Advance pivot point with clustered price

- 지표

- Oyinemomoemi Emeledor

- 버전: 1.0

This indicator is a **Pivot-Confluence Zone Identifier** that focuses exclusively on identifying key support and resistance levels where price clusters align with classic pivot points. Here's what it does:

## Core Functionality

**Pivot Confluence Detection**:

- Only displays price zones that align with classic pivot point levels (R1, R2, R3, S1, S2, S3)

- **Excludes the main pivot point** - focuses only on support and resistance levels

- Uses a configurable pip range to detect confluence near pivot levels

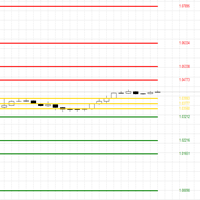

## Visual Features

**Color Coding**:

- 🟡 **Gold Lines**: Active pivot confluence zones (price clusters near R1-R3/S1-S3)

- ⚫ **Gray Lines**: Broken zones (when price has moved through the level)

- **Time Decay**: Older active zones gradually blend toward gray

**Display Elements**:

- Horizontal lines at pivot-confluent price levels

- Text labels below each zone showing:

- Zone type (SUPPORT/RESISTANCE)

- Strength (Strong/Potential)

- Fractal count (Support/Resistance fractals)

- Pivot level (R1, S2, etc.)

- Volume data and age

## Technical Components

**Volume-Weighted Clusters**:

- Analyzes price distribution across specified bars

- Groups prices into bins to identify high-volume zones

- Combines volume data with fractal confirmation

**Fractal Validation**:

- Detects fractal patterns at cluster price levels

- Requires minimum fractal count for "strong" zones

- Tracks both support and resistance fractals

**Zone Management**:

- **Time Decay**: Reduces weight of older clusters

- **Zone Filtering**: Ensures minimum distance between zones

- **Break Detection**: Identifies when zones are no longer valid

## Input Parameters

**Main Settings**:

- `BarsToAnalyze`: Historical data range (default: 100)

- `PriceBinSize`: Granularity for price clustering

- `ClustersToShow`: Maximum zones to display (default: 5)

**Pivot Settings**:

- `PivotConfluencePips`: Detection range from pivot levels

- `PivotTimeframe`: Timeframe for pivot calculations (default: D1)

**Validation**:

- `RequiredFractals`: Minimum fractals for strong zones

- `CandlesToConfirmBreak`: Bars needed to confirm zone break

## Use Case

This indicator is designed for traders who want:

- Clean, uncluttered charts showing only significant levels

- Focus on pivot-based support/resistance rather than all possible zones

- Visual distinction between active and broken levels

- Volume-confirmed price levels with fractal validation

## What Makes It Unique

1. **Exclusive Focus**: Only shows pivot-confluent zones, ignoring all other price levels

2. **No Main Pivot**: Concentrates on R1-R3 and S1-S3 only

3. **Clear Visual Hierarchy**: Gold for active, gray for broken

4. **Smart Filtering**: Time decay and distance filtering prevent clutter

The indicator helps traders quickly identify the most significant support and resistance levels where price is likely to react, based on the combination of volume clustering, fractal patterns, and classic pivot point theory.