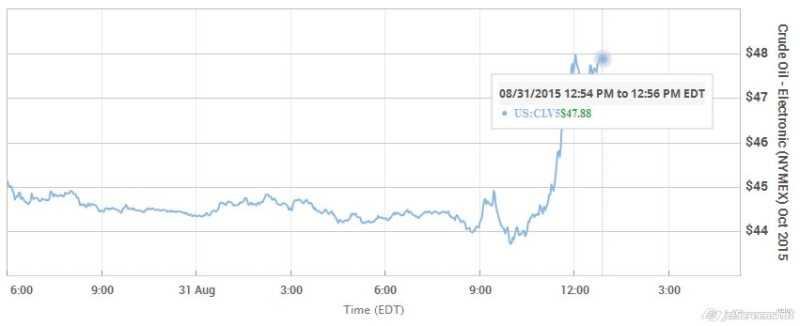

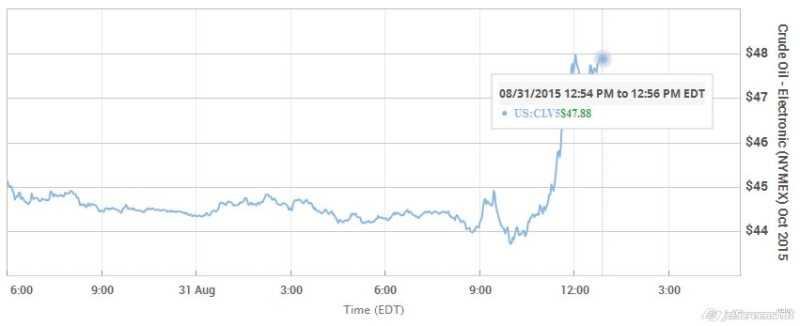

The Organization of the Petroleum Exporting Countries on Monday communicated worry about the drop in oil costs and said it stands "prepared to talk" to different makers. In an article in its month to month announcement, OPEC communicated worry that maintained low costs could take a toll on tasks went for extending limit, additionally sounded a hopeful note on gauges for oil request. The association said it would keep on doing "all in its energy" to make an enviroment that would permit the oil business sector to accomplish "harmony with reasonable and sensible costs." OPEC said it "stands prepared to converse with every single other maker. In any case, this must be on a level playing field." The association said it would "secure its own advantage" however that collaboration "is and will dependably remain the way to oil's future and that is the reason dialog among the primary partners is so imperative going ahead." Nymex October raw petroleum fates CLV5, +6.21% were up more than 6% at $47.98 a barrel.

Collaboration holds the way to oil's future

OPEC Bulletin Commentary July-August 2015

Worldwide unrefined petroleum costs in July endured their biggest month to month decrease subsequent to Lehman Brothers broken down in the United States in 2008, denoting the onset of the worldwide monetary emergency. Today's proceeding with weight on costs, achieved by higher unrefined generation, combined with business sector hypothesis, remains a reason for sympathy toward OPEC and its Members — undoubtedly for all partners in the business.

Aside from the conspicuous loss of quite required income needed for Member Countries' financial advancement, developing apprehensions, under the present low-value situation, interest in future limit increments will keep on being racked or crossed out through and through.

With the long lead times connected with putting up new oil for sale to the public, the industry can't manage the cost of a slip in spending, especially in perspective of the long haul desires for oil request, which direct emphatically toward a significant ascent in world oil utilization throughout the following two decades at any rate.

Inability to put now could mean costs in the coming years spiking to levels conflicting with what is viewed as "sensible" for both makers and customers.

Then again, it is maybe an excessive amount to anticipate that oil organizations will hazard noteworthy spending in the current financial atmosphere. They as of now have enough on their plate in needing to conserve and discover methods for lessening expenses in their current activities, coordinating operational spending plans to today's low costs.

The one good thing to leave a time of lower costs is that request usually ascends as less expensive fuel supports more use by the buyers. What's more, the present circumstance has all the earmarks of being no special case. Indeed, three of the business' primary definitive foundations — OPEC, the International Energy Agency (IEA) in Paris and the Energy Information Administration (EIA) of the United States — all conjecture oil interest enhancing going into one year from now. Their figures demonstrate that this will happen on the back of a normal increment in worldwide financial development, which, thus, ought to additionally help unrefined costs to fortify.

OPEC's Monthly Oil Market Report (MOMR) for August focuses out that given the superior to anything expected development in worldwide oil request so far in 2015, together with indications of a get in the economies of the real expending nations, raw petroleum request in the coming months ought to keep on moving forward.

It includes that this improvement would likewise serve to step by step decrease the awkwardness in oil supply and interest basics.

The OPEC Secretariat's projections are stuck to the way that worldwide monetary development will ascend by 3.2 for each penny this year, with a far superior execution of 3.5 for each penny slated for 2016.

Of essentialness is the way that the OECD and Euro-zone locales, which beforehand endured years of stagnation, are set to extend one year from now — by 2.1 for every penny and 1.3 for each penny, individually.

Add to the mathematical statement the way that India will see its total national output enhance to 7.7 for every penny in 2016, China will in any case be moderately solid at 6.5 for each penny, while Russia and Brazil are seen moving out of retreat, and one can acknowledge why there is developing positive thinking over oil request development progressing.

Supported by the OECD Americas and Europe, OPEC figures demonstrate that world oil request this year is presently anticipated that would ascend by 1.38 million barrels/day from its 2014 level to 92.70m b/d, while in 2016 it is relied upon to include another 1.34m b/d to development.

This all foreshadows well at oil costs and ought to assume a major part in serving to restore market security.

History has more than once taught us that when managing something as mind boggling and perplexing as the global oil market, which includes numerous personal stakes hoping to guard their particular positions, it is infrequently going to be plain cruising.

In any case, if the colossal projections on oil interest are right, then it is only an instance of riding out the tempest and sitting tight for more settled waters to return.

Evidently, OPEC, as usual, will keep on doing all in its energy to make the right empowering environment for the oil business to accomplish balance with reasonable and sensible costs.

As the Organization has focused on various events, it stands prepared to converse with every single other maker. Be that as it may, this must be on a level playing field. OPEC will ensure its own particular hobbies. As creating nations, its Members, whose economies depend vigorously on this one valuable asset, can sick bear to do something else.

Collaboration is and will dependably remain the way to oil's future and that is the reason dialog among the fundamental partners is so critical going ahead.

There is no snappy fix, yet in the event that there is a readiness to confront the oil business' difficulties together, then the prospects for the future must be a considerable measure superior to anything what everybody included in the business has been encountering in the course of recent months or somewhere in the vicinity. Just time wi

Collaboration holds the way to oil's future

OPEC Bulletin Commentary July-August 2015

Worldwide unrefined petroleum costs in July endured their biggest month to month decrease subsequent to Lehman Brothers broken down in the United States in 2008, denoting the onset of the worldwide monetary emergency. Today's proceeding with weight on costs, achieved by higher unrefined generation, combined with business sector hypothesis, remains a reason for sympathy toward OPEC and its Members — undoubtedly for all partners in the business.

Aside from the conspicuous loss of quite required income needed for Member Countries' financial advancement, developing apprehensions, under the present low-value situation, interest in future limit increments will keep on being racked or crossed out through and through.

With the long lead times connected with putting up new oil for sale to the public, the industry can't manage the cost of a slip in spending, especially in perspective of the long haul desires for oil request, which direct emphatically toward a significant ascent in world oil utilization throughout the following two decades at any rate.

Inability to put now could mean costs in the coming years spiking to levels conflicting with what is viewed as "sensible" for both makers and customers.

Then again, it is maybe an excessive amount to anticipate that oil organizations will hazard noteworthy spending in the current financial atmosphere. They as of now have enough on their plate in needing to conserve and discover methods for lessening expenses in their current activities, coordinating operational spending plans to today's low costs.

The one good thing to leave a time of lower costs is that request usually ascends as less expensive fuel supports more use by the buyers. What's more, the present circumstance has all the earmarks of being no special case. Indeed, three of the business' primary definitive foundations — OPEC, the International Energy Agency (IEA) in Paris and the Energy Information Administration (EIA) of the United States — all conjecture oil interest enhancing going into one year from now. Their figures demonstrate that this will happen on the back of a normal increment in worldwide financial development, which, thus, ought to additionally help unrefined costs to fortify.

OPEC's Monthly Oil Market Report (MOMR) for August focuses out that given the superior to anything expected development in worldwide oil request so far in 2015, together with indications of a get in the economies of the real expending nations, raw petroleum request in the coming months ought to keep on moving forward.

It includes that this improvement would likewise serve to step by step decrease the awkwardness in oil supply and interest basics.

The OPEC Secretariat's projections are stuck to the way that worldwide monetary development will ascend by 3.2 for each penny this year, with a far superior execution of 3.5 for each penny slated for 2016.

Of essentialness is the way that the OECD and Euro-zone locales, which beforehand endured years of stagnation, are set to extend one year from now — by 2.1 for every penny and 1.3 for each penny, individually.

Add to the mathematical statement the way that India will see its total national output enhance to 7.7 for every penny in 2016, China will in any case be moderately solid at 6.5 for each penny, while Russia and Brazil are seen moving out of retreat, and one can acknowledge why there is developing positive thinking over oil request development progressing.

Supported by the OECD Americas and Europe, OPEC figures demonstrate that world oil request this year is presently anticipated that would ascend by 1.38 million barrels/day from its 2014 level to 92.70m b/d, while in 2016 it is relied upon to include another 1.34m b/d to development.

This all foreshadows well at oil costs and ought to assume a major part in serving to restore market security.

History has more than once taught us that when managing something as mind boggling and perplexing as the global oil market, which includes numerous personal stakes hoping to guard their particular positions, it is infrequently going to be plain cruising.

In any case, if the colossal projections on oil interest are right, then it is only an instance of riding out the tempest and sitting tight for more settled waters to return.

Evidently, OPEC, as usual, will keep on doing all in its energy to make the right empowering environment for the oil business to accomplish balance with reasonable and sensible costs.

As the Organization has focused on various events, it stands prepared to converse with every single other maker. Be that as it may, this must be on a level playing field. OPEC will ensure its own particular hobbies. As creating nations, its Members, whose economies depend vigorously on this one valuable asset, can sick bear to do something else.

Collaboration is and will dependably remain the way to oil's future and that is the reason dialog among the fundamental partners is so critical going ahead.

There is no snappy fix, yet in the event that there is a readiness to confront the oil business' difficulties together, then the prospects for the future must be a considerable measure superior to anything what everybody included in the business has been encountering in the course of recent months or somewhere in the vicinity. Just time wi