Current trend

The USD/JPY pair stabilised after the publication of the Bank of Japan Minutes and prior to the publication of the key US statistics.

As expected, the Bank of Japan kept its key interest rate at 0%. The quantitative easing program also left unchanged at 80 trillion yen a year.

Today, markets are waiting for the publication on NFPR form the US. Predictions varying as poor labor statistics from the ADP earlier this week could negatively affect the number of newly created jobs.

Support and resistance

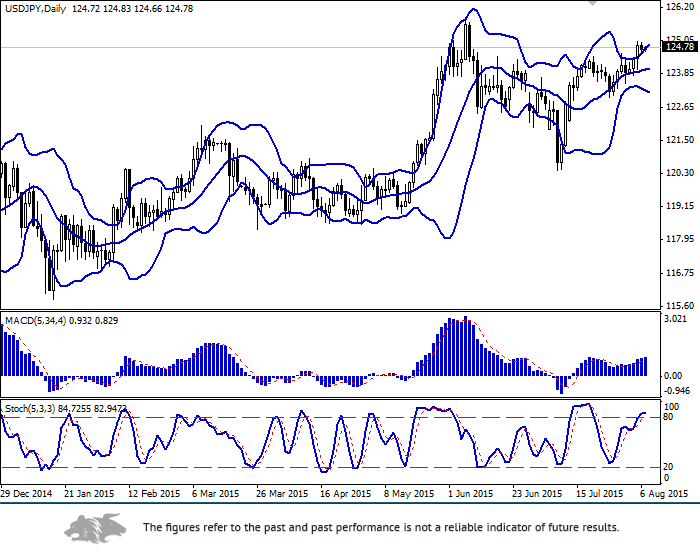

Bollinger Bands on the daily chart is trying to turn horizontally and is giving a sell signal as the price left the top border of its range. MACD is growing. Stochastic is in the overbought zone and is trying to turn, which could be interpreted as a potential attempt to form the downward correction in the short-term.

The indicators are not giving a clear signal.

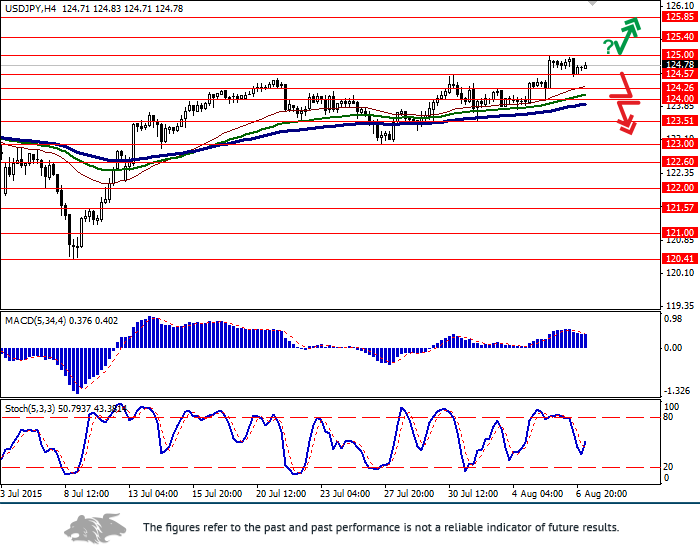

Support levels: 124.57 (local low), 124.26, 124.00, 123.51, 123.00 (27 July low), 122.60, 122.00, 121.57, 121.00, 120.41 (8 July low).

Resistance levels: 125.00 (5 August high), 125.40, 125.85 (5 June high), 126.00.

Trading tips

Long positions can be opened after the price rebound from the level of 125.00 with the target at 125.85 and stop-loss at 124.26.

Short positions can be opened after the price consolidation below the level of 124.00 (with the appropriate indicators signals) with targets at 123.00, 122.60 and stop-loss at 125.00.