당사 팬 페이지에 가입하십시오

- 조회수:

- 100

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

저자: 안드레이 N. 볼콘스키

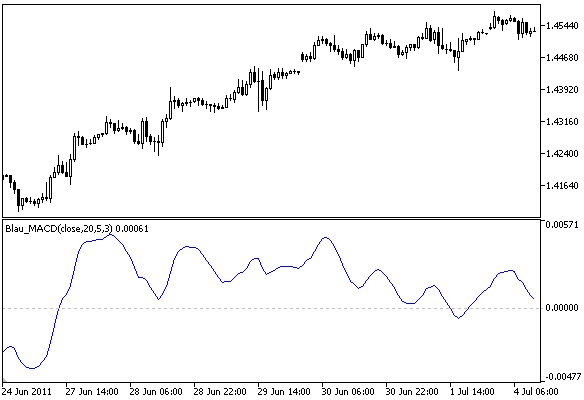

이동 평균의 지표 수렴/발산 윌리엄 블라우는 모멘텀, 방향성, 발산이라는 책에서 설명합니다.

이동평균 수렴/발산(MACD) 은 두 지수 이동평균(지수)의 차이(발산)로, 기간 s의 빠른 지수와 기간 r의 느린 지수이며 지수는 종가에 적용됩니다.

MACD 부호는 느린 r주기의 지수에 대한 빠른 s주기의 지수의 위치를나타냅니다: 양수 MACD는 EMA(s)가 EMA(r) 이상이고 음수 MACD는 EMA(r)보다 낮습니다. 절대값의 MACD 변화: |MACD|의 상승은 이동평균의 발산을 나타내고, |MACD|의 하락은 이동평균의 수렴을 나타냅니다.

자세한 내용은 윌리엄 블라우의 MQL5의 인디케이터와 트레이딩 시스템 문서에서 확인하세요 . 1부: 인디케이터.

- WilliamBlau.mqh는 terminal_data_directory\MQL5\Include\에 위치해야 합니다.

- Blau_MACD.mq5는 터미널 데이터 디렉토리\MQL5/Indicators\에 위치해야 합니다.

윌리엄 블라우 이동평균 수렴/발산 인디케이터

계산:

이동평균 수렴/발산 공식:

macd(price,r,s) = EMA(price,s) - EMA(price,r)

s < r

- 가격 - 현재 기간의 종가;

- EMA(가격,r) - 가격에 적용된 기간 r의 느린 지수이동평균(지수)입니다;

- EMA(가격,s) - 가격에 적용된 기간 s의 빠른 지수.

이동평균 수렴/발산 지표는 빠른 지수 이동평균과 느린 지수 이동평균(평활 이동평균 수렴/발산) 사이의 비율을 표시합니다.

이동평균 수렴/발산 지표의 공식은 다음과 같습니다:

MACD(가격,r,s,u) = EMA( macd(가격,r,s),u) = EMA( EMA(가격,s)-EMA(가격,r),u)

s < r

- 가격은 종가 - 가격 차트의 가격 기준입니다;

- EMA(price,r) - 1차 평활 - 가격에 적용된 기간 r의 느린 지수 이동 평균(지수)입니다;

- EMA(가격,s) - 두 번째 평활 - 가격에 적용된 기간 s의 빠른 지수;

- macd(r,s)=EMA(가격,s)-EMA(가격,r) - 가격에 적용된 빠른(기간 s) 지수 및 느린(기간 s) 지수의 수렴/발산;

- 세 번째 평활화 - 이동평균의 수렴/발산에 적용되는 기간 u의 지수: 빠른 EMA(가격,s) 및 느린 EMA(가격,r).

- r - 가격에 적용되는 첫 번째 느린 EMA의 주기입니다(기본값 r=20);

- s - 가격에 적용되는 두 번째 빠른 EMA의 주기(기본값은 s=5)

- u - 이동평균의 수렴/발산과 관련된 세 번째 EMA의 기간(기본값 u=3);

- 적용된 가격 - 가격 유형 (기본값은 적용된 가격=PRICE_CLOSE).

- R>1, S>1;

- s<r(이론 요구 사항에 따른 제한, 소프트웨어 수준에서 확인되지 않음);

- u>0. u=1이면 평활화가 수행되지 않습니다;

- 가격 배열의 최소 크기 =([max(r,s)]+u-2+1).

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/375

에르고딕 DTI 오실레이터 Blau_Ergodic_DTI

에르고딕 DTI 오실레이터 Blau_Ergodic_DTI

윌리엄 블라우의 에르고딕 DTI 오실레이터(방향성 추세 지수).

Blau_DTI 방향성 추세 지수

Blau_DTI 방향성 추세 지수

윌리엄 블라우의 방향성 추세 지수(DTI).

Keltner Channel MT5

Keltner Channel MT5

켈트너 채널(메타트레이더 지표) - 1960년 체스터 W. 켈트너가 개발한 고전적 기술 분석 지표입니다. 이 지표는 볼린저 밴드 및 엔벨로프와 다소 유사합니다. 중간 선은 일반적인 가격((고가 + 저가 + 종가)/3)에 적용된 10일 단순이동평균이고, 상단 및 하단 밴드는 중간 선에서 일일 가격 범위의 이동평균(고가 및 저가 차이)을 더하고 빼서 생성됩니다. 이런 식으로 변동성 기반 채널이 만들어집니다. 이 버전의 인디케이터에서는 MA의 모든 매개 변수를 수정할 수 있습니다. 이 인디케이터는 MT4 및 MT5 버전의 플랫폼에서 모두 사용할 수 있습니다.

Float MT5

Float MT5

플로트 메타트레이더 지표 - 특정 통화쌍의 이전 차트 기록을 분석한 다음 현재 상황의 추세를 분석하는 정교한 지표입니다. 별도의 차트 창에서 추세가 시작되고 끝나는 지점과 피보나치 되돌림 수준을 기본 차트에서 디나폴리 수준과 결합하여 보여줍니다. 또한 로컬 고점과 저점이 감지된 시간도 표시합니다. 이 인디케이터는 MT4 및 MT5에서 사용할 수 있습니다.