Today, investors are waiting for the publication of the U.S. Retail Sales statistics for June. It is one of the key indicators for the U.S. economy which significantly influences GDP. Consumer spending accounts for 70% of U.S. GDP, and retail sales take a large part of consumer spending. Retail Sales Index does not include the cost of services, but still it can be used as a leading indicator for GDP.

The figure, both for Retail Sales and Retail Sales excluding auto, which is a highly volatile component, is expected to reduce to 0.3% and 0.5%, respectively. Thus, Retail Sales continue to grow, but not as significantly as in May, when the indicators reached the level of 1.2% and 1.0%, respectively. Should the statistics match the forecast, it may add pressure on the U.S. currency and weaken it against most major currencies.

Moreover, today it is worth noting the speech given by Mark Carney, the Bank of England Governor. No special surprises are expected, but a hint at the further direction of U.K. monetary policy may be given.

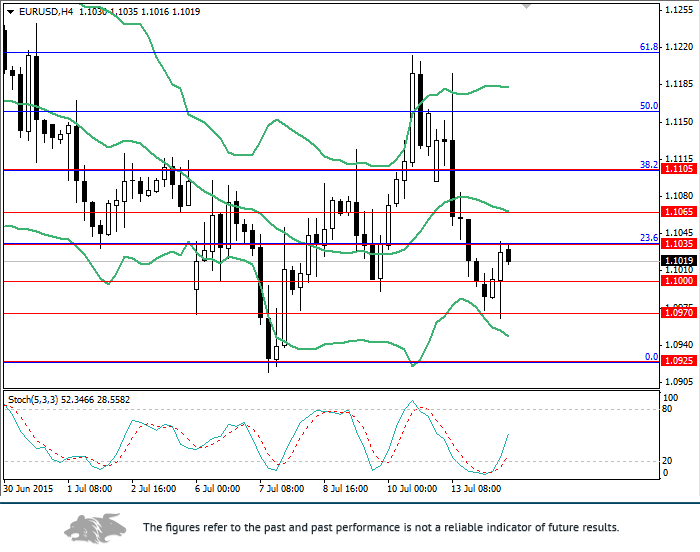

If the forecast for June’s Retail Sales Index in the U.S. confirms, the EUR/USD pair may grow to 1.1065 and 1.1105. Long positions can be opened from 1.1035 with stop-loss at 1.1000. But if the figures are more favorable for the U.S. dollar, the pair price should go down to 1.0970 and 1.0925. Open short positions below 1.1000 with stop-loss at 1.1035.