Current trend

In the beginning of last week, the pair EUR/JPY grew but fell again soon after amid poor macroeconomic data from the eurozone.

Demand for the Yen, together with its status of the safe-haven currency, was stimulated by the positive data from Japan on Retail Trade that in June grew by 0.9%. Nevertheless, on Friday poor data on the Household Spending (-2.0%) and unemployment (3.4%) came out that put pressure the pair.

Support and resistance

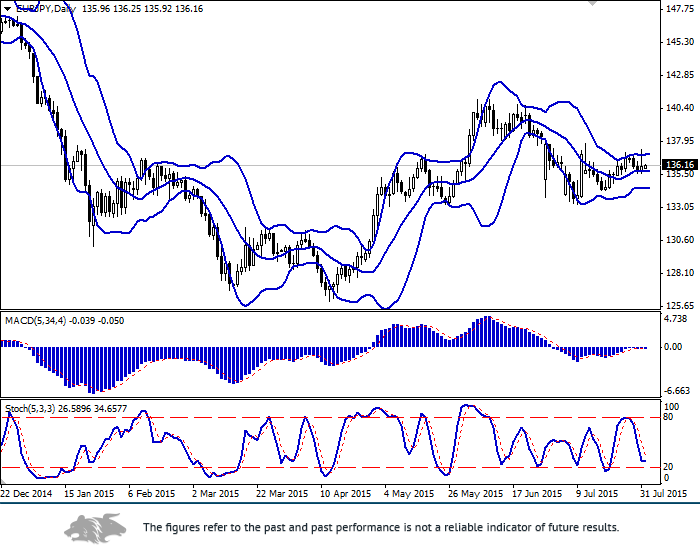

Bollinger Bands on the daily chart shows flat.

Similarly, MACD stays near the zero line. Stochastic reach the oversold zone and turned horizontal.

The indicators do not give clear trading signals.

Resistance levels: 136.43, 137.00 (upper border of the range), 137.34 (31 July high), 137.79 (13 July high) (138.12 (29 June high).

Support levels: 135.92, 135.53 (30 July low), 134.84, 134.32 (17 July low), 133.81, 133.28 (9 July low).

Trading tips

Open long positions after the price rebound from the level of 135.92 (with the appropriate indicators signals) with targets at 137.00, 137.34 and stop-loss at 135.53.

Short positions can be opened after the price consolidation below the level of 135.53 with targets at 134.84, 134.50 and stop-loss at 136.20.