The interesting pairs also discussed in the Forex Ranking and Rating list of this weekend are:

- The EUR/NZD which is a weaker currency against an average performing currency with a currency score difference of (3-8=) -5. Looking at the short term the NZD is even a stronger currency.

- The GBP/USD which has become currently a weak currency against a stronger currency with a currency score difference of (2-7=) -5. Looking at the longer term the GBP is a stronger currency like the USD, however it is currently in a dip. The preference goes to trade when the currency score difference is significant and that is the case.

- The EUR/USD which is a weaker currency against a stronger currency with a currency score difference of (3-7=) -4.

- The NZD, USD, CHF, AUD, CAD against the JPY on pull back in the Weekly chart below the Upper Bollinger Band. These are all strong and average performing currencies against the weakest currency JPY with a score of 1.

- The GBP/NZD looks interesting but based on a longer term perspective the GBP is the stronger currency so the preference goes to trade the GBP only against another stronger currency from a longer term perspective, in this case the USD.

All preferred combinations comply to the guide lines which define what type of currency, strong/average/weak, can be traded against the other. Besides this the currency score difference is significant for these pairs and they support this view. For more information continue reading this article.

The TA charts for the GBP/USD confirms a short position

together with the currency score difference so this has more weight

than the longer term perspective of the Currency Score. It is unknown

for how long the GBP will have a low performing currency score. If it

takes too long and it does not recover then the GBP may become an

average performing currency. This is the way to trade a pair like this

because the change in calssification may take a while and at the same

time the TA charts and currency score may already be pointing in that

direction.

The FxTaTrader Forex Currency Score chart is meaningful data for my FxTaTrader Hybrid Grid strategy. Besides this chart I also provide my weekly analysis on my strategy and the Forex ranking and rating list which is available 3 times a week on this blog.

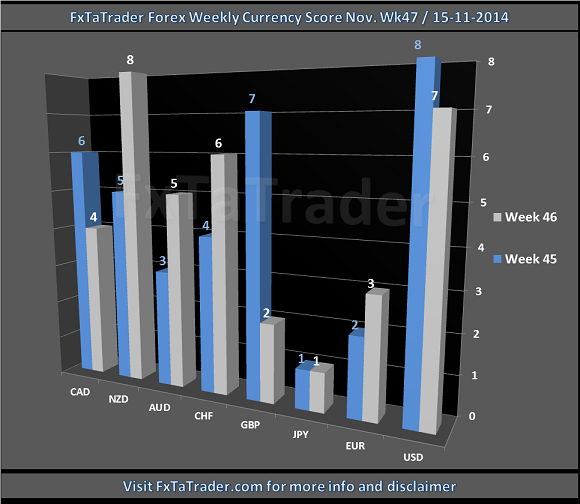

- There are a lot of changes this week as can be seen in the screenshot. One of the changes that can clearly be seen is the strength in the NZD, CHF and AUD. Also the current weakness in GBP is significant.

- The NZD, USD, CHF are currently the stronger currencies. The JPY, GBP and EUR are the weaker currencies. The best pairs to look at are combinations of those currencies.

- Currencies with a score of 4 and 5, meaning the CAD and the AUD are difficult to trade because they are in the middle of the range. Being in the middle of the range means the currency has no direction and it can easily go in the wrong direction any time. It is better to have a currency with some momentum in a certain direction because it is then clear how to trade this currency.

- Conclusion for going long is that for the coming week it seems best to go long with the NZD, USD and CHF. However the NZD and CHF are average performers from a longer term perspective so it does not have the preference.

- For the weaker currencies the conclusion is that for the coming week it seems best to go short with the JPY, GBP and EUR. The GBP is a stronger currency from a longer term perspective so it does not have the preference to go short with unless it is traded against another stronger currency and with a significant Currency score difference.

- The best combinations for the coming week also according to the Top 10 in the Forex Ranking and Rating list and the TA charts are the NZD/JPY, USD/JPY, EUR/NZD, CHF/JPY, GBP/USD, AUD/JPY, EUR/USD and the CAD/JPY.

There are some rules for taking positions according to the FxTaTrader Hybrid Grid Strategy. The strategy can open multiple positions of a currency pair but each currency may only be present once in the pairs chosen for trading. It means that not all the possible positions of coming week can be opened. For more information see FxTaTrader Hybrid Grid Strategy.

Another rule is that a pair outside the Bollinger Band in the Weekly chart is considered overbought/oversold. No positions are taken for these pairs until they are no more overbought. These are in this case the JPY pairs.

Depending on the opportunities that may come up the decision to trade a currency may become more obvious at that moment.

Last week (pending) orders were placed for the EUR/GBP and the AUD/USD with loss 2x EUR/GBP and profit 1x AUD/USD.

More on this in my strategy article that will be published later today. The possible positions for coming week for the strategy will then also be described.

___________________________________________

In the previous weeks we looked into the weaker, stronger and average performing currencies from a longer term perspective using the data of the Currency Score. We also looked into the Currency Score difference. The conclusion was briefly:

- a stronger currency can be traded against a weaker and average performing currency.

- a weaker currency against a stronger and average performing currency.

- the average performing currencies can be traded against the stronger and weaker currencies.

- only trade the average performing currencies against each other when a clear trend is being developed. The currency Score difference may support this view.

The weaker currencies

The stronger currencies

How to trade the average performing currencies

Using the Currency Score difference for trading decisions

___________________________________________

This weekend I will provide the weekly review on my FxTaTrader Hybrid Grid strategy. Good luck to all and have a great trading week.

Although the explanation may seem simple and clear there is always risk involved. I added a disclaimer to my blog for this purpose. If you like to use this article then mention the source by providing the URL www.FxTaTrader.com or the direct link to this article.

___________________________________________

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours. Thank you.