2015-02-18 19:00 GMT (or 21:00 MQ MT5 time) | [USD - FOMC Meeting Minutes]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[USD - FOMC Meeting Minutes] = It's a detailed record of the FOMC's most recent meeting, providing

in-depth insights into the economic and financial conditions that

influenced their vote on where to set interest rates.

==========

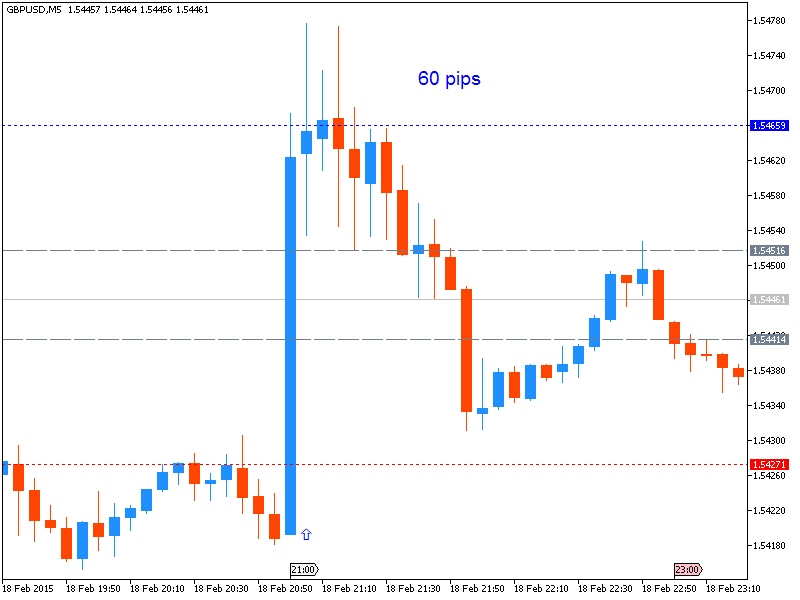

GBPUSD M5: 60 pips price movement by USD - FOMC Meeting Minutes news event:

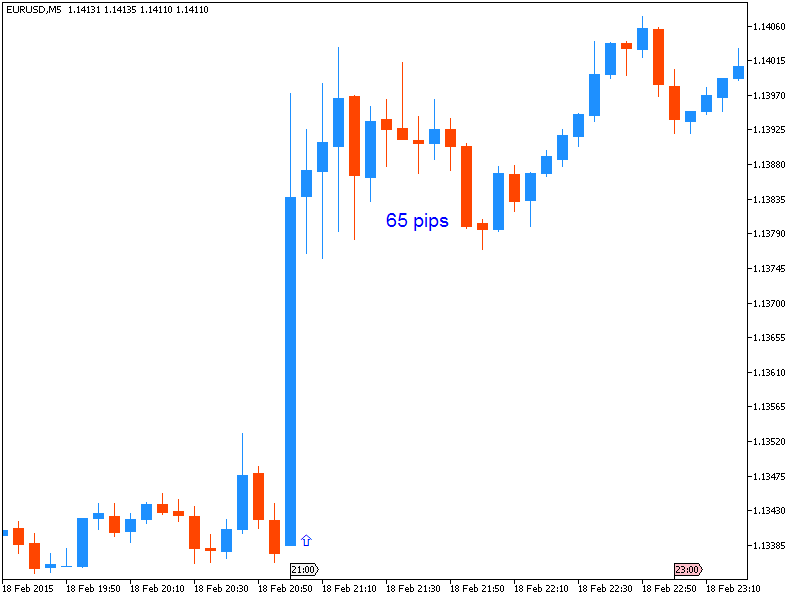

EURUSD M5: 65 pips price movement by USD - FOMC Meeting Minutes news event:

BofA Merrill: The recent steady stream of Fed speakers advocating for a potential June rate hike led to expectations for relatively hawkish FOMC minutes. The headlines for the minutes surprised to the dovish side, and led to a decline in Treasury yields and the US dollar. However, a closer reading suggested a more modest dovish bent with a lot of disagreement among participants. Thus, attention now shifts to Chair Yellen's Congressional testimony next week, which in our view should elaborate and update the assessment of risks while still leaving a June liftoff in play. We expect persistently below-target inflation delays the Fed until September, but the minutes confirm a fair degree of uncertainty about the timing of the first rate hike.

Credit Agricole: The minutes of the January FOMC meeting were relatively dovish and spelled more caution over the inflation outlook and timing of the rate liftoff. On balance, we continue to expect rate normalization to begin in the Q3 2015.

UBS: The minutes of this FOMC meeting are quite ambiguous. There was no definitive view on the impact of foreign developments. Also, there was no clear view on the outlook or the timing of the first rate hike. This was due, likely in part, to the fact that there was uncertainty about the right inflation measures to look at and what other measures might influence them. Even the phrase "patient" was debated: Would removing it cause markets to adjust the timing of the first rate hike too aggressively?...Unfortunately, all the cross currents give us little direction. Prior to the re-acceleration in wages and the continued strong labor market readings and the rebound in oil prices, it would appear that fading a June hike would have made sense given these minutes. Post these realities, it is not clear. The testimony next week is unlikely to prove too instructive as Yellen testifies on behalf of the committee, which last met on January 28th. For now we will keep our forecast of a June rate hike counting on the still-strong labor market and rebound in energy prices to win the day. We will have to be "patient" to see how this wind blows.

Deutsche Bank: The minutes from the January 27 - 28 FOMC meeting did not indicate any substantive changes to the growth outlook compared to the Fed's most recent projections released last December. The near-term inflation outlook was revised down slightly due to further declines in oil prices. However the staff's inflation forecast for 2016 and 2017 was "essentially unchanged." There was considerable debate over the interpretation of market-based measures of inflation compensation but there were no firm conclusions with respect to the longer-term inflation outlook, which the FOMC still sees as gradually rising toward its 2% target. Moreover, the Fed reiterated the view that low energy prices were a net positive for the economy. In short, there were no material changes with respect to the economic and financial outlook.

ANZ: The minutes from the January FOMC meeting were more dovish than expected although we do not expect there has been a wholesale change in view. The FOMC appears more concerned about risks from offshore and the higher USD and many FOMC members would prefer to keep the fed funds rate at near zero bound for a longer time. In our view, we would not read too much into the term 'longer'. In addition, given many of the offshore risks - such as the Greek and Ukraine situations - now look more likely to be resolved, this should allay a lot of the stated reasons for hesitancy. We continue to look for the first hike around mid-year although we acknowledge the risks of the Fed waiting have increased. Yellen's speeches next week will be important

NAB: The killer paragraph in the minutes of the Fed's January meeting reads as follows: "Many participants indicated that their assessment of the balance of risks associated with the timing of the beginning of policy normalization had inclined them toward keeping the federal funds rate at its effective lower bound for a longer time". In FOMC speak, many is taken to mean a majority, and these words have had the effect of pushing implied money market yields in the fourth quarter of 2015 down by about 5bps on average, and by as much as 10bps further out along the shorter end of the yield curve. It's worth remembering here that the mood music coming from Fed officials ahead of the minutes - but since the meeting itself - had been consistent in suggesting that a June Fed 'lift-off' is still a very live risk. Janet Yellen's testimonies next week now loom large. Trading will be thinner than normal given today is the Lunar New Year holiday and so Greater China is shut.

SEB: It is our understanding that the Fed minutes did not suggest that the FOMC is paving the way for a June rate hike as "many officials were inclined to stay at zero for longer". Moreover, the drop in inflation expectations was apparently worrying since a number of participants emphasized that they would need to see either an increase in market-based measures of inflation compensation or evidence that continued low readings on these measures did not constitute grounds for concern. While we may have a different view after Chair Yellen's semi-annual testimony before congress next week, the minutes are not suggesting to us that "patience" will be dropped as early as in the March statement. Our forecast still is for liftoff a few meetings later, in September.

Barclays: Our main takeaway from the January FOMC minutes is that concern about downside risk to inflation has risen and, consequently, the bar for raising rates by June is higher than it was in December. We maintain our baseline forecast for a June rate hike at this juncture, but the risk of a later takeoff has risen, particularly if downside surprises on core inflation continue. We look to Chair Yellen's comments in front of the US Senate and House of Representatives next week for further clarification on the committee's thinking.

Danske: The minutes from the January FOMC meeting strongly suggest that the FOMC's fed funds rate projections will be lowered at the upcoming 18 March meeting and the minutes were in general more dovish than recent Fed speeches. Data received since the FOMC meeting on 28 January includes the January employment report, which was very strong. However, we doubt that one data point is enough to turn the Committee's sentiment, in particular when inflation indicators continue to be soft. This challenges our call that the Fed will remove 'patient' from the statement in March and raise the fed funds rate this summer If February data on employment continue to show solid improvement and inflation indicators stabilise, we continue to believe the Fed would like to have the flexibility to raise rates in June. Hence, 'patient' should be dropped in March but will be combined with soft comments from Janet Yellen and lower economic projections in order to keep the market reaction moderate.

CIBC: The latest minutes show that many officials felt dropping patient could lead markets to price in too early a move to tighten policy, putting upwards pressure on rates when some sectors like housing are still showing uneven signs of recovery. Notwithstanding that, several members suggested that a "late departure" could result in monetary policy becoming excessively accommodative. Not inconsistent with that view, there was general agreement that the minutes should "acknowledge solid growth over the second half of 2014, as well as the further improvement in the labour market." The minutes overall show that opinion within the FOMC remains deeply split on when the Fed should take the next step on the road to policy normalization. Although inflation has moved down, the minutes also affirm the statement in suggesting that most members continue to see the drop as a transitory consequence of lower oil prices, and therefore not sufficient at this point to warrant a notable delay in moving interest rates up from the lower bound. Today's release does not change our view that June still remains the most likely date for policy lift off. A slight positive for bonds given further signs of the Committee's reluctance to dispense with the key word "patience". The focus now shifts to Yellen's testimony next week for further information on the policy outlook.