Rsi OBOS Ea MT4

- Experts

- Satya Prakash Mishra

- 버전: 1.0

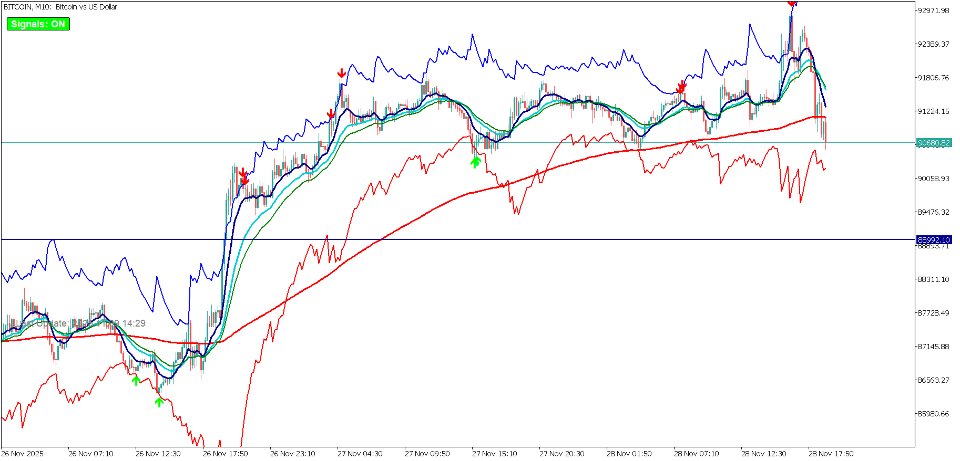

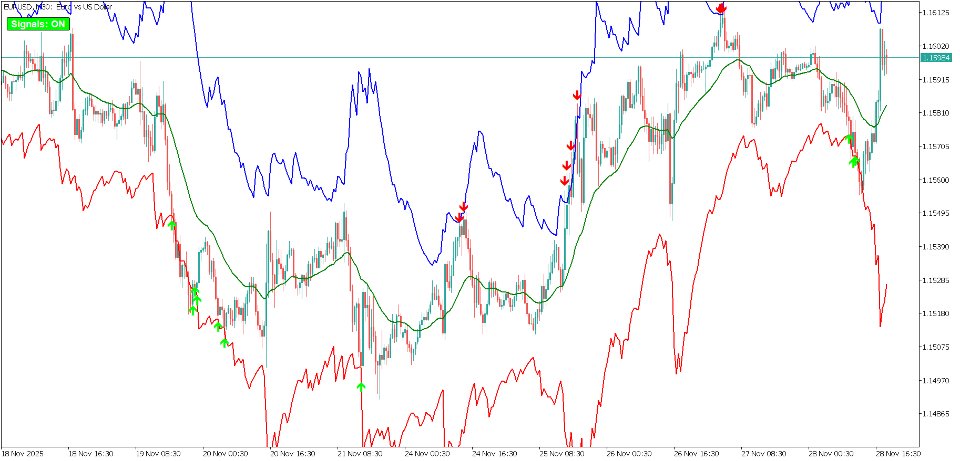

RSI Crossover AutoTrader EA – Trend-Based RSI Trading SystemTrend RSI EA — trades only when RSI is above 50 in trend direction (cross confirmation).s.

RSI Crossover AutoTrader EA is a trend-aligned RSI crossover strategy designed for traders who want simple, rule-based entries with strong trend filtering.

The EA focuses on RSI movement around the mid-level (50), opening trades only when the market shows strength above or below this threshold. This prevents counter-trend entries and keeps the system aligned with underlying momentum.

The EA includes automatic trailing stop management, flexible risk control, margin-based lot calculation, and an optional opposite-trade closing mechanism.

Core Trading Logic

-

The EA calculates RSI values on every new candle.

-

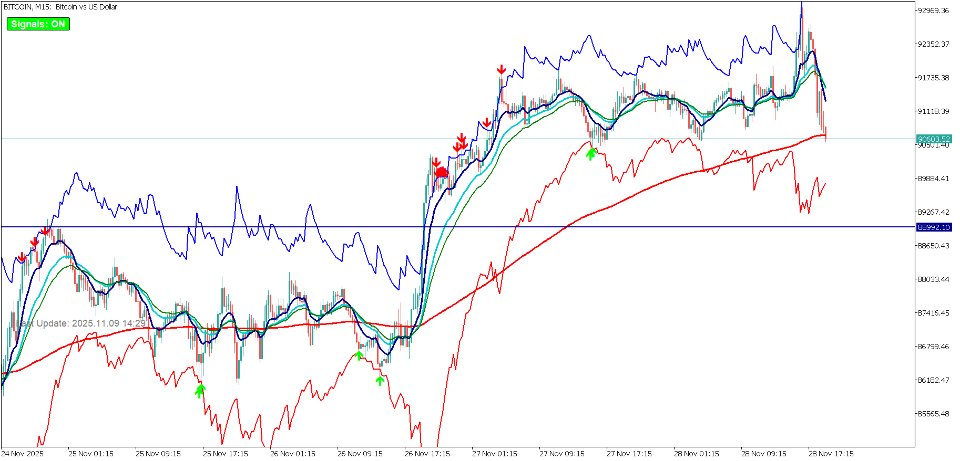

A BUY signal is generated when RSI crosses above 50, indicating strength in the trend.

-

A SELL signal is generated when RSI crosses below 50, indicating weakness and downward momentum.

-

Only one position per direction is allowed at a time.

-

If enabled, the EA automatically closes any opposite position when a new signal appears.

-

Optional trailing stop adjusts stop loss as price moves in favor of the trade.

This structure ensures the EA trades with the prevailing trend instead of against it.

Key Features

-

Fully automated RSI-based trend strategy

-

RSI-level cross detection without repainting

-

Trades only when RSI crosses the 50-level (trend confirmation)

-

Auto close opposite positions on new signals

-

Built-in trailing stop system with step filtering

-

Auto lot adjustment based on available margin

-

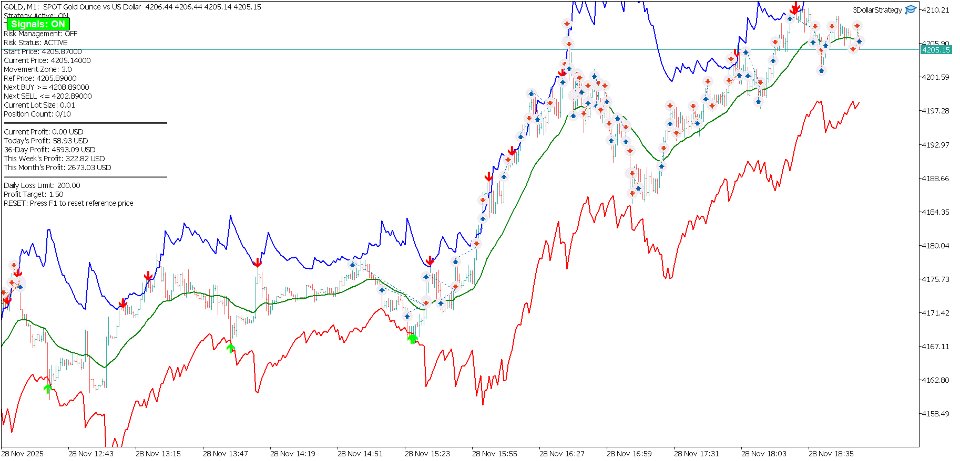

Works on any trading symbol: Forex, indices, metals, crypto

-

Clear entry and exit conditions

-

Slippage control, Magic Number control, and safety-margin check

-

Stable logic using only closed candle data for consistency

-

Broker-validated lot handling (min, max, step compliant)

Parameters Overview

RSI Settings

-

RSI period

-

Applied price

-

Buy and Sell trigger levels (default 50)

Trade Management

-

Fixed lot size

-

Stop loss and take profit

-

Close opposite trade on signal

-

Slippage

-

Magic Number

Trailing Stop Settings

-

Enable/disable trailing

-

Trailing start (minimum profit)

-

Trailing distance

-

Trailing step

Risk & Margin Management

-

Auto-adjust lot size based on free margin

-

Margin safety percentage threshold

How Trailing Stop Works

Trailing begins only when the trade reaches minimum profit (TrailingStart).

After this point, the EA continually updates the stop loss by TrailingDistance and TrailingStep conditions. Buy trades trail below price; sell trades trail above price.

This ensures lock-in profit while still allowing the trend to continue.

Recommended Usage

-

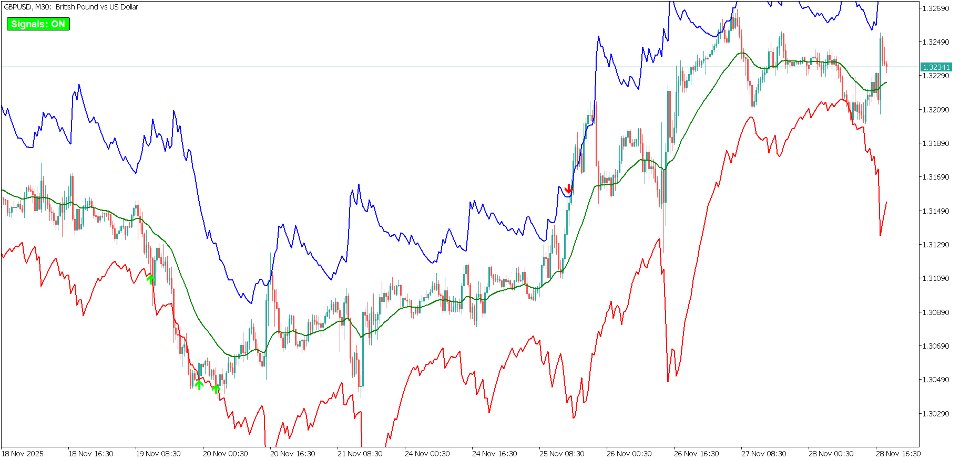

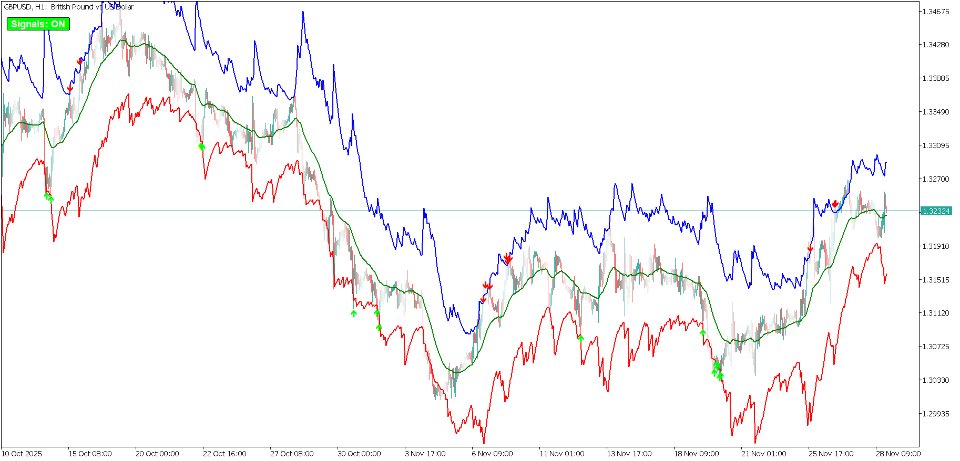

Works well on trending markets and higher timeframes such as M15, M30, H1.

-

Suitable for symbols with clear RSI swings (gold, major currency pairs).

-

Best performance when combined with volatility or session filters (external).

-

Use backtesting and forward testing to determine best RSI thresholds per instrument.

Important Notes

-

The EA does not use any grid, martingale, or hedging techniques.

-

All entries are based purely on RSI mid-level cross and trend confirmation.

-

Trades only once per direction until exit or trailing stop is triggered.

-

All logic is candle-based to avoid noise from incoming ticks.