A standout amongst the Most Successful Trading Strategies This Year May Be Coming to an End

20 August 2015, 13:12

0

287

Speculators who've been stamping cash as indicated by the Wall Street saying that the pattern is your companion just got an update that nothing works until the end of time.

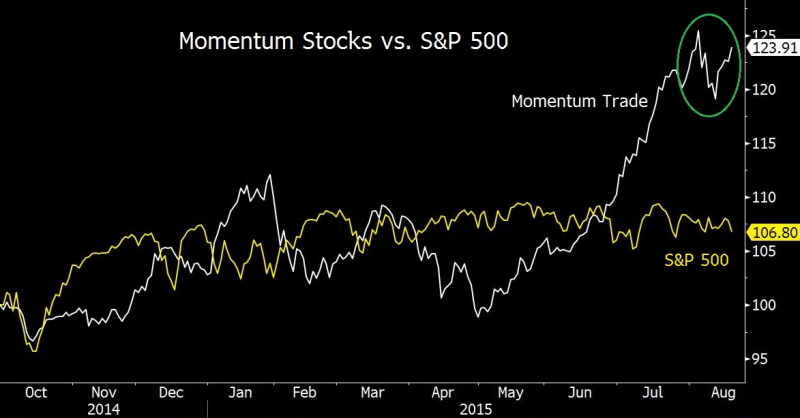

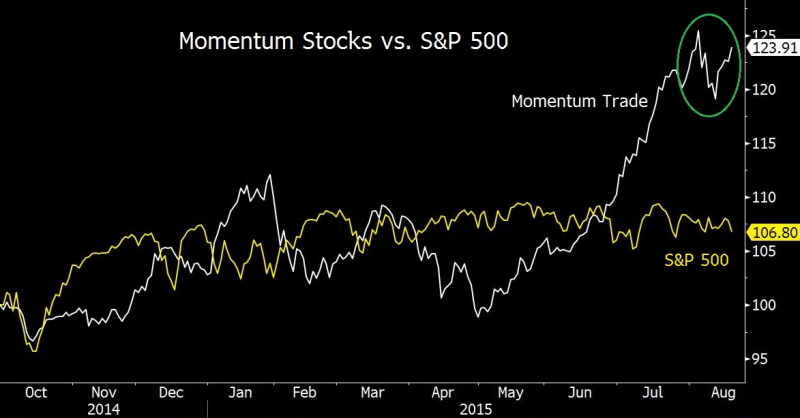

A Citigroup Inc. list that tracks U.S. energy stocks like Apple Inc. furthermore, Netflix Inc. did something a week ago it hadn't done subsequent to June - it fell. While as yet trouncing the Standard & Poor's 500 Index in 2015, experts at the bank have cautioned that the technique is drawing nearer a limit where turns have happened previously.

Practically nothing has worked better in the current year's diminishing value market than energy, where you load up on stocks that have risen the most in the previous two to 12 months and trust they keep going up. Sent up high by managed revitalizes in biotech and media shares, concern is mounting that the exchange has gotten excessively well known, setting the stage for more keen swings.

"In the previous couple of years, including this year, there have been a considerable measure of minutes when exchanges have ended up swarmed," said Arvin Soh, a New York-based store chief who creates worldwide full scale techniques at GAM, which manages $130 billion. "What's diverse is that the inversions that in the long run come do have a tendency to be more extreme now than what we've seen over a more drawn out time skyline."

With broadness narrowing before the Federal Reserve raises rates, staying with champs has been an outline for achievement in 2015. Quantitative trusts were among the best entertainers out of value, occasion driven and large scale methodologies through July this year, trailing just innovation, social insurance and dissident directors, as per information by Hedge Fund Research Inc.

Singular financial specialists have taken note. One of the biggest trade exchanged trusts utilizing the strategy, the iShares MSCI USA Momentum Index Fund, baited a record $125 million in July, boosting its aggregate by around a fifth. It hasn't had a solitary month of outpourings since it began in 2013.

Owning it has paid off, as well: the store is up 8.2 percent in 2015, contrasted and 1.8 percent in the S&P 500. Another ETF, the Powershares DWA Momentum Portfolio, as of late saw resources cross $2 billion and has returned more than 7 percent this year. Still, a percentage of the exchanges contributing the achievement have been debilitating.

Since July, industry initiative in the S&P 500 has been moving, not what energy financial specialists need to see. Utilities are driving the business sector since August and a year ago's champs, human services and customer organizations, are trailing. The Newedge CTA Index, which tracks PC driven systems and trusts that place wagers on expansive monetary patterns, has fallen 6.5 percent from a high in April.

Indeed, even Apple, the organization that has contributed more to the U.S. positively trending business sector than some other organization, is vacillating. After the iPhone producer's 10-fold surge subsequent to 2009, shares have tumbled 12 percent from a record-breaking high in February.

"The inquiry is whether you're seeing the story change around biotech and it's bringing on that force exchange to lose steam," said Grieves, a London-based portfolio supervisor at Miton, who runs the association's U.S. Opportunities Fund. "The issue with force exchanges is that you have no edge of wellbeing. When you get on the fleeting trend, you close your eyes to valuation." https://www.mql5.com/en/signals/120434#!tab=history

A Citigroup Inc. list that tracks U.S. energy stocks like Apple Inc. furthermore, Netflix Inc. did something a week ago it hadn't done subsequent to June - it fell. While as yet trouncing the Standard & Poor's 500 Index in 2015, experts at the bank have cautioned that the technique is drawing nearer a limit where turns have happened previously.

Practically nothing has worked better in the current year's diminishing value market than energy, where you load up on stocks that have risen the most in the previous two to 12 months and trust they keep going up. Sent up high by managed revitalizes in biotech and media shares, concern is mounting that the exchange has gotten excessively well known, setting the stage for more keen swings.

"In the previous couple of years, including this year, there have been a considerable measure of minutes when exchanges have ended up swarmed," said Arvin Soh, a New York-based store chief who creates worldwide full scale techniques at GAM, which manages $130 billion. "What's diverse is that the inversions that in the long run come do have a tendency to be more extreme now than what we've seen over a more drawn out time skyline."

With broadness narrowing before the Federal Reserve raises rates, staying with champs has been an outline for achievement in 2015. Quantitative trusts were among the best entertainers out of value, occasion driven and large scale methodologies through July this year, trailing just innovation, social insurance and dissident directors, as per information by Hedge Fund Research Inc.

Singular financial specialists have taken note. One of the biggest trade exchanged trusts utilizing the strategy, the iShares MSCI USA Momentum Index Fund, baited a record $125 million in July, boosting its aggregate by around a fifth. It hasn't had a solitary month of outpourings since it began in 2013.

Owning it has paid off, as well: the store is up 8.2 percent in 2015, contrasted and 1.8 percent in the S&P 500. Another ETF, the Powershares DWA Momentum Portfolio, as of late saw resources cross $2 billion and has returned more than 7 percent this year. Still, a percentage of the exchanges contributing the achievement have been debilitating.

Since July, industry initiative in the S&P 500 has been moving, not what energy financial specialists need to see. Utilities are driving the business sector since August and a year ago's champs, human services and customer organizations, are trailing. The Newedge CTA Index, which tracks PC driven systems and trusts that place wagers on expansive monetary patterns, has fallen 6.5 percent from a high in April.

Indeed, even Apple, the organization that has contributed more to the U.S. positively trending business sector than some other organization, is vacillating. After the iPhone producer's 10-fold surge subsequent to 2009, shares have tumbled 12 percent from a record-breaking high in February.

"The inquiry is whether you're seeing the story change around biotech and it's bringing on that force exchange to lose steam," said Grieves, a London-based portfolio supervisor at Miton, who runs the association's U.S. Opportunities Fund. "The issue with force exchanges is that you have no edge of wellbeing. When you get on the fleeting trend, you close your eyes to valuation." https://www.mql5.com/en/signals/120434#!tab=history