und werden Sie Mitglied unserer Fangruppe

Veröffentliche einen Link auf das Skript, damit die anderen ihn auch nutzen können

Bewerten Sie es im Terminal MetaTrader 5

- Ansichten:

- 70857

- Rating:

- Veröffentlicht:

- Aktualisiert:

-

Benötigen Sie einen Roboter oder Indikator, der auf diesem Code basiert? Bestellen Sie ihn im Freelance-Bereich Zum Freelance

Author:

The developer of these indicators is Arturo López, founder of Point Zero Trading Solutions.

Who is Toby Crabel?

Toby Crabel is a self-made millionaire commodities trader who has avoided having a losing year from 1991 to 2002. Among other achievements, he wrote a great trading book entitled Day Trading with Short-term Price Patterns.

What is the Stretch?

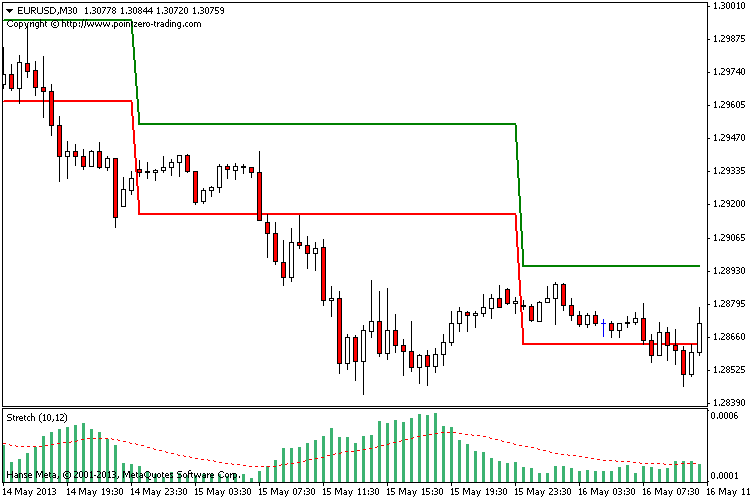

The Stretch is calculated by taking the 10 period SMA of the absolute difference between the open and either the high or low, whichever difference is smaller. It represents the minimum average price movement/deviation from the open price during a period of time, and that value is used to calculate breakout thresholds for the current trading session. This can be used to plot a multitimeframe breakout channel.

The Opening Range Breakout (ORB) Trading Strategy

Using this strategy, the trader places a buy stop just above the open price plus the Stretch and a sell stop just below the open price minus the Stretch. The first stop triggered enters the trader into the trade and the other stop becomes the protective stop.

Crabel's research shows that the earlier in the trading session the entry stop is hit the more likely the trade will be profitable at the close. A market movement that kicks off a trend quickly in the current trading session could add significant profit to a trader's position by the close and should be considered for a multi-day trade.

Extending Crabel's research results it is obvious that as time passes and we are not filled early on then the risk increases and it becomes prudent to reduce the size of the position during the day. Trades filled towards the end of the day carry the most risk and the later in the day the trade is filled the less likely the trader will want to carry that trade overnight.

Opening Range Breakout Preference (ORBP) Trading Strategy

An ORBP trade is a one sided Opening Range Breakout (ORB) trade. If other technical indicators show a strong trend in one direction then the trader will exercise a preference for the direction in which to trade the ORB trade. A stop to open a position would be placed on the side of the trend only and if filled a protective stop would then be placed. The calculation of where to place the "stop to open" would be the same as that for the ORB trade: For longs, the Open price plus the Stretch and for shorts the Open price minus the Stretch.

PZ Reversal Trend Following EA

PZ Reversal Trend Following EA

You can either be long or short at any given time. You buy and close a short position if the market makes a new 100-day high, and sell and close a long position if the market makes a new 100-day low.

CheckPower of Bulls/Bears

CheckPower of Bulls/Bears

Based on ibull/ibear, but compare power to define good entry bars.

PZ Parabolic SAR EA

PZ Parabolic SAR EA

This Expert Advisor trades Parabolic Sar (PSAR) trend changes and applies a fast exit strategy. The parabolic SAR is a technical indicator developed by J. Wells Wilder. Basically, if the stock is trading below the parabolic SAR you should sell. If the sto

AntiFragile EA

AntiFragile EA

AntiFragile EA is an innovative trading strategy built on the idea of Antifragility professed by Nassim Nicholas Taleb. The general idea is to gain from disorder.