당사 팬 페이지에 가입하십시오

- 조회수:

- 6770

- 평가:

- 게시됨:

- 업데이트됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

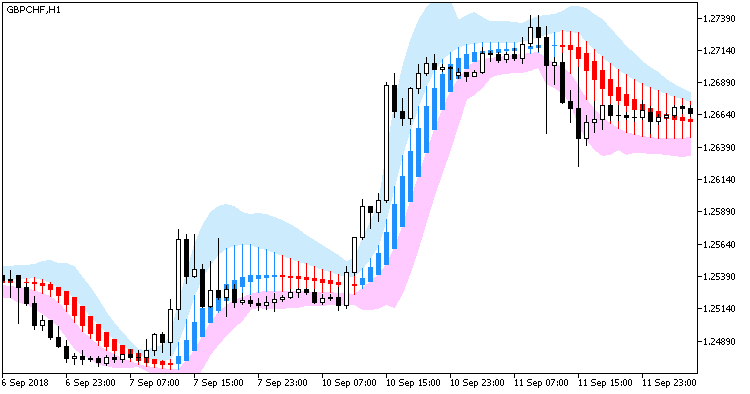

Indicator Heiken_Ashi_Smoothed with two color-filled channels built on mean-square deviations from the High and the Low of the indicator candles. For the indicator to be displayed correctly, you should check the Chart on Top checkbox in the chart properties.

input Smooth_Method HMA_Method=MODE_JJMA; //Averaging method input int HLength=30; //depth of averaging input int HPhase=15; //averaging parameter, //---- for a JJMA ranging within -100 ... +100, it affects the quality of the transition process; //---- For VIDIA, it is the CMO period, while for AMA it is the slow moving average period input uint BBLength=10; //Bollinger period input double BandsDeviation=1.0; //deviation

The indicator uses the classes of library SmoothAlgorithms.mqh (to be copied to terminal_data_catalog\MQL5\Include), working with which was described in details in article Averaging Price Series for Intermediate Calculations without Using Additional Buffers.

Fig.1. Indicator Heiken_Ashi_Smoothed_Chl

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/22671

Heiken_Ashi_Smoothed_HTF

Heiken_Ashi_Smoothed_HTF

Indicator Heiken_Ashi_Smoothed with the possibility of changing its timeframe in its input parameters

Simplified opening of stop orders

Simplified opening of stop orders

Short description

Heiken_Ashi_Smoothed_Trend

Heiken_Ashi_Smoothed_Trend

A semaphore signal indicator that gives trade signals when candles Heiken Ashi Smoothed change their directions

RSI RFTL EA

RSI RFTL EA

An EA based on indicators iRSI (Relative Strength Index, RSI) and RFTL