Current trend

Tomorrow at 00:00 (GMT + 3) the Reserve Bank of New Zealand is expected to lower its key interest rate by 25 basis points from the current 3.25%. The forthcoming cut has already been considered by most market participants.

Today, since the opening of the Asian session, the pair is declining. Nearly zero inflation rate, falling prices for dairy products, Fed’s intention to raise the US interest rate by the end of the year, as well as the expectation of further interest rate cuts in New Zealand affect the NZ currency.

Today there are no news releases from New Zealand.

Support and resistance

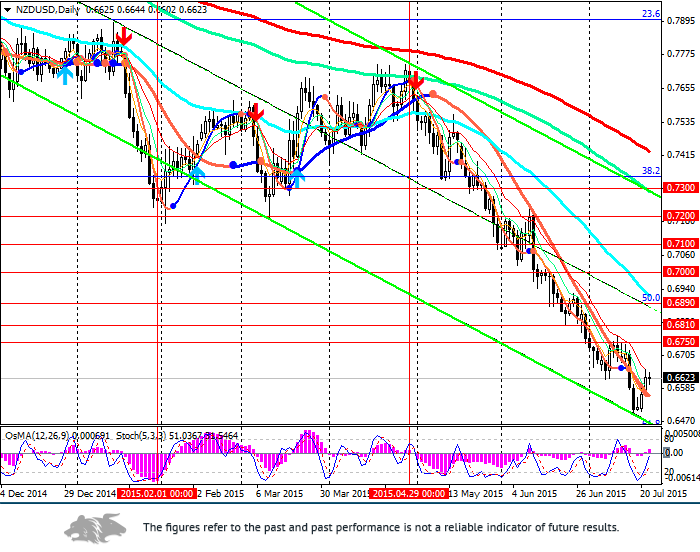

The pair is trading at 5-year lows, but the downward trend resumes. The pair should reach the expected support levels 0.6500 (recent lows), 0.6435 (61.8% Fibonacci), 0.6000 (2006 lows).

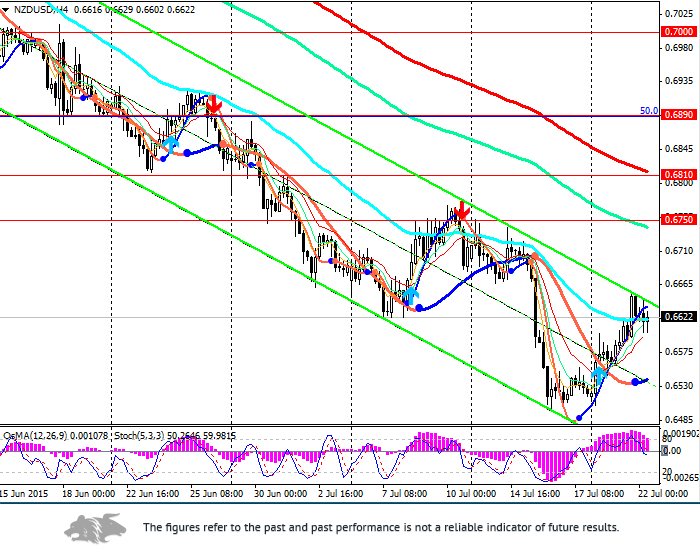

On the 4-hour chart the pair is trading within the narrow downward channel at its upper border. OsMA and Stochastic indicators on the 4 hour chart turned to sales, though on the daily chart they moved to the buy zone. Fundamental factors and indicators on the 4 hour chart favor short positions.

Support levels: 0.6500, 0.6435, 0.6400.

Resistance levels: 0.6750, 0.6810, 0.6890, 0.7000.

Trading tips

Open short positions from the current levels and from 0.6700, 0.6750, 0.6800 with targets at 0.6500, 0.6450, 0.6435, 0.6400 and stop-loss at 0.6830.

Alternative long positions may be considered after the breakout of 0.6890 (50% Fibonacci level) with targets at 0.6900, 0.6950, 0.7000.