당사 팬 페이지에 가입하십시오

- 조회수:

- 6055

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

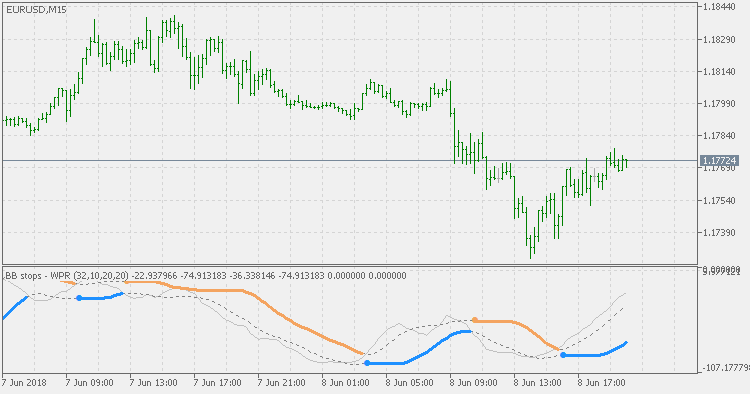

BB Stops indicator of smoothed WPR.

Smoothing types that can be applied to WPR are the usual 4 basic types of averages:

- SMA

- EMA

- SMMA

- LWMA

To avoid WPR smoothing (in which case it becomes an original WPR) use smoothing periods that is less than or equal to 1.

BB Stops - RSI

BB Stops - RSI

BB Stops using RSI for stops calculation.

BB Stops - MACD

BB Stops - MACD

MACD indicator that is using very well known BB Stops instead of using signal line for signals.

Historical Volatility

Historical Volatility

Historical Volatility (HV) is a statistical measure of the dispersion of returns for a given security or market index over a given period of time. Generally, this measure is calculated by determining the average deviation from the average price of a financial instrument in the given time period.

Historical Volatility - High/Low

Historical Volatility - High/Low

This version also does not use Close prices for volatility calculation. Instead it uses the High/Low ratio (the calculation is different from the "regular" Historical Volatility indicator).