Hedge fund manager: Brace for a new era of increased volatility

The recent turbulence in markets presages a new era of increased volatility. That is the conclusion of Anthony Limbrick, whose hedge fund profited on bearish wagers during the August turmoil.

Limbrick sees two clear reasons for that:

1) U.S. stocks are expensive. Valuations

for U.S. stocks when compared to earnings before interest, tax,

depreciation and amortization hark back to the dot-com bubble era, Bloomberg referred to Limbrick as saying.

2) Emerging markets will continue to plague developed counterparts for

years to come, repeating the Asian financial crisis of the 1990s.

Back in 2013, Limbrick’s firm, 36 South Capital Advisors, saw trouble brewing in

developing economies.

In his opinion, the U.S. central bank won’t do anything to calm equities after the double worry - about China and a rate hike - pushed the VIX soaring 135 percent in August.

“It

may well be ‘sell the rumor, buy the fact’ into the Fed meeting,” with equities being initially higher, but the important question is how long this rally will linger.

“Markets may have an upward bias for a while, but we’d expect to see another leg down.”

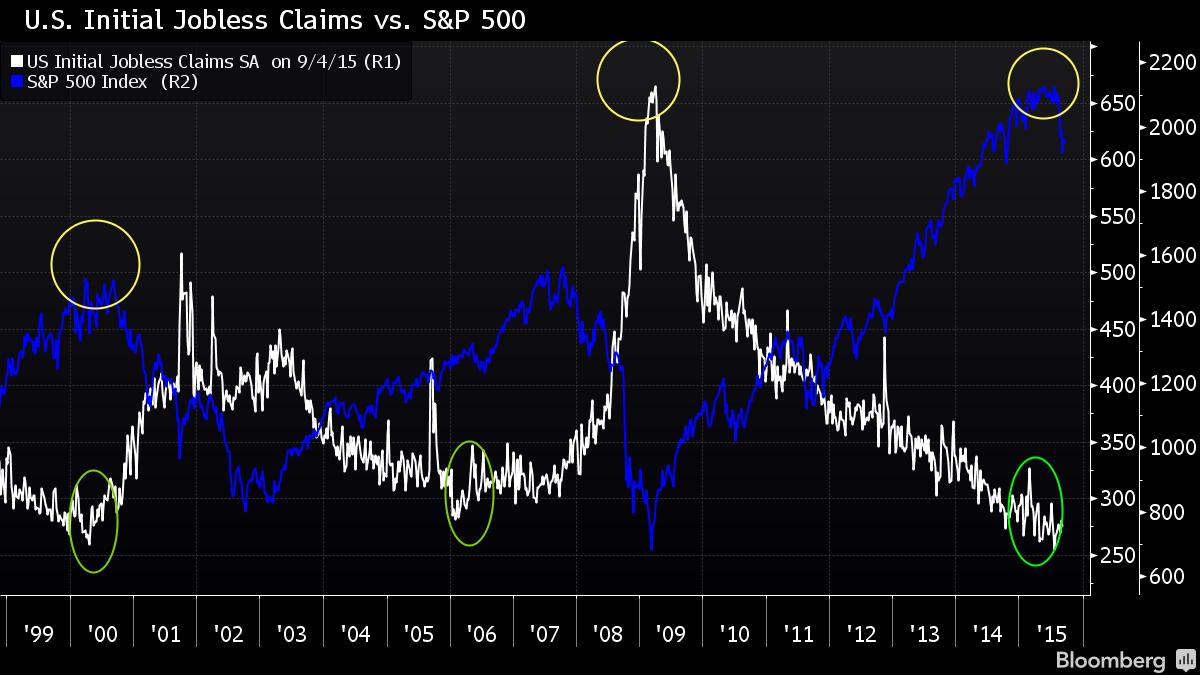

Have a look at data on initial jobless claims - which he closely watches. When applications for

unemployment benefits have reached a trough, it’s historically a good time to

sell equities since the trend encourages the Fed to raise rates, he said.

Moreover, shorting volatility became a popular, then crowded, trade earlier in the year and now a reversal is due.

Market is fragile when the consensus is built around one side of the market, Limbrick said.

“That was one reason we started to get confident that a low in volatility had been made ahead of this summer.”

According to data compiled by Bloomberg, volatility hedge fund 36 South reacted to technical signals in June that markets were fragile by building up bearish positions. In August, its Kohinoor Core Fund returned 13 percent, outpacing 98 percent of peers. However, the fund is down 2 percent so far in 2015, a sub-par performance relative to rivals.