Current trend

The pair USD/CHF shows a moderate growth and reaches new local highs.

A growth in the USD is a result of the promising statement by the Fed and strong macroeconomic data from the US. At the same time, the USD strengthening against the CHF was not significant, which indicates that investors are not ready yet to take on high risk.

In addition, strong macroeconomic data supported the CHF. On Thursday, KOF Leading Indicators was published in Switzerland that came out a lot better than forecasts and showed an increase from 89.8 to 99.8 points.

Support and resistance

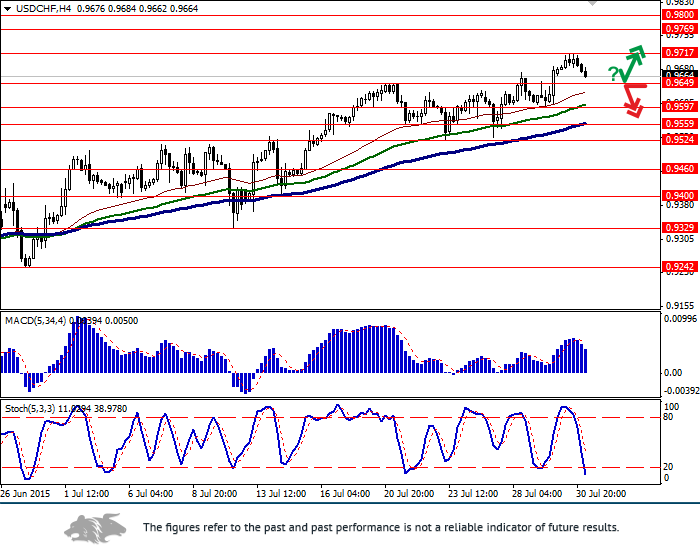

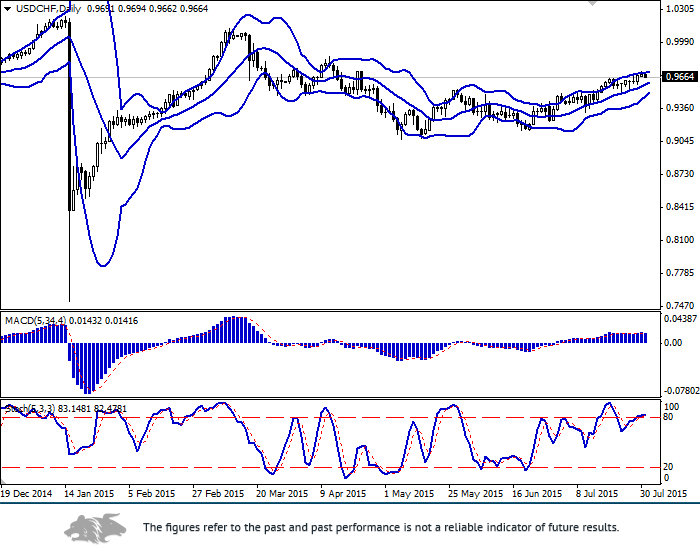

Bollinger Bands on the daily chart moves upwards, while the price range remains narrow. The indicator signal a possibility of a small downward correction within the short-term.

MACD tries to turn down and would also suggest short-term sales, should the signal be formed.

Stochastic reached the overbought zone and does not give a clear signal at the moment.

Resistance levels: 0.9717 (30 July high), 0.9769 (15 April highs), 0.9800.

Support levels: 0.9649 (strong resistance from 20-21 July), 0.9597, 0.9559, 0.9524 (23 July low), 0.9460, 0.9400, 0.9329 (10 July low), 0.9242 (29 June low).

Trading tips

Open long positions after the price rebound from the levels of 0.9649, 0.9600 with the target at 0.9800 and stop-loss at 0.9524.

Short positions can be opened after the breakdown of the level of 0.9649 with the target at 0.9524 and stop-loss at 0.9750.