"We are not easily spooked, but we are not in a hurry to raise rates," was the message central bankers sent to market players at the Kansas City Federal Reserve’s annual retreat in Jackson Hole. Indeed, global volatility and fears over the possible economic contagion have made the Federal Reserve more uncertain about lifting interest rates as soon as September.

Policy makers from the Fed have been reiterating throughout 2014 they don’t want to surprise the markets. Thus, as former Fed Vice Chairman Alan Blinder put it, if the consensus had been found, markets would have been immediately notified about it.

“If they knew, they’d already be giving strong hints. You’d have heard something from Janet Yellen pushing in the September-ish or December-ish direction. We’ve heard nothing like that from chair Yellen,” Blinder said in a radio interview.

The volatility in the U.S. equity market — at the levels not seen in five years — makes Fed officials more pensive in respect of their further moves.

On Wednesday, New York Fed President William Dudley said a possible September hike looked “less compelling,” given the market turmoil.

Later, however, Fed Vice Chairman Stanley Fischer seemed to open the door back up, considering that markets might calm down quickly. There was a quite strong possibility of a September rate liftoff before China devalued the yuan earlier this month, said Fed Vice Chairman Stanley Fischer on Friday. The U.S. central bank doesn’t fully understand the market volatility that emerged from China’s shift in its foreign exchange regime, Fischer said. But there is a chance things could settle down quickly, he added.

Out of this, Blinder concluded that this was an evidence of the lack of consensus: “If you don’t know yourself, what are you supposed to say?”

At Jackson Hole, one party of economists expressed readiness to increase rates, suggesting the volatility is an inevitable side effect of the easy policy stance since 2008.

Others, however, suggested that the market volatility is a signal that inflation will remain low and there is no sense in rushing to increase rates.

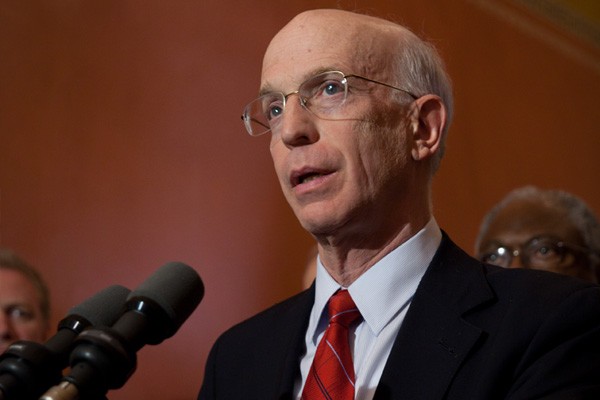

Alan Blinder, Princeton University faculty member and 15th Vice Chairperson of the Federal Reserve System

There is one thing, however, analysts agree upon: if the financial markets rout does not settle down, the Fed will delay the hike.

Mickey Levy, chief U.S. economist for Berenberg, said the Fed was likely to postpone the liftoff. “They will skip September. If you look at Fed history, they either ease or are on hold during financial turmoil,” he said.

Paul Ashworth, chief U.S. economist at Capital Economics had the same view: “Until we hear otherwise, we have to assume that liftoff has been delayed yet again.”

Alan Blinder commented that in the interview that the chances are greater that the Fed stays on hold in September.

Zach Pandl, an economist at Goldman Sachs, said the recent turmoil in global financial markets warranted a downward adjustment to U.S. GDP forecasts by a quarter of one percentage point each over the next three quarters. The drag from weaker global trade will intensify and financial conditions have tightened. Goldman still predicts a rate liftoff in December but said “the risks of a later liftoff have increased significantly.”

Healthy or not, China’s market turmoil spread to the

U.S. In the five trading days through Aug. 24, the

S&P 500 Index dropped 10 percent, says Bloomberg.

As they arrived in Jackson Hole mid-week, Fed policy makers shrugged off investor worries that financial markets were on the brink of a meltdown.

“The key question for the committee is how much would you want to change the outlook based on the volatility that we’ve seen over the last 10 days, and I think the answer to that is going to be: not very much,” said St. Louis Fed President James Bullard, who favors raising rates.

Minneapolis Fed President Narayana Kocherlakota, who wants the FOMC to wait at least until 2016 before moving, agreed.

“Should it cause a change in our outlook for inflation and unemployment going forward? There I think my own answer would be no,” he said.