Fan sayfamıza katılın

Öyleyse bir link gönderin -

başkalarının da faydalanmasını sağlayın

- Görüntülemeler:

- 17499

- Derecelendirme:

- Yayınlandı:

-

Bu koda dayalı bir robota veya göstergeye mi ihtiyacınız var? Freelance üzerinden sipariş edin Freelance'e git

Theory :

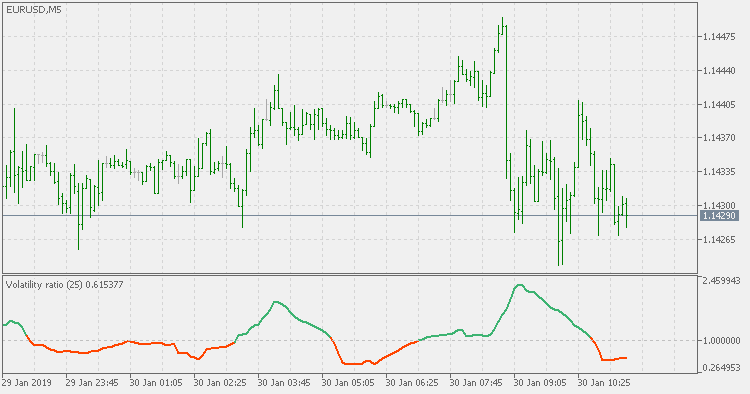

There is always a need to measure if the market is "quiet" or it is volatile. One of the possible way is to use standard deviations, but the issue is simple : we do not have some levels that could help us find out if the market is in a state of lower or higher volatility. This indicator is attempting to do that :

- values above level 1 are indicating state of higher volatility

- values above level 1 are indicating state of lower volatility

Usage :

This is not a directional indicator. It should be used for volatility detection, not trend assessment - for that you have to use some other indicator and then check this one if the market volatility conditions are those that you expect

Chande's DMI - std adaptive with floating levels

Chande's DMI - std adaptive with floating levels

Chande's DMI - std adaptive with floating levels

Chande's DMI - std adaptive with dsl signal lines

Chande's DMI - std adaptive with dsl signal lines

Chande's DMI - std adaptive with dsl signal lines

Volatility ratio - with floating levels

Volatility ratio - with floating levels

Volatility ratio - standard deviations based with floating levels

RSX volatility ratio adaptive

RSX volatility ratio adaptive

RSX volatility ratio adaptive