당사 팬 페이지에 가입하십시오

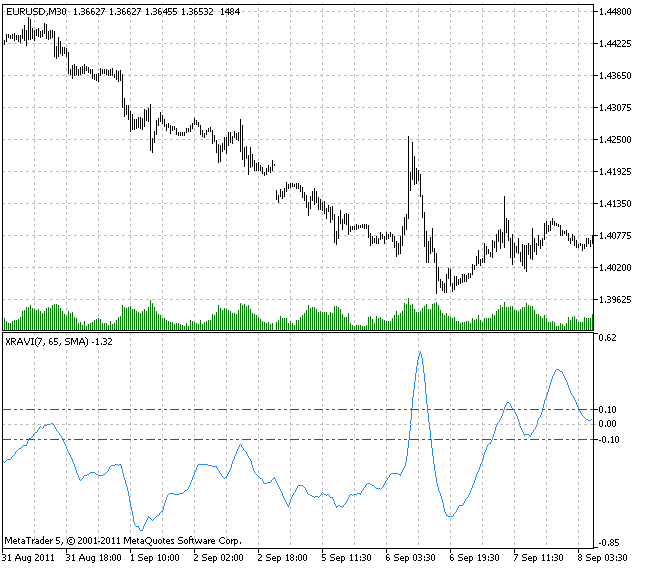

T. Chande가 소개한 추세 지표는 매우 유용합니다. Chande - 범위 동작 확인 지수를 나타내는 RAVI 표시기.

그 구성 원리는 ADX 지표의 구성에 사용되는 것과 다릅니다. Chande는 가치에 대한 시장 참여자의 분기별(1분기는 3개월 또는 65영업일) 심리를 나타내는 13주 SMA를 RAVI 지표의 기초로 제안했습니다. RAVI 지표에 포함되는 단기 평균은 장기 평균의 10%에 해당하며 7로 반올림됩니다.

RAVI 지표는 다음 공식으로 표현할 수 있습니다:

RAVI = 100*(SMA(7) - SMA(65)) / SMA(65)

여기서 SMA(기간)는 기간과 같은 기간을 갖는 단순이동평균입니다.

찬데는 시장 특성에 따라 플러스 또는 마이너스 0.3% 또는 플러스 또는 마이너스 0.1%를 RAVI 지표의 기준선으로 권장했습니다. RAVI 지표선이 기준선을 위쪽으로 교차하면 상승 추세의 시작 신호이고, RAVI 지표선이 기준선을 아래쪽으로 교차하면 하락 추세의 시작 신호입니다. RAVI 지표선이 상승하는 한 추세는 상승 추세를 유지하고, 하락하는 한 추세는 하락 추세를 유지합니다.

RAVI 지표가 0 선으로 반전되면 추세의 끝과 채널의 시작을 나타냅니다 (채널 외환 전략). 그러나 기준선에 의해 생성 된 간격에 들어 가지 않고 RAVI 지표가 반복적으로 반전되면 추세 재개를 나타냅니다.

Chand가 제안한 RAVI 지표는 매우 간단합니다. MACD 지표 및 가격 오실레이터와 매우 유사합니다. RAVI의 독특한 특징은 수렴-발산 지표를 추세 지표로 사용하며 평균의 교차가 아닌 발산에 주목한다는 것입니다.

ADX의 구성에 대해 이야기할 때 두 가지 스무딩이 있다는 것을 알 수 있습니다. ADX와 달리 RAVI 지표에는 하나의 스무딩이 있습니다. 이로 인해 더 민감한 지표이며 언급 된 값으로 18 일 ADX보다 일찍 추세 시작 및 종료 이벤트에 대해 경고합니다.

이 지표에서 평균화 방법은 10가지 옵션 중에서 선택하여 변경할 수 있습니다:

- SMA - 단순이동평균;

- EMA - 지수이동평균;

- SMMA - 평활 이동 평균;

- LWMA - 선형 가중 이동 평균;

- JJMA - JMA 적응 평균;

- JurX - 초선형 평균;

- ParMA - 파라볼릭 평균;

- T3 - 틸슨 다중 지수 평활;

- VIDYA - 투샤르 찬데 알고리즘을 사용한 평균화;

- AMA - 페리 카우프만 알고리즘을 사용한 평균화.

위상 유형 매개변수는 평균화 알고리즘에 따라 의미가 상당히 다르다는 사실에 주의해야 합니다. JMA의 경우 -100에서 +100까지 변화하는 외부 변수 위상입니다. T3의 경우 더 나은 인식을 위해 평균화 계수에 100을 곱한 값이고, VIDYA의 경우 CMO 오실레이터의 주기이며, AMA의 경우 느린 EMA의 주기입니다. 다른 알고리즘에서는 이러한 매개변수가 평균에 영향을 미치지 않습니다. AMA의 경우 빠른 EMA의 주기는 고정되어 있으며 기본적으로 2와 같습니다. AMA의 차수 계수도 2로 고정되어 있습니다.

이 인디케이터는 SmoothAlgorithms.mqh 라이브러리 클래스(terminal_data_terminal 디렉토리\MQL5\Include에 복사)를 사용하며, 이에 대한 자세한 설명은 "중간 계산을 위한 추가 버퍼 없이 가격 시리즈 평균화" 문서에 게시되어 있습니다.

이 지표는 MQL4에서 처음 구현되었으며 2008.02.15 CodeBase에 게시되었습니다.

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/516

크로넥스 슈퍼 포지션

크로넥스 슈퍼 포지션

두 가지 기술 지표인 RSI와 디마커의 중첩.

SUPERMACBOT

SUPERMACBOT

슈퍼맥봇은 이동평균 크로스오버 전략과 MACD 지표를 결합하여 정확하고 안정적인 매매 신호를 제공하는 완전 자동매매 로봇입니다. 이 전문가용 어드바이저는 모든 종목과 차트주기에 원활하게 작동하도록 설계되어 다양한 시장 상황에서 트레이더에게 다목적성과 적응성을 제공합니다.

Yaanna

Yaanna

금융 자산의 가장 간단한 과매수/과매도 지표입니다.

Popular MACD Strategy from Viral YouTube Video (3.5M+ Views)

Popular MACD Strategy from Viral YouTube Video (3.5M+ Views)

350만 회 이상의 조회수를 기록한 바이럴 YouTube 동영상에서 볼 수 있는 인기 있는 MACD 기반 전략을 구현하는 자동화된 전문가 조언자입니다. MACD 크로스오버, 200 MA와 추세 필터링, 지지/저항 감지를 결합합니다.