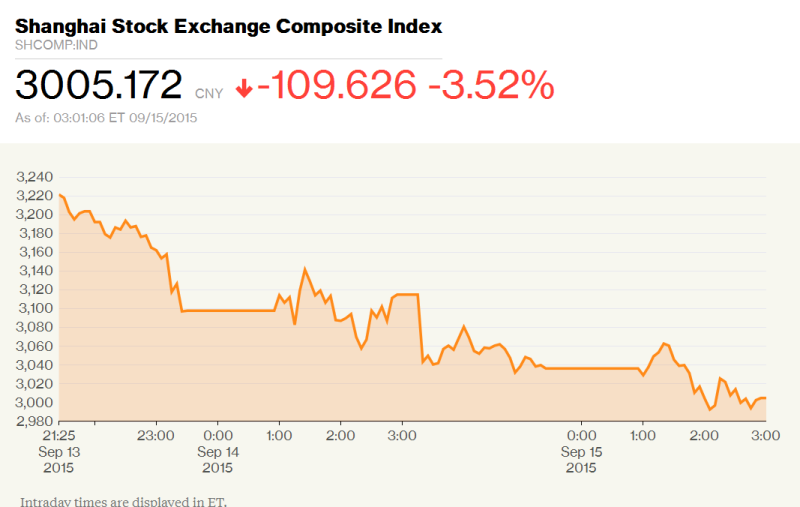

The Shanghai Composite Index dropped 3.5 percent to 3,005.17 at the nearby, drove by ware makers and innovation organizations. Around 14 stocks declined for every one that rose on the gage, while volumes were 36 percent underneath the 30-day normal. The file finished its greatest two-day misfortune in three weeks with a decrease of 6.1 percent.

Terrain Chinese value trusts lost 44 percent of their quality toward the end of a month ago contrasted and July, information demonstrated Monday, as exceptional state measures to stop a $5 trillion selloff neglected to turn away recovery. Information this month demonstrated five interest-rate slices following November and arrangements to help state spending have yet to restore an economy weighed around overcapacity and maker value emptying. Yuan positions at the national bank and monetary organizations fell by the most on record in August, a sign that strategy creators ventured up mediation to bolster the coin.

"The economy has not hinted at a get after a progression of cuts in

interest rates and store necessities, while assumptions about yuan

devaluation are still there," said Zhang Haidong, boss strategist at

Jinkuang Investment Management in Shanghai. "Yuan-designated resources confront descending weight. The business is still powerless."

Still Expensive

The CSI 300 Index declined 3.9 percent. Hong Kong's Hang Seng China Enterprises Index slipped 0.3 percent, while the Hang Seng Index withdrew 0.5 percent.

The Shanghai record may tumble to 2,700 as stocks are still lavish, said

Francis Cheung, CLSA head of China and Hong Kong technique, said in a preparation on Tuesday. Values on territory bourses exchanged at a middle 45 times reported income a week ago. That is the most noteworthy among the 10 biggest markets and more than double the 18 different for the Standard & Poor's 500 Index. The Shanghai Composite, where low-valued banks have a percentage of the greatest weightings, has a proportion of 15.

Gages of innovation and material stocks on the CSI 300 drooped more than 6 percent for the greatest decreases among industry bunches. Searainbow Holding Corp. furthermore, Yunnan Copper Co. both tumbled by the 10 percent day by day limit.

Value Funds

The 569 open-finished terrain Chinese stock trusts had consolidated net resource estimations of 724.8 billion yuan ($113.8 billion) in August, contrasted and 1.3 trillion yuan in July, as indicated by information posted on the Asset's site Management Association of China on Monday. The business body didn't clarify the explanation behind the decay. The Shanghai Composite fell 12 percent in August.

Edge obligation on the Shanghai Stock Exchange dropped to a nine-month low of 599.9 billion yuan on Monday. Merchants have cut utilized wagers on Chinese bourses by more than half since the top this year to $154 billion.

Barclays Plc. cut its estimate for the country's development one year from now to 6 percent from 6.6 percent after information Sunday demonstrated mechanical yield missed financial analysts' conjectures Sunday, while interest in the initial eight months expanded at the slowest pace subsequent to 2000. Bloomberg's month to month total national output tracker was at 6.64 percent a month ago, scarcely changed from July.

In a juggling demonstration that is getting more unpredictable by the month, powers are trying to pad the log jam, bolster the share trading system, settle the yuan and proceed with changes to open up the economy. The most recent steps incorporate arrangements to change state-claimed endeavors, decreases to capital necessities for some venture undertakings, and endeavors to draw more private cash for open tasks.