VIDEO LESSON - Trading the News: Consumer Price Index (CPI)

Released at 8:30 am eastern standard on approximately the 15th of each

month, the Consumer Price Index (CPI) is a measure of the changes in

prices paid by urban consumers for a fixed basket of goods and services.

- The PPI is designed to measure the entire marketed output of US producers which includes goods and services purchased by other producers. (The CPI includes only goods purchased by consumers)

- Imports are excluded from PPI but included in CPI

- Taxes paid as part of the purchasing price by the consumer are not included in PPI but are included in CPI.

The important thing to understand here is that while changes in PPI

are normally looked at as having predictive power as to changes in the

CPI, a rise or fall in the PPI does not necessarily mean the same rise

or fall in the CPI. As this is the case, and as the CPI is the end

price paid by the consumer, this number best represents the level of

inflation in the US economy.

In addition to showing fluctuations in price for different areas of

the country, the CPI also shows the fluctuation in price for different

groups of products such as housing, transportation, medical care etc.

This allows traders to see not only the price fluctuations of the

overall economy but also for different areas of the economy.

There are two main CPI numbers reported which are the CPI for Urban

Wage Earners and Clerical Workers (CPI-W) and the CPI for all Urban

Consumers (CPI-U) which basically give two separate numbers for the

price increases experienced by working people and the price increases

experienced by all consumers.

As with the PPI the Consumer Price Index is also presented without

volatile food and energy included. This “Core CPI” number or CPI-U

minus food and energy is the most widely followed number.

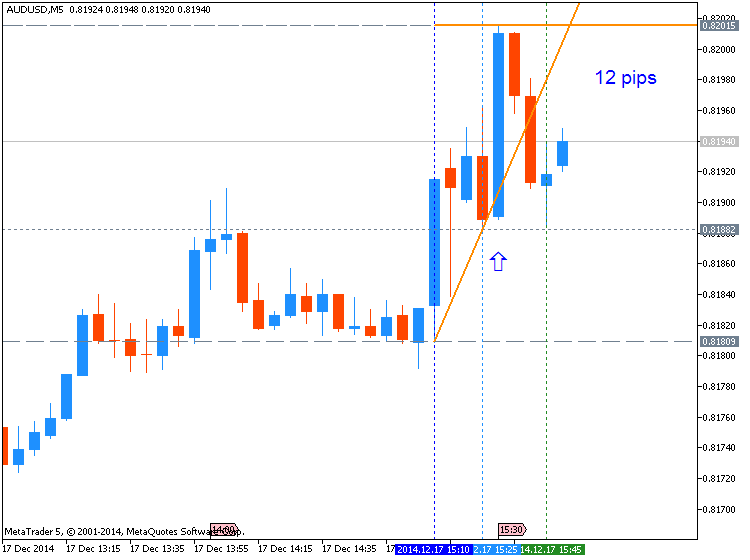

AUDUSD M5: 12 pips price movement by USD - CPI news event

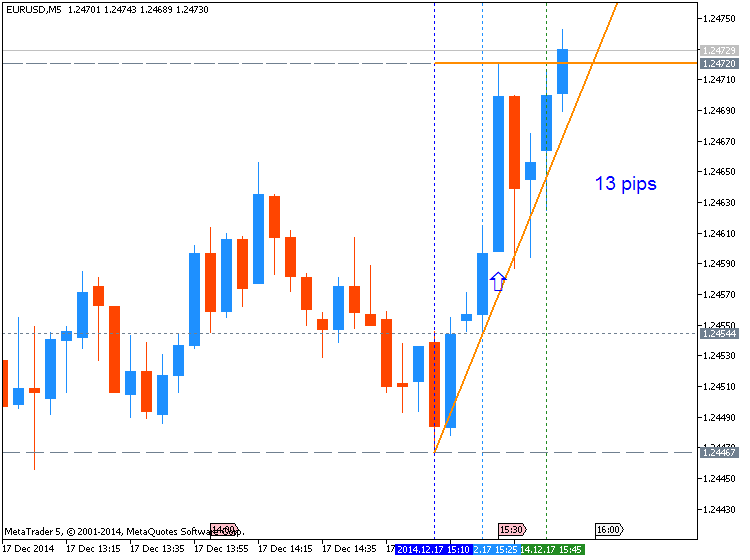

EURUSD M5: 13 pips price movement by USD - CPI news event