Outer lowflationary powers keep on keeping UK expansion fundamentally frail, while locally created swelling seems to have been building up as of late, yet is still excessively feeble, making it impossible to counterbalance the impact of modest vitality and imports.

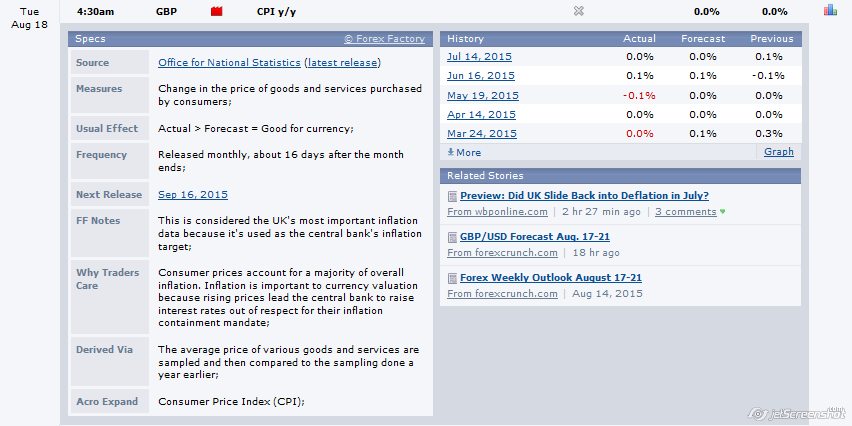

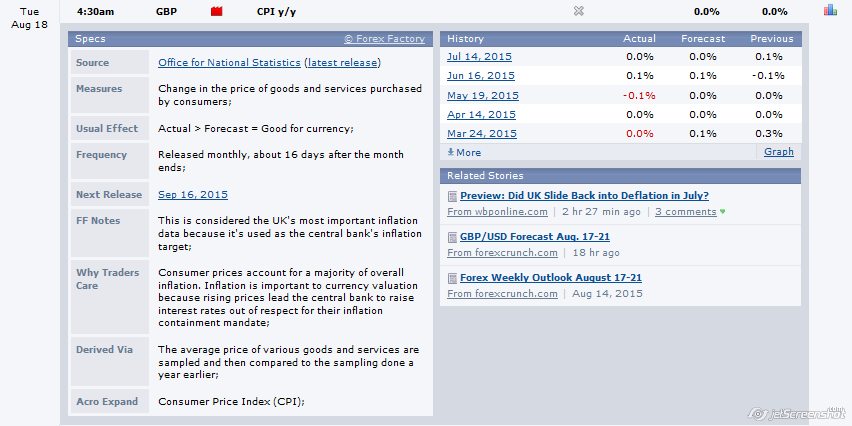

Sneak peak: Did UK Slide Back into Deflation in July?

London - The middle evaluation recommends UK CPI swelling stayed unaltered at 0% in July. The center CPI, a less unstable gage stripped of vitality and sustenance costs, is assessed to have stayed at 0.8% - the most minimal level in fourteen years. The UK's Office for National Statistics (ONS) is discharging July figures on Tuesday this week.

In spite of desires indicating no adjustment in expansion, striking falls in oil and petrol costs in July this year, contrasted and that month a year prior, propose swelling may have slipped back beneath zero once more, facilitating weight on the Bank of England (BoE) to start giving back the base premium rate gradually towards more typical levels.

Falling petrol costs

As per the AA Fuel Report, the UK national normal cost of unleaded petrol in July this year was as much as 11% beneath the normal petrol cost back in July 2014. What's more, the way that vehicle costs in July a year ago were the principle upward driver to the yearly CPI transform, we can expect checked descending weight from this fragment on the current year's July expansion rate.

The cost of Brent unrefined fell in the middle of June and July this year by 6.3%, and was a monstrous 40% underneath the level seen in July a year ago. The Bank of England (BoE) repeated in its August estimate that as much as seventy five percent of the descending deviation of CPI expansion from the 2% objective has originated from the unstable costs of vitality and sustenance. Those outside components, consolidated with quelled locally created swelling, have been keeping the general CPI underneath the objective since December 2013.

The BoE hence struck a more dovish tone again in its August Inflation Report, reexamining down the close term swelling point of view toward the back of solid descending outer weights originating from feeble oil costs and sterling appreciation.

"In light of the lessening in oil costs and energy about sterling in the course of recent months, it gave the idea that the increment in swelling over the next year would be more steady than had beforehand been assumed," the BoE's Monetary Policy Committee (MPC) minutes read in August.

Sterling go through difficult to assess, however discriminating

Writing in The Telegraph on Sunday a week ago, MPC rate-setter Kristin Forbes said the go through from past sterling thankfulness could be quicker and gentler than assessed, however included that "dangers from sterling's late developments are the hardest to assess, yet discriminating"

"Sterling's gratefulness from mid 2013 to mid-2014 did not diminish import costs by as much as has verifiably happened, along these lines bringing on less drag to swelling. In the event that this lower level of go through proceeds, or any go through happens quicker than before, swelling could recuperate speedier than we gauge," Forbes composed.

She likewise cautioned that "keeping up interest rates at the present low levels amid an extension dangers making twists." Forbes has been voting in favor of no change to rates since she joined the MPC in July 2014.

With respect to the May Inflation Report, the BoE brought down fleeting expansion conjecture practically significantly to extend a swelling rate of just 0.3% on a middle premise before the end of 2015, then rising gradually to 1.5% toward the end of 2016, coming to the 2% objective in the second from last quarter of 2017. The lower close term swelling standpoint suggests steady premium rate builds, affirming current business sector desires of a February lift-off, yet with the danger of a postponement to May staying conceivable, if powerless expansion continues.

Shop value collapse, as measured by the British Retail Consortium (BRC), additionally adds to this descending pattern. In its July overview, the BRC assessed that general shop value emptying sank more profound to 1.4% in July, lower than the 1.3% fall in June.

Wage development reinforces

As to created inflationary weights, for example, compensation, those have hinted at speculative building up, yet at the same time remain excessively feeble, making it impossible to balance solid outside low flationary powers.

As indicated by the most recent work market information, normal wages - those demonstrating an additionally fundamental development stripped of unpredictable extra installments - kept on expanding by 2.8% over the quarter to June, which was the most elevated rate of development since 2009. Absolute income, including rewards, dropped surprisingly to 2.4% in June from 3.2% a month prior, however this sudden drop was for the most part because of the way that the reward season was over at the season of June's information accumulation.

Until further notice, record-low swelling, consolidated with rising wages, offers higher genuine salary to family units, who thus feel less weight on their financial plans following quite a while of above-target expansion and low wages. In any case, the danger that expansion overshoots the objective again remains very conceivable if the BoE keeps on sitting on rates for more than would normally be appropriate.

"Since this is not just about swelling, as you probably are aware, through the span of the following couple of months, yet expansion for the medium term, so individuals don't need to stress over expansion, so individuals can appreciate the profit, maybe, of lower petrol costs, lower nourishment costs today, without agonizing over a payback in the medium term," Governor Mark Carney said amid the August Inflation Report question and answer session.https://www.mql5.com/en/signals/120434

Sneak peak: Did UK Slide Back into Deflation in July?

London - The middle evaluation recommends UK CPI swelling stayed unaltered at 0% in July. The center CPI, a less unstable gage stripped of vitality and sustenance costs, is assessed to have stayed at 0.8% - the most minimal level in fourteen years. The UK's Office for National Statistics (ONS) is discharging July figures on Tuesday this week.

In spite of desires indicating no adjustment in expansion, striking falls in oil and petrol costs in July this year, contrasted and that month a year prior, propose swelling may have slipped back beneath zero once more, facilitating weight on the Bank of England (BoE) to start giving back the base premium rate gradually towards more typical levels.

Falling petrol costs

As per the AA Fuel Report, the UK national normal cost of unleaded petrol in July this year was as much as 11% beneath the normal petrol cost back in July 2014. What's more, the way that vehicle costs in July a year ago were the principle upward driver to the yearly CPI transform, we can expect checked descending weight from this fragment on the current year's July expansion rate.

The cost of Brent unrefined fell in the middle of June and July this year by 6.3%, and was a monstrous 40% underneath the level seen in July a year ago. The Bank of England (BoE) repeated in its August estimate that as much as seventy five percent of the descending deviation of CPI expansion from the 2% objective has originated from the unstable costs of vitality and sustenance. Those outside components, consolidated with quelled locally created swelling, have been keeping the general CPI underneath the objective since December 2013.

The BoE hence struck a more dovish tone again in its August Inflation Report, reexamining down the close term swelling point of view toward the back of solid descending outer weights originating from feeble oil costs and sterling appreciation.

"In light of the lessening in oil costs and energy about sterling in the course of recent months, it gave the idea that the increment in swelling over the next year would be more steady than had beforehand been assumed," the BoE's Monetary Policy Committee (MPC) minutes read in August.

Sterling go through difficult to assess, however discriminating

Writing in The Telegraph on Sunday a week ago, MPC rate-setter Kristin Forbes said the go through from past sterling thankfulness could be quicker and gentler than assessed, however included that "dangers from sterling's late developments are the hardest to assess, yet discriminating"

"Sterling's gratefulness from mid 2013 to mid-2014 did not diminish import costs by as much as has verifiably happened, along these lines bringing on less drag to swelling. In the event that this lower level of go through proceeds, or any go through happens quicker than before, swelling could recuperate speedier than we gauge," Forbes composed.

She likewise cautioned that "keeping up interest rates at the present low levels amid an extension dangers making twists." Forbes has been voting in favor of no change to rates since she joined the MPC in July 2014.

With respect to the May Inflation Report, the BoE brought down fleeting expansion conjecture practically significantly to extend a swelling rate of just 0.3% on a middle premise before the end of 2015, then rising gradually to 1.5% toward the end of 2016, coming to the 2% objective in the second from last quarter of 2017. The lower close term swelling standpoint suggests steady premium rate builds, affirming current business sector desires of a February lift-off, yet with the danger of a postponement to May staying conceivable, if powerless expansion continues.

Shop value collapse, as measured by the British Retail Consortium (BRC), additionally adds to this descending pattern. In its July overview, the BRC assessed that general shop value emptying sank more profound to 1.4% in July, lower than the 1.3% fall in June.

Wage development reinforces

As to created inflationary weights, for example, compensation, those have hinted at speculative building up, yet at the same time remain excessively feeble, making it impossible to balance solid outside low flationary powers.

As indicated by the most recent work market information, normal wages - those demonstrating an additionally fundamental development stripped of unpredictable extra installments - kept on expanding by 2.8% over the quarter to June, which was the most elevated rate of development since 2009. Absolute income, including rewards, dropped surprisingly to 2.4% in June from 3.2% a month prior, however this sudden drop was for the most part because of the way that the reward season was over at the season of June's information accumulation.

Until further notice, record-low swelling, consolidated with rising wages, offers higher genuine salary to family units, who thus feel less weight on their financial plans following quite a while of above-target expansion and low wages. In any case, the danger that expansion overshoots the objective again remains very conceivable if the BoE keeps on sitting on rates for more than would normally be appropriate.

"Since this is not just about swelling, as you probably are aware, through the span of the following couple of months, yet expansion for the medium term, so individuals don't need to stress over expansion, so individuals can appreciate the profit, maybe, of lower petrol costs, lower nourishment costs today, without agonizing over a payback in the medium term," Governor Mark Carney said amid the August Inflation Report question and answer session.https://www.mql5.com/en/signals/120434