Fan sayfamıza katılın

Öyleyse bir link gönderin -

başkalarının da faydalanmasını sağlayın

- Yayınlayan:

- Harrison Kiptallam Kipchumba

- Görüntülemeler:

- 147

- Derecelendirme:

- Yayınlandı:

-

Bu koda dayalı bir robota veya göstergeye mi ihtiyacınız var? Freelance üzerinden sipariş edin Freelance'e git

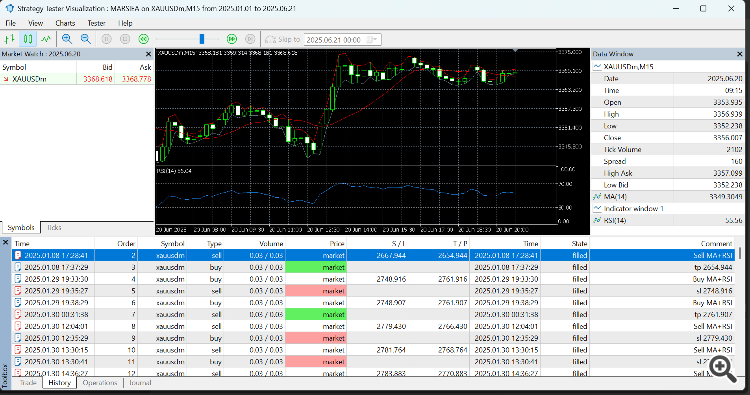

MARSI-

EA, XAUUSD (Altın) gibi finansal piyasalarda alım satım sinyallerini belirlemek ve yürütmek için Göreceli Güç Endeksi (RSI ) ve Basit Hareketli Ortalama (SMA ) mantığını birleştiren yeni başlayan dostu bir Uzman Danışmandır (EA).

EA, XAUUSD (Altın) gibi finansal piyasalarda alım satım sinyallerini belirlemek ve yürütmek için Göreceli Güç Endeksi (RSI ) ve Basit Hareketli Ortalama (SMA ) mantığını birleştiren yeni başlayan dostu bir Uzman Danışmandır (EA).

EA göstermek için inşa edilmiştir:

-

Hesap riskine göre dinamik lot boyutlandırma

-

RSI tabanlı aşırı alım/aşırı satım giriş koşulları

-

Hareketli Ortalama kullanarak trend filtreleme

-

SL ve TP seviyeleri sembol tik hassasiyetine göre ayarlandı

Bu EA, özellikle teknik stratejileri deneyen ve gösterge işlemlerinin, dinamik riskin ve broker rakamı farklılıklarının ticaret mantığını nasıl etkilediğini anlamak isteyen öğrenciler için kullanışlıdır.

Ticaret Mantığı

EA aşağıdaki giriş kuralları ile çalışır:

-

Ne zaman satın alın:

-

Mevcut fiyat hareketli ortalamanın üzerinde (yükseliş)

-

RSI aşırı satım eşiğinin altında (fiyatın yükseleceğini gösteriyor)

-

-

Ne zaman satılır:

-

Fiyat hareketli ortalamanın altında (düşüş)

-

RSI aşırı alım eşiğinin üzerinde (fiyatın düşeceğini gösteriyor)

-

-

Zararı Durdur ve Kâr Al, komisyoncunun fiyatlandırma hassasiyetine ( _Digits ) göre ayarlanan _Point kullanılarak yapılandırılır.

Harici Giriş Parametreleri

| Değişken | Açıklama |

|---|---|

| maPeriod | Basit Hareketli Ortalama için kullanılan periyot |

| rsiPeriod | Göreceli Güç Endeksi için kullanılan dönem |

| rsiOverbought | Piyasanın aşırı alım olarak kabul edildiği RSI eşiği (satış tetikleyicisi) |

| rsiOversold | Piyasanın aşırı satım olarak kabul edildiği RSI eşiği (alım tetikleyicisi) |

| riskPercent | İşlem başına bakiyenin riske oranı |

| stopLoss | Puan cinsinden Zararı Durdur mesafesi |

| takeProfit | Kar mesafesini nokta cinsinden alın |

| kayma | Puan olarak izin verilen maksimum kayma |

Önerilen Kullanım

-

Sembol: XAUUSD (Altın)

-

Zaman dilimi: M15 veya H1

-

Broker: Uygun tik verilerine sahip herhangi bir broker (tutarlılık için hem 2/3 hem de 4/5 basamaklı brokerler arasında test edin)

-

Geriye dönük test aralığı: 3-6 ay önerilir

-

Koşullar: Güvenilir RSI/MA değerleri için tik verilerinin mevcut olduğundan emin olun

Ek Notlar

-

PipSize() işlevi, farklı _Digit'lere sahip brokerler arasında pip değerlerini normalleştirmeye yardımcı olur.

-

EA, mevcut hesap bakiyesine ve tanımlanan riske göre otomatik olarak bir lot büyüklüğü hesaplar.

-

Kod modülerdir ve takip eden durdurmalar, haber filtreleri veya diğer koşullarla kolayca genişletilebilir.

-

Bu proje devam eden bir projedir ve geri bildirimleri bekliyoruz!

MetaQuotes Ltd tarafından İngilizceden çevrilmiştir.

Orijinal kod: https://www.mql5.com/en/code/60730

BrainTrend2 göstergesine dayalı alım satım sinyalleri modülü

BrainTrend2 göstergesine dayalı alım satım sinyalleri modülü

Bir satın alma sinyalinin koşulu, bir satış sinyali için Kireç renginde oluşturulmuş bir mumdur - Eflatun.

BrainTrend2Stop

BrainTrend2Stop

BrainTrend2Stop bir trend durdurma göstergesidir, geçişi mevcut piyasa trendinde bir değişiklik ve daha önce açılan bir işlemden çıkma ihtiyacı anlamına gelen bir durdurma çizgisi ile gösterilir.

Daily Percentage Change MT5

Daily Percentage Change MT5

Günlük Yüzde Değişim (MetaTrader göstergesi) - önceki günlük kapanışla ilgili döviz kurundaki değişikliği hesaplar ve platformun ana grafik penceresinde yüzde puan olarak görüntüler. Ek olarak, haftalık ve aylık yüzde değişikliklerini görüntüleyebilir. Pozitif veya negatif fiyat artışları için farklı renkler ayarlanabilir. Ayrıca, özelleştirilebilir küçük bir ok, fiyat değişim yönünü görselleştirmeye yardımcı olur. Brokeriniz alışılmadık bir saat dilimi kullanıyorsa, gösterge günün sonu için kullanacağı saati ayarlamak için Zaman Kaydırma parametresini kullanabilir. Gösterge MT4 ve MT5'te eşit derecede iyi çalışır.

Donchian Kanalı

Donchian Kanalı

Donchian Kanalı, son zamanlardaki en yüksek ve en düşük fiyatları kullanarak mevcut fiyat aralığını hesaplamaya dayanan bir volatilite göstergesidir.