Monetary policy will undoubtedly be the key driver for markets, money and metals in the years ahead. Stoeferle’s fundamental belief is that we will experience unintended consequences of these monetary interventions resulting in increasing volatility. Although nobody can predict the exact timing, it is realistic to expect this taking place somewhere in 2015.

As suggested by the above charts, the disinflationary trend is likely to continue in the short run. However, based on the steepness of the disinflationary / deflationary phases, one could expect extreme measures by central banks which could result in (highly) inflationary phases. In other words, because of monetary policy, one should realistically expect alternately periods of inflation and deflation.

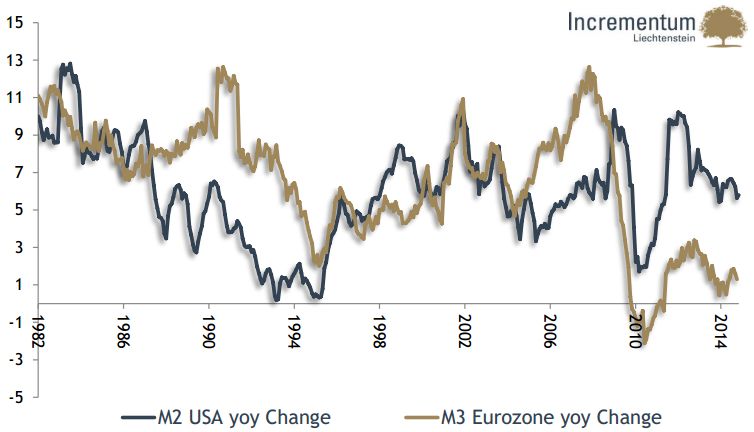

The following chart makes the point on monetary inflation vs deflation. The U.S. and European central banks have embarked upon monetary disinflation in 2014. The real economy has not shown meaningful acceleration, however. It is fair to expect that monetary inflation will return. That is another fundamental driver for gold’s long term prospect.

Astute readers remember which draconian measures the U.S. Fed has underataken since 2007. We sum them up in chronological order: interest rate cuts in 2007/8, zero interest rates and communications policy since 2008, QE I between 2008 and 2010, QE II between 2010 and 2011, Operation Twist between 2011 and 2012, QE III since 2012.

All those measures have had only moderate results in the real economy, i.e. the results have not reflected the extreme character of the measures. That is why a disinflationary bust could be the trigger for central banks to launch one or more of the following measures in 2015:

- more QE

- strengthen the guidance of unemployment and inflation thresholds

- direct measures like the funding for lending program

- very drastic direct measures like helicopter money

- charging interest rates on reserves

Think for a moment about the last point in the list. Charging on reserves is really not that far away. The timing of the article could not have been better in that respect, as only a week ago the Swiss National Bank has announced a negative interest rates on some reserves of Swiss banks.

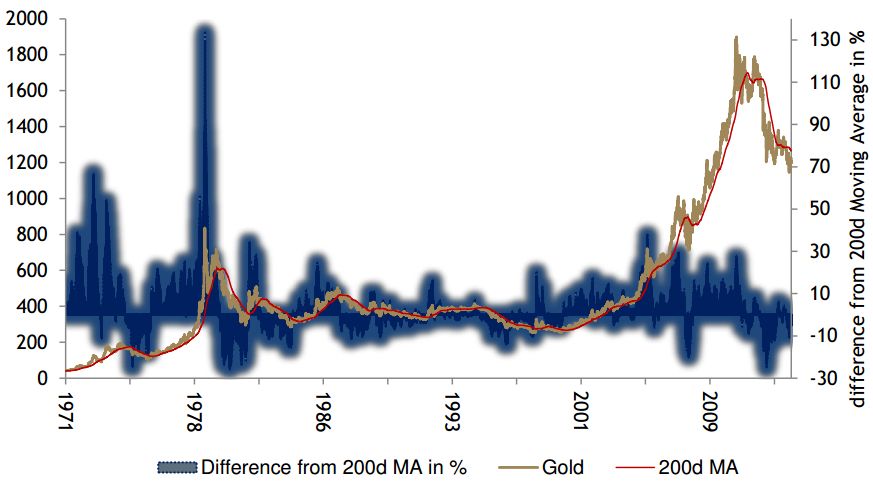

Another indication why gold is not set to rise sharply in 2015 is the historic behaviour of gold’s 200 day moving average. The next chart suggests that periods in which gold had moved longer than average above or below its 200 day moving average have taken some time till normalization or reversal took place.

Given all the above trends and data points, Stoeferle feels that gold is in a long term bottom range. Although the price of the yellow metal could go lower in the short run, it seems unlikely that another price crash similar to the one in the first half of 2013 is about to repeat. That is clearly a contrarian call compared to the expectations of “pundits” in the mainstream media (think of the calls of $800 gold).

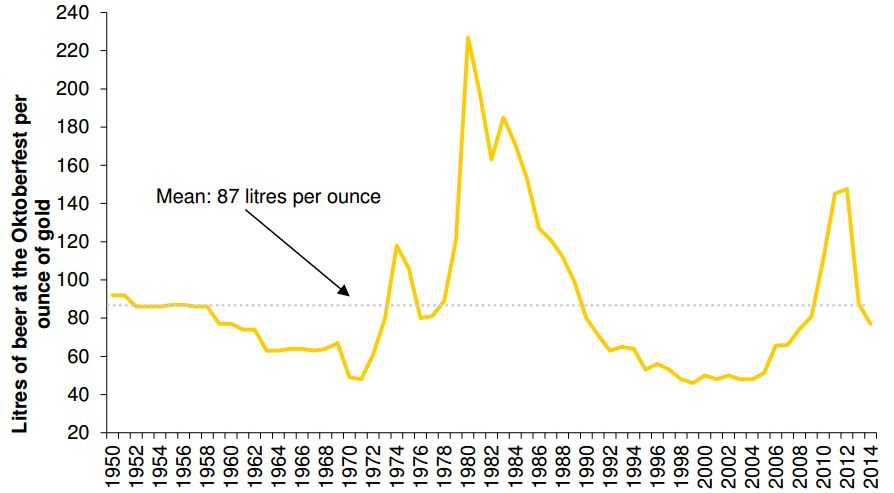

As anecdotal evidence, the bonus chart below shows the liters of beer that can be bought during the Oktoberfest, with one ounce of gold. It is still above its long term average, suggesting the bull market is still intact.