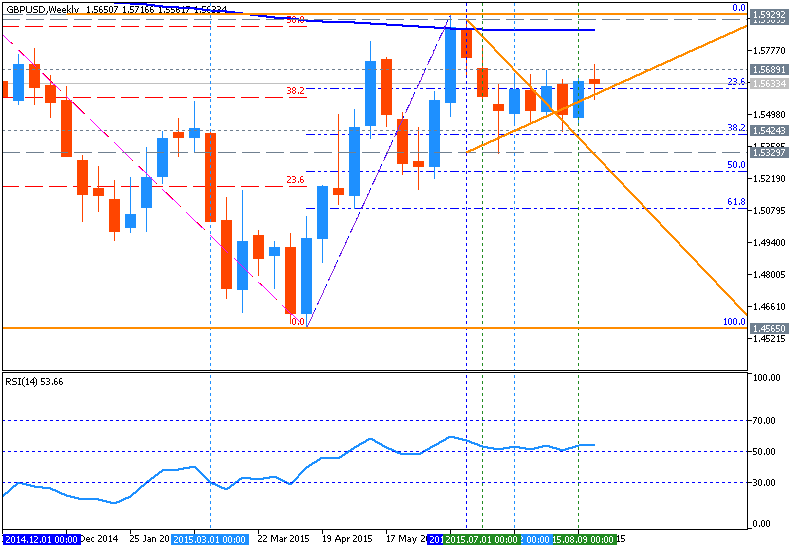

GBPUSD Price Action Analysis - market rally with possible reversal

22 August 2015, 21:11

0

2 588

W1 price is located just below 200 period SMA (200-SMA) and 100 period SMA (100-SMA) for the primary bearish market condition: the price is ranging between 38.2% Fibo support level at 1.5408 and Fibo resistance level at 1.5929:

- the price broke 23.6% Fibo level at 1.5606 for the secondary market rally to be started;

- symmetric triangle pattern was broken by the price from below to above for rally;

- data of RSI indicator is estinating the local uptrend as the secondary market rally within the primary bearish;

- "our near-term trend bias is negative on cable while below 1.5720";

- "a move below Fibonacci support around 1.5560 is needed to re-instill some downside momentum in the rate";

- "daily close above 1.5720 would turn us positive on the pound".

If the price will break 38.2% Fibo support level at 1.5408 so the bearish market condition will be continuing.

If the price will break Fibo resistance level at 1.5929

from below to above so we may see the reversal of the price movement from the primary bearish to the bullish market condition (price will break 200-SMA in this case).

If not so the price will be ranging within the levels.

Trend: