Experts expected bonds would surely begin declining this fall in anticipation of the Fed beginning to raise interest rates sometime next year

With the Fed cutting back its massive QE bond-buying program this year bonds would plunge. It seems that economists expecting bonds to plunge failed to anticipate that foreign demand for U.S. treasury bonds would make up for the slowing of Fed bond buying.

Instead, with the rest of the world’s economies, currencies, and bonds tumbling further into problems this year, U.S. bonds have continued to rally as a global safe haven.

The foreign buying influence was seen in the Treasury Department’s auction on Tuesday of $35 billion in five-year Treasury bills, which saw significant demand from global investors. The auction’s bid-to-cover ratio was on the high side at 2.91. Indirect bidders, a group that includes foreign central banks, bought 65% of the offering, compared to an average of 36% over the last four auctions.

The bond rally this year has the 30-year U.S. Treasury bond up 12.2% year-to-date. The iShares 20-year T’bond ETF, symbol TLT, is up 19.9% year-to-date.

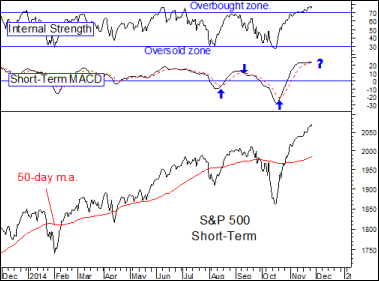

By comparison, the U.S. stock market stumbled in January and again in the Sept/Oct pullback. At its mid-October low, the stock market had given back all its year-to-date gains.

It then found support, the market’s favorable annual seasonality kicked in on schedule, and the stock market gained back all its losses and went on to new highs.

As a result, the S&P 500 is up 12.5% year-to-date, a double-digit gain, but trounced by safe-haven Treasury bonds.