Barclays Capital discuses what a weaker CNY means for EUR/USD and USD/JPY

18 August 2015, 12:11

0

1 974

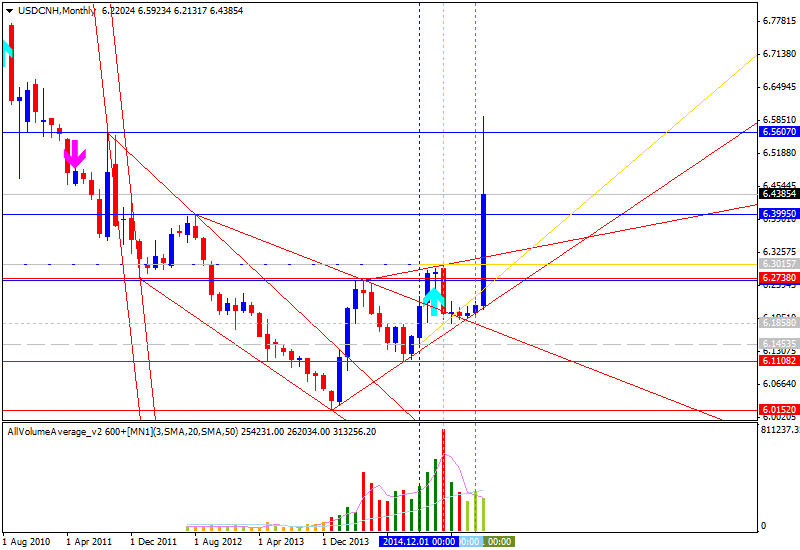

Barclays Capital is continuing to make a forecasting and analysis for major pairs and for now - concerning weaker CNY with USDCNY pair. As we see - the forecasts of Barclays Capital (as well as any other int'l institutions) are more related to fundamental factors than technical ones, and that is why it may be interesting for the traders for example.

-

"In summary, we read the recent announcements as a signal that more

CNY depreciation is ahead, and that China’s slowdown is more severe than

priced. We expect every major central bank to react in different ways, with implications for EURUSD, and USDJPY."

-

"We expect the Fed to proceed with lifting rates in September,

a view that sharply contrasts with the recent market reaction. We would

expect the market scepticism about the Fed’s hiking pace to keep long

dated rates tight, but would expect the USD to remain relatively firm in

line with our views that the Fed is likely to remain a bit more

isolated to China news than other major central banks. Our views on China suggest that our USDJPY forecasts have now upside risk."

- The combination of slower Chinese growth and a

cheaper CNY (and other Asian currencies which combined with China carry a

49% weight in JPY REER) should put pressure on the JPY to depreciate

against the USD, even if we expect the BoJ to refrain from materially

changing its monetary policy stance. We see the USDJPY stability

of recent days as mostly justified by the risk-off environment but, as

soon as the bid for safe haven currencies begin to fade and Asia

currencies depreciate, we would expect USDJPY to drift higher."

-

"In contrast, we think the news in China could push the ECB

closer to announcing an extension of the QE programme beyond next

summer, adding medium-term downside risks to our EURUSD forecasts.

Indeed, EA 5y5y breakeven swaps dropped to 1.65% on the PBoC’s CNY

announcement, and are now 20bp off their early July peak. Likewise,

lower 2y year breakevens have contributed to a tightening in financial

conditions, as 2-year EA real rates have risen to -10bp from -70bp in

early July."

-

"The recent strengthening of the EUR relative to all other currencies, including the USD, seems unwarranted, in our view, as we expect the ECB to stand behind its commitment to meet its inflation target."