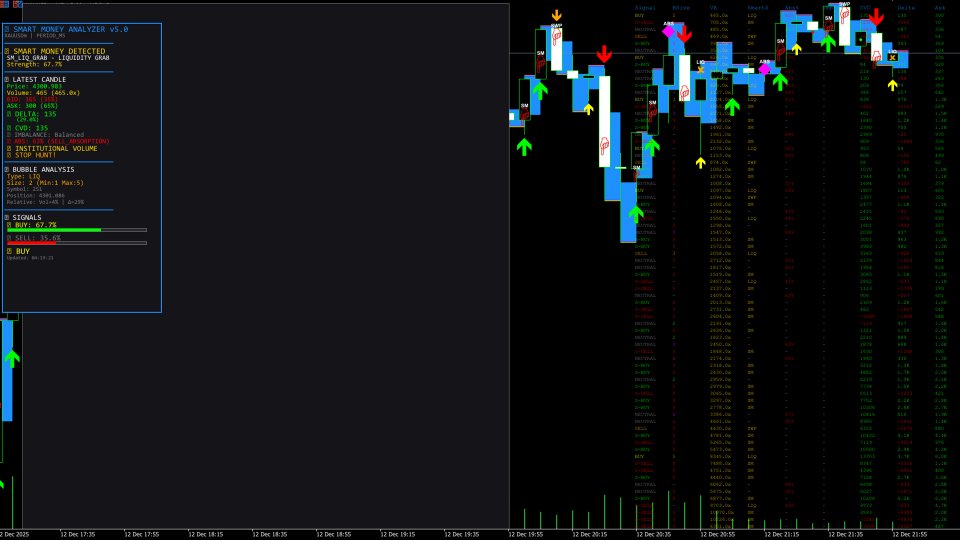

Professional Order Flow vs Volume Analysis

- 指标

- Mahmoud Ahmed Abdou Ali

- 版本: 3.0

- 更新: 15 十二月 2025

- 激活: 5

Professional Order Flow & Volume Analysis Indicator

Overview

This advanced TradingView/MT5 indicator provides institutional-grade order flow and volume analysis, designed to identify smart money movements, liquidity grabs, and high-probability trading opportunities through sophisticated volume delta analysis and market microstructure detection.

Core Features

📊 Candle Analysis Engine

Analyze multiple historical candles with customizable lookback periods

Real-time analysis of forming candles

Detailed candle breakdown table showing bid/ask dynamics

Visual representation of volume distribution across price levels

📈 Volume Delta Analysis

Imbalance Detection: Identifies significant buy/sell volume imbalances using customizable ratios

Stacked Imbalances: Detects consecutive imbalanced levels indicating strong directional pressure

Absorption Analysis: Reveals areas where large orders absorb incoming market pressure

Delta Divergence: Highlights discrepancies between price action and underlying volume delta

🎯 Cumulative Volume Delta (CVD)

Track cumulative buying and selling pressure over time

Configurable lookback periods for different timeframe analysis

CVD divergence detection to spot potential reversals

Early warning system for momentum shifts

💰 Smart Money Detection

Institutional Volume Spikes: Identifies abnormally large volume suggesting institutional participation

Stop Hunt Detection: Recognizes wick patterns characteristic of liquidity sweeps

Liquidity Grab Identification: Spots when smart money triggers retail stops before reversing

Sweep Detection: Identifies high/low sweeps that trap retail traders

Minimum delta thresholds ensure signal quality

📊 Volume Profile Integration

Multi-level volume profile analysis

Point of Control (POC): Displays the price level with highest trading activity

Value Area: Shows where 70% of volume occurred (key support/resistance)

Visual zones marking institutional interest areas

🔵 Advanced Volume Bubbles (Professional)

Dynamic bubble sizing based on volume intensity, delta strength, and signal type

Separate visual indicators for:

Buy/Sell Pressure: Standard volume-based signals

Absorption Events: Major orders absorbing market pressure

Imbalances: Significant order flow imbalances

Smart Money: Institutional activity markers

Liquidity Grabs: Stop hunt events

Customizable symbols (circles, squares, diamonds, stars) for each signal type

Adjustable size multipliers for fine-tuned visualization

Optional neutral volume display

🌊 Buy/Sell Pulse Detection

Identifies sustained directional pressure through consecutive high-volume bars

Configurable pulse sensitivity and duration requirements

Real-time alerts for emerging pulse patterns

Helps confirm trend strength and potential breakouts

📍 Chart Annotations

Trading Arrows: Visual entry/exit signals at key levels

Price Labels: Important reference prices for decision-making

Support/Resistance Zones: Dynamically identified from volume profile data

Customizable arrow sizing and placement

🎚️ Signal Strength Classification

Strong Signals: High-confidence setups exceeding 70% threshold

Moderate Signals: Valid setups between 50-70% confidence

Color-coded visual hierarchy for quick assessment

Helps prioritize trading opportunities

📋 Data Tables & Panels

Candle Analysis Table: Comprehensive breakdown of recent price action

Bid/Ask volume per candle

Volume delta calculations

CVD progression

Imbalance ratios

Absorption indicators

Smart money flags

Live Statistics Panel: Real-time market metrics

Current volume analysis

Active signals summary

Market bias indicator

Fully customizable positioning, sizing, and color schemes

🎨 Professional Theming

Dark mode optimized with customizable background colors

Adjustable color schemes for all signal types:

Buy signals (default: Lime)

Sell signals (default: Red)

Absorption (default: Magenta)

Smart money (default: Gold)

Liquidity grabs (default: Orange)

Customizable table borders, headers, and fonts

Multiple corner positioning options

Key Parameters Explained

Volume Delta Settings

Imbalance Ratio: Defines how skewed buy/sell volume must be (1.5 = 60/40 split)

Stacked Levels: How many consecutive imbalanced levels confirm a strong signal

Absorption Threshold: Percentage of volume required to qualify as absorption

Divergence Threshold: Minimum delta/price divergence percentage

Smart Money Detection

MM Volume Multiplier: How many times average volume indicates institutional activity (2.5x recommended)

Volume Average Period: Baseline calculation period for volume comparisons

Wick Percentage: Minimum wick size relative to candle body for stop hunt detection

Min Delta: Minimum delta percentage required for smart money classification

Bubble Visualization

Volume Size Multiplier: Controls how volume affects bubble size (10-30 range)

Delta Size Multiplier: Controls how delta strength affects size (10-40 range)

Boost Multipliers: Additional sizing for special signal types (absorption, imbalance, smart money)

Min/Max Bubble Size: Prevents bubbles from being too small or oversized

Use Cases

1. Reversal Trading

Spot absorption + CVD divergence for high-probability reversals

Identify liquidity grabs before trend changes

Use stacked imbalances to time entries

2. Trend Following

Detect buy/sell pulses confirming trend strength

Follow smart money volume spikes in trend direction

Use POC and value area as dynamic support/resistance

3. Scalping

Monitor real-time delta for quick momentum shifts

Trade off imbalance signals for fast moves

Use forming candle analysis for precise entries

4. Institutional Tracking

Identify where smart money is positioning

Follow absorption zones as key levels

Recognize stop hunts and fade retail traps

Display Options

Positioning

Tables and panels can be placed in any screen corner

Adjustable X/Y offsets for perfect placement

Configurable dimensions for different screen sizes

Performance

Adjustable update intervals (default 500ms) balance accuracy and system load

Option to hide neutral signals reduces visual clutter

Selective column display optimizes table size

Who Is This For?

Professional day traders seeking institutional-level market insight

Volume analysts who trade order flow and market profile

Scalpers needing real-time momentum data

Swing traders identifying major support/resistance from volume

Anyone wanting to see what smart money is doing

Advantages Over Standard Volume Indicators

✅ Goes beyond simple volume bars to analyze bid/ask dynamics

✅ Detects institutional activity patterns invisible on standard charts

✅ Combines multiple confirmation factors for high-probability signals

✅ Provides both real-time and historical analysis

✅ Highly customizable to match individual trading styles

✅ Professional visualization makes complex data instantly actionable

Note: This indicator works best on liquid markets (major forex pairs, index futures, popular stocks) where order flow data is robust. Recommended timeframes: 1-minute to 1-hour for optimal signal quality.