Citi Research: Market sentiment broke into 'panic' territory; Brace for jittery September

Market sentiment has been damaged with the recent correction and will hardly improve in the short term, setting stocks up for a volatile September as international worries overshadow domestic ones.

Last week stocks took a blow with the Dow Jones Industrial Average dropping 3.3%, the S&P 500 index shedding 3.4%, and the Nasdaq Composite Index falling 3%.

Many analysts still believe the correction has enough room to go with one indicator showing that investor sentiment has fallen to “panic” levels.

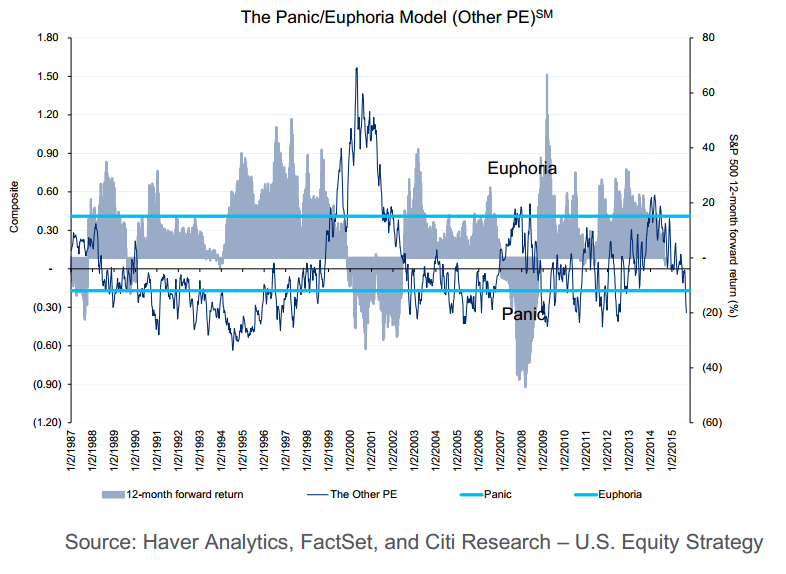

Citi Research’s Tobias Levkovich said his Panic/Euphoria model, which brings together such indicators as short-interest ratios, margin debt, compiled bullishness data, and put/call ratios, broke into “panic” territory for the first time since late 2012.

Although it may not seem good in the short term, Levkovich said that

historically stocks have gone up 96% of the time over the next 12 months

when the gauge has achieved that level:

To Brad McMillan, chief investment officer at Commonwealth Financial, the international environment is feeding market volatility more than any other domestic factor.

Germany’s soft manufacturing orders report likely had more to do with Friday’s selloff than the jobs report’s effect on a September rate increase from the Federal Reserve, McMillan said.

A lingering market selloff is what could affect the FOMC's decision. McMillan said if investors come back from the Labor Day holiday and

decide to take risk off the table, the S&P 500 could break down

through 1,870 as low as 1,790.

If this occurs, then the likelihood for a September rate increase drops below 50%, in his view.

“We’ve got another month or so before confidence bounces back,” McMillan said. “A lot of damage has been done to sentiment.”