ICT Anchored Market Structures

- 指标

- Cao Minh Quang

- 版本: 1.0

- 激活: 5

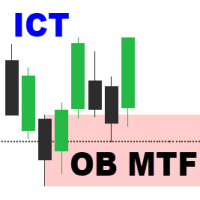

The ICT Anchored Market Structures with Validation trading indicator is designed to bring precision, objectivity, and automation to price action analysis. It helps traders visualize real-time market structure shifts, trend confirmations, and liquidity sweeps across short, intermediate, and long-term market phases — all anchored directly to price, without relying on any external or user-defined inputs.

Uses

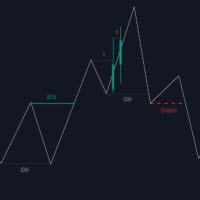

Market structure is one of the most critical foundations of price action trading strategies. This indicator automatically detects and displays real-time structures across multiple time horizons — short, intermediate, and long-term — allowing traders to instantly identify the market’s directional bias. By observing these automated structure levels, traders can easily see when a market is transitioning from accumulation to expansion, shifting between bullish and bearish conditions, or simply consolidating.

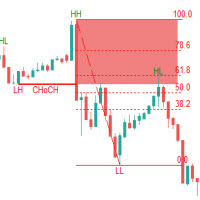

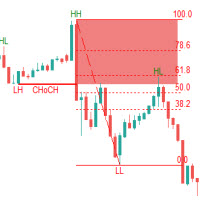

When a Change of Character (CHoCH) occurs, it signals a potential reversal — often appearing when price breaches a previous swing high or low. In contrast, a Break of Structure (BoS) confirms continuation in the prevailing trend direction. Understanding these dynamics helps traders determine when to enter or stay in a trade, aligning entries with the broader trend or counter-trend reversals.

It’s essential to recognize that not every CHoCH or BoS guarantees a reversal or continuation. Sometimes, these areas simply act as liquidity zones — where price seeks orders before resuming its primary direction. That’s where this indicator’s validation logic comes in, confirming whether a structure represents a true breakout or a liquidity sweep, adding another layer of accuracy to your market structure trading strategy.

Key Features

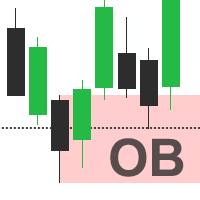

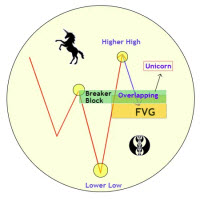

Swing points are crucial for understanding market trends and identifying key trading opportunities.

Recognize Trends: Higher swing highs/lows indicate an uptrend, while lower swing highs/lows indicate a downtrend.

Identify Key Liquidity Levels: Swing highs represent Buyside Liquidity Zones, while swing lows mark Sellside Liquidity Zones — both are critical for identifying potential reaction points.

Spot Reversal Patterns: Swing formations often build classical reversal setups like double tops/bottoms or head-and-shoulders patterns.

Plan Risk Management: Swings are ideal for setting stop loss and take profit levels — as these areas often contain liquidity pools targeted by institutional moves.

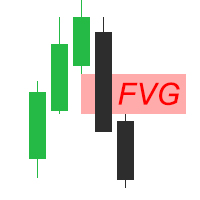

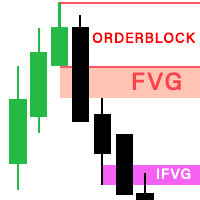

Market Structure Validation Logic ensures that each detected CHoCH or BoS is more than just a temporary wick or fake-out. The indicator checks whether the price closes beyond the deviation range defined by a 17-period ATR (Average True Range).

Confirmed Breakout: The close is beyond the ATR deviation zone.

Sweep: The price breaches but closes within the deviation range, marking a liquidity grab.

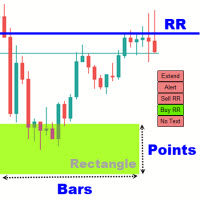

When a sweep is detected, the indicator labels it clearly and draws a visual box highlighting the price range of the event. This feature helps traders instantly recognize liquidity sweeps versus genuine breakouts

Settings

These options make the ICT Anchored Market Structures indicator suitable for traders across all styles — from scalpers to swing traders — who rely on clean, informative structure visualization.Swings & Size: Show or hide swing highs/lows, customize icons, and adjust their size.

Market Structure Lines: Toggle structure lines for trend visualization.

Validation Display: Enable or disable breakout validation logic.

Structure Labels: Show CHoCH/BoS labels directly on chart.

Line Style & Width: Modify visual presentation to suit your chart theme.

Colors & Themes: Adjust swing and label colors for easier structure distinction.

Alert: Receive an alert when a new CHoCH/BOS or SWEEP is created.