Trade Your Way to Financial Freedom by Van Tharp

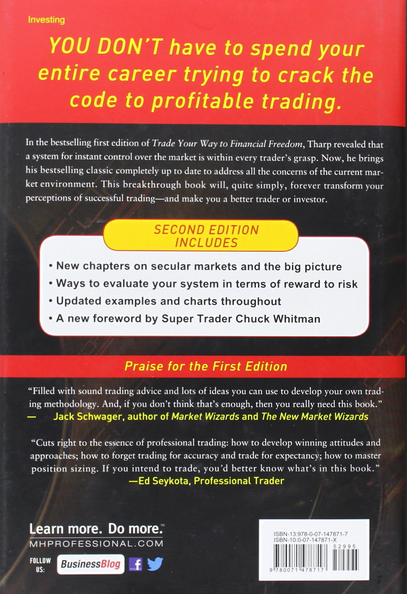

The bestselling holy grail of trading information-now brought completely up to date to give traders an edge in the marketplace

“Sound trading advice and lots of ideas you can use to develop your own trading methodology.”-Jack Schwager, author of Market Wizards and The New Market Wizards

This

trading masterpiece has been fully updated to address all the concerns

of today's market environment. With substantial new material, this

second edition features Tharp's new 17-step trading model. Trade Your Way to Financial Freedom

also addresses reward to risk multiples, as well as insightful new

interviews with top traders, and features updated examples and charts.

From trading crude oil you know that a 1 cent or 1 point move in the

market equals $10 per contract. So analyzing further to determine your

position size you would multiply $10 times the number of points your

stop is away from your entry price (in this case 100) and you would come

up with $1000 in risk per contract. Lastly you divide the total dollar

amount you are willing to risk by your total risk per contract ($2000

total risk/$1000 risk per contract) to get the number of contracts which

you can place on this trade (in this case 2 contracts)

As Dr. Van K. Tharp Points out in his book Trade Your Way to Financial Freedom, the advantages of this style of position sizing are that it allows both large and small accounts to grow steadily and that it equalizes the performance in the portfolio by the actual risk. As he also points out the disadvantages of this system are that it will require you to reject some trades because they are too risky (ie you will not have enough money in your account to trade the minimum contract size while staying under your maximum risk level) and that there is no way to know for sure what the actual amount you are risking will be because of slippage which can result in dramatic differences in performance when trading larger positions or using tight stops.