Trend Pullback and Reversal Finder

- 지표

- Edo Revado Gunawan

- 버전: 1.50

- 활성화: 5

This indicator is deliberately constructed to avoid repainting. Once a candle has closed, the output it produces remains fixed and unchanged. This behavior ensures accuracy during backtesting and provides reliability in real-time strategy execution.

Unlike traditional methods such as linear or polynomial regression, kernel-based methods don't assume any specific form or distribution for the data. Instead, they rely on a kernel function—a mathematical tool that assigns influence to each nearby point depending on its distance from the target. These weights are then used to compute a locally weighted average, yielding a smooth estimation of the trend.

While it may seem similar to a Simple Moving Average (SMA) at first glance, there’s a key distinction. The SMA treats all data within its lookback period equally, effectively using a uniform (rectangular) kernel where each value contributes the same weight. In contrast, the approach used here employs a Regression with learning machine quadratic kernel functions, which gives greater importance to values closer to the current point. As a result, the output adapts more responsively to recent changes in the data, offering a more dynamic and sensitive trendline.

With Color Smoothing Mode,Lets you switch between visualizations based on rate-of-change or crossover dynamics for clearer signal interpretation.

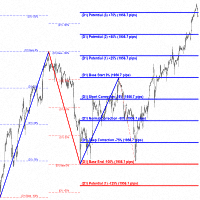

The chart illustrates a clearer entry signal, allowing for more confident position openings and convenient stop-loss placement just below the bar preceding the crossover.

Use it seamlessly on any timeframe that suits your trading style.