Market Structure Signal MT4

- 指标

- Cao Minh Quang

- 版本: 1.3

- 更新: 4 十月 2025

- 激活: 5

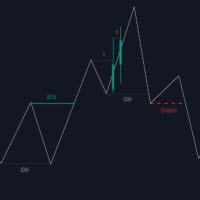

The Market Structure Signal indicator is designed to detect Change of Character (CHoCH) and Break of Structure (BOS) in price action, helping traders identify potential trend reversals or continuations. It combines market structure analysis with volatility (ATR) to highlight possible risk/reward zones, while also supporting multi-channel alerts so that no trading signal is missed.

Interpretation

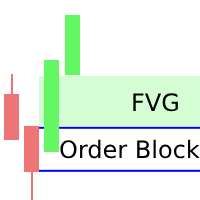

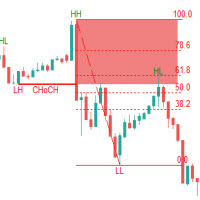

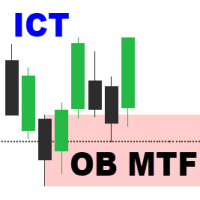

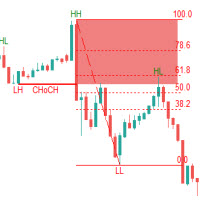

Trend Analysis: The indicator’s trend coloring, combined with BOS and CHoCH detection, provides an immediate view of market direction. Rising structures indicate bullish momentum, while falling structures signal bearish momentum. CHoCH markers highlight potential trend reversals or significant liquidity sweeps.

Volatility and Risk Assessment: ATR-based calculations determine stop-loss distances and target levels, giving a quantitative measure of risk relative to market volatility. Wide ATR readings indicate periods of high price fluctuation, whereas narrow readings suggest consolidation and reduced risk exposure.

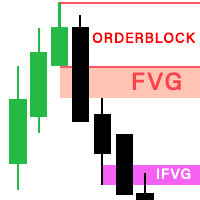

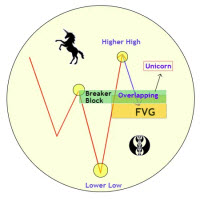

Market Structure Insights: By monitoring swing highs and lows alongside break confirmations, traders can identify where institutional players are likely active. Areas with multiple structural breaks or overlapping targets can indicate liquidity hotspots, potential reversal zones, or areas of market congestion.

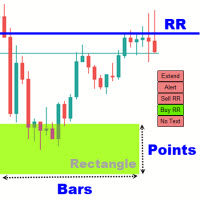

Trade Management: The built-in trade zones allow traders to visualize entry, risk, and reward simultaneously. Progressive targets (TP1, TP2, TP3) reflect incremental profit-taking strategies, while dynamic stop-loss levels help preserve capital during adverse moves.

Input Parameters

SETTING

Structure Period (default 20) → Number of periods to detect swing highs/lows and build market structure.

Display Structure (true/false) → Enable/disable structure visualization on chart.

Volatility (ATR) period (default 14) → ATR period for volatility measurement.

Volatility Multiplier (default 2) → ATR multiplier for risk/reward zone projection.

STYLES

Bullish (default Green) → Color for bullish structure.

Bearish (default Red) → Color for bearish structure.

Structure style (line style: dashed/solid/...) → Line style for market structure.

Target risk (default LightGray) → Color for risk area.

Target reward (default LightBlue) → Color for reward area.

ALERTS

Alert (true/false) → Enable/disable on-screen alerts when signal detected.

Send Notification (true/false) → Send MT5 push notification.

Send Email (true/false) → Send signal via email.

Core Features

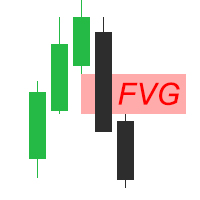

CHoCH & BOS Detection → Marks breakouts and structural shifts on chart.

Risk/Reward Analysis → Uses ATR to define projected zones for trade management.

Customizable Display → Flexible color, line style, and visibility options.

Multi-channel Alerts → Never miss a signal with built-in support for MT5, Email.

Buffers for EA Integration

To allow Expert Advisors (EAs) to read signals programmatically, the indicator provides buffers:

Buffer 0 → 1 when a BUY is detected, -1 when a SELL is detected.

Buffer 1 → Entry price

Buffer 2 → Stoploss price

Buffer 3 → Takeprofit 1 Price

Buffer 4 → Takeprofit 2 Price

Buffer 5 → Takeprofit 3 Price

These buffers make it possible for an EA to automatically read market structure signals and execute trades accordingly.

The Market Structure Signal transforms complex market behavior into an actionable visual framework. By combining market structure analysis, liquidity tracking, ATR-based risk/reward mapping, and a dynamic trade dashboard, it provides a multidimensional view of the market. Traders can focus on execution, interpret trends, and evaluate overextensions or reversals without relying on guesswork. The indicator is suitable for scalping, intraday, and swing strategies, offering a comprehensive system for understanding and trading alongside institutional participants.